- United Kingdom

- /

- Metals and Mining

- /

- LSE:ANTO

Antofagasta (LSE:ANTO) Faces Dividend Cut and Lower Earnings Despite Strong Production Growth Prospects

Reviewed by Simply Wall St

Click here and access our complete analysis report to understand the dynamics of Antofagasta.

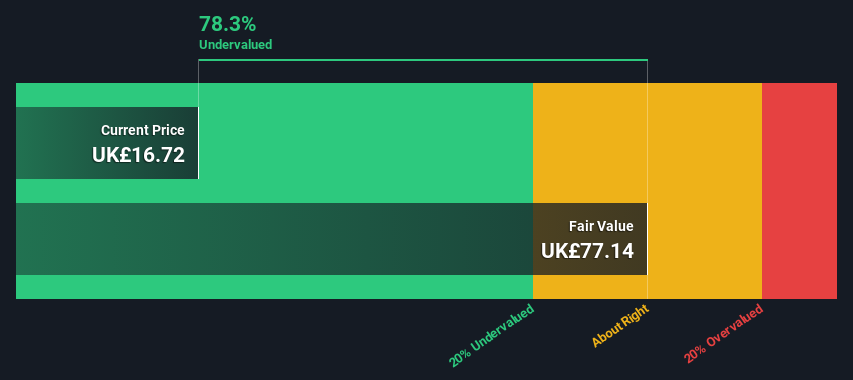

Strengths: Core Advantages Driving Sustained Success For Antofagasta

Antofagasta has demonstrated robust financial performance, with revenue increasing by 2% and EBITDA rising by 5%, as highlighted by CEO Iván Arriagada. This financial health is further supported by a 15% increase in cash flow. The company's strategic investments in brownfield expansions are expected to boost production by nearly 35%, reaching close to 900,000 tonnes per year. These expansions offer lower execution risks and construction costs, enhancing operational efficiency. Additionally, Antofagasta's interim dividend policy, representing 35% of earnings, underscores its commitment to shareholder returns. The company is currently trading at £18.25, significantly below the estimated fair value of £76.96, indicating it may be undervalued despite being expensive relative to its peers and industry based on its Price-To-Earnings Ratio.

Weaknesses: Critical Issues Affecting Antofagasta's Performance and Areas For Growth

Despite its strengths, Antofagasta faces several challenges. The company is trading at a high Price-To-Earnings Ratio of 31.4x, compared to the peer average of 15.7x and the UK Metals and Mining industry average of 11x, indicating it is expensive relative to its peers. Production guidance has been revised to the lower end of the 670,000 to 710,000 tonnes range, reflecting operational uncertainties. Local inflation has also impacted costs, with the second half expected to see higher production but increased expenses. Water issues have been a recurring problem, affecting production efficiency. Lastly, the company's Return on Equity is forecast to be low at 5.9% in three years, highlighting potential concerns about future profitability.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Antofagasta has several growth opportunities on the horizon. The expansion of the desalination plant, expected to be completed by the end of 2026, will significantly enhance water supply, crucial for sustaining production levels. Exploration activities in Peru and Chile are anticipated to add valuable assets to the company's portfolio, providing long-term growth prospects. Strategic partnerships, such as the collaboration with Buenaventura, offer potential for portfolio expansion and operational synergies. Furthermore, Antofagasta's earnings are forecast to grow at 19.8% per year, outpacing the UK market's 14.5% growth rate, indicating strong future growth potential.

Threats: Key Risks and Challenges That Could Impact Antofagasta's Success

Several external factors pose risks to Antofagasta's success. Market challenges, particularly in the copper sector, could impact pricing and demand dynamics over the next decade. Regulatory risks are also significant, with permits expected to take between 2 to 3 years to be granted, potentially delaying projects. Economic factors and competition, especially in regions like Argentina, add to the uncertainty. Additionally, profit margins have decreased to 12% from 25.8% last year, reflecting operational pressures. These threats highlight the need for strategic risk management to safeguard the company's market position and growth trajectory.

Antofagasta's strong financial performance, highlighted by increasing revenue, EBITDA, and cash flow, