- United Kingdom

- /

- Metals and Mining

- /

- LSE:CAPD

Devolver Digital Leads These 3 UK Penny Stocks To Consider

Reviewed by Simply Wall St

In the last week, the UK market has been flat, but over the past 12 months, it has risen by 7.8%, with earnings forecasted to grow by 15% annually. Investing in penny stocks—often smaller or newer companies—can still open doors to growth opportunities when backed by strong financial health. In this article, we will highlight three penny stocks that offer compelling opportunities with a balance of financial strength and potential for long-term success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £813.81M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.235 | £70.45M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.015 | £76.87M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.125 | £96.01M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.28 | £197.41M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.46 | £443.57M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.416 | $241.83M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Devolver Digital (AIM:DEVO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Devolver Digital Inc. is a company that develops and publishes video games for PC and mobile devices both in the United States and internationally, with a market cap of £116.25 million.

Operations: No specific revenue segments have been reported for this company.

Market Cap: £116.25M

Devolver Digital, Inc. has a market cap of £116.25 million and reported sales of US$51.58 million for the first half of 2024, showing growth from US$43.88 million a year prior. Despite reducing its net loss to US$4.41 million from US$10.04 million, the company remains unprofitable and has seen shareholder dilution with shares outstanding increasing by 6.7%. Positively, Devolver is debt-free with short-term assets exceeding both long-term liabilities and short-term liabilities significantly, indicating financial stability in covering obligations while trading significantly below estimated fair value offers potential upside if profitability improves.

- Dive into the specifics of Devolver Digital here with our thorough balance sheet health report.

- Understand Devolver Digital's earnings outlook by examining our growth report.

Springfield Properties (AIM:SPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Springfield Properties Plc, with a market cap of £106.29 million, operates in the United Kingdom's house building industry through its subsidiaries.

Operations: The company generates revenue from its Housing Building Activity segment, amounting to £266.53 million.

Market Cap: £106.29M

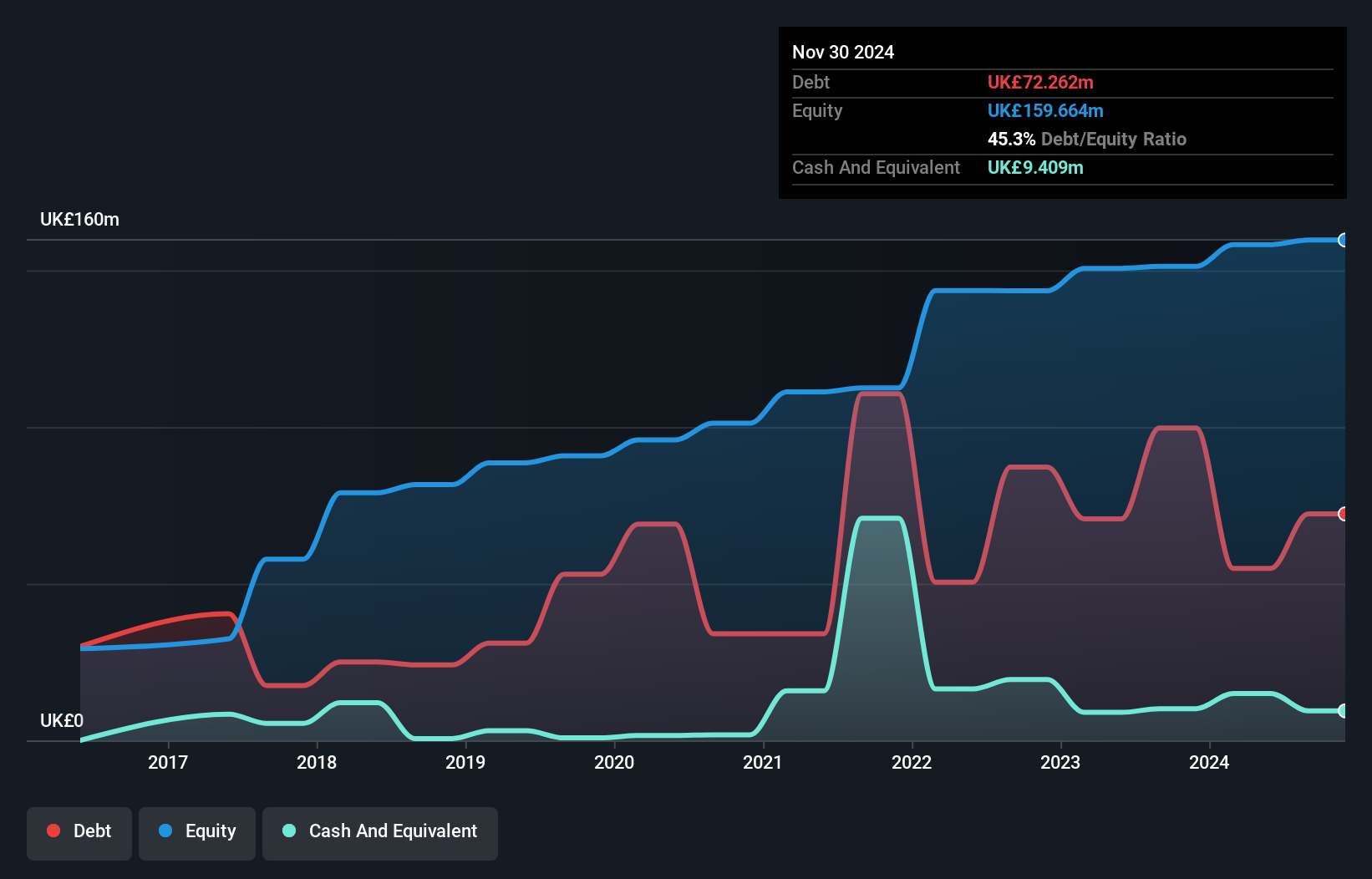

Springfield Properties Plc, with a market cap of £106.29 million, reported a decline in sales to £266.53 million for the year ending May 2024, down from £332.13 million the previous year, alongside reduced net income of £7.55 million from £12.07 million. Despite high-quality earnings and satisfactory debt levels with operating cash flow covering 77.8% of its debt, challenges persist with low return on equity at 4.8% and negative earnings growth over the past year (-37.5%). The company’s short-term assets (£285.6M) comfortably cover both short-term (£116.7M) and long-term liabilities (£30.3M), indicating solid financial footing amidst industry pressures.

- Click to explore a detailed breakdown of our findings in Springfield Properties' financial health report.

- Gain insights into Springfield Properties' outlook and expected performance with our report on the company's earnings estimates.

Capital (LSE:CAPD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Capital Limited, with a market cap of £163.68 million, offers a range of drilling solutions to clients in the minerals industry through its subsidiaries.

Operations: The company's revenue is derived entirely from its Business Services segment, totaling $333.59 million.

Market Cap: £163.68M

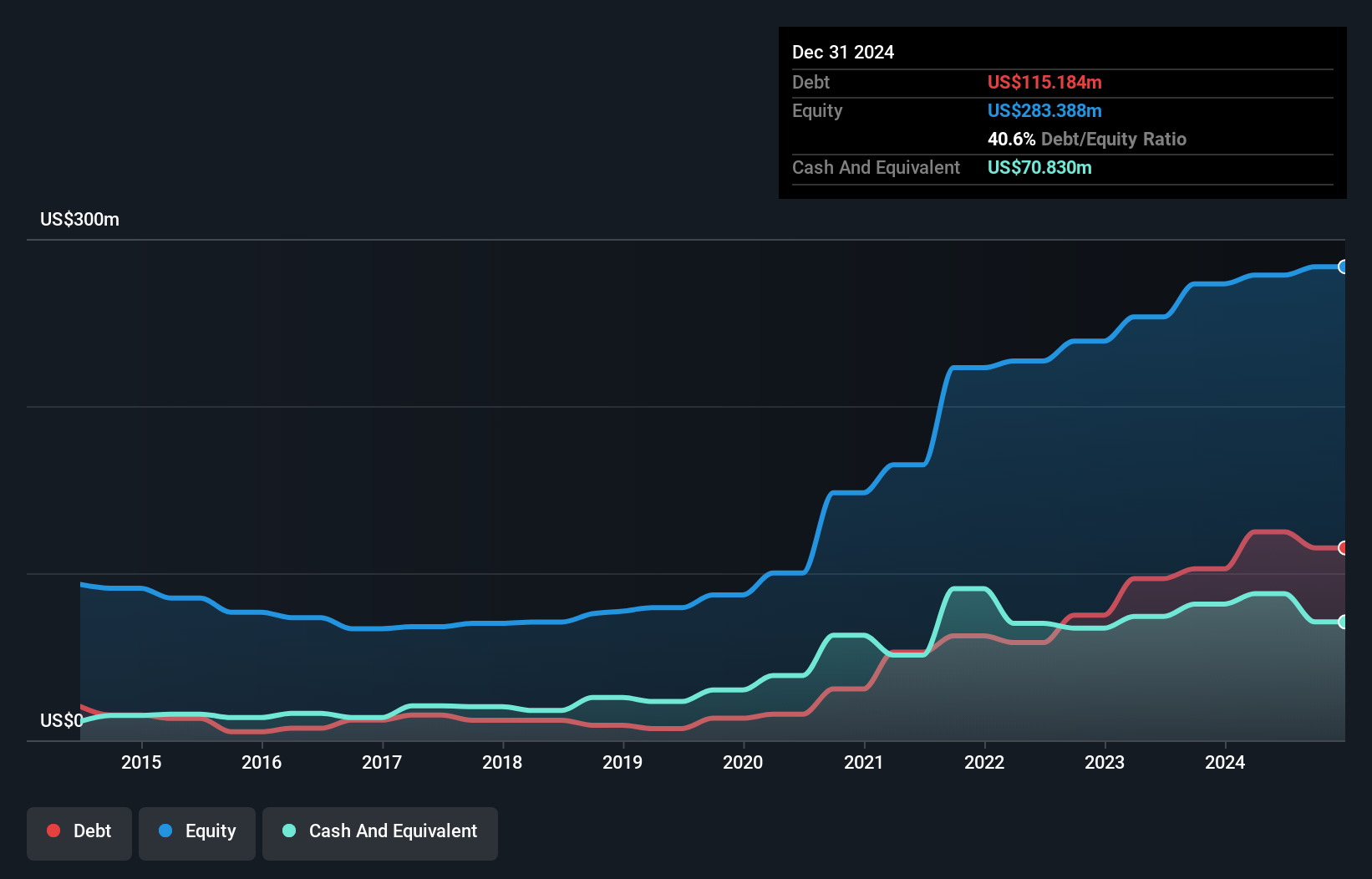

Capital Limited, with a market cap of £163.68 million, is navigating the penny stock landscape with mixed financial indicators. Despite recent board changes, including the appointment of Graeme Dacomb as an Independent Non-Executive Director, the company maintains a stable management team. Revenue guidance for 2024 is set between $355 million and $375 million, reflecting its solid position in the business services sector. While its debt to equity ratio has increased over five years, short-term assets significantly exceed liabilities, ensuring financial stability. However, negative earnings growth over the past year and a low return on equity present challenges amidst potential growth opportunities.

- Get an in-depth perspective on Capital's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Capital's future.

Taking Advantage

- Take a closer look at our UK Penny Stocks list of 470 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CAPD

Capital

Provides drilling, mining, mineral assaying, and surveying services.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives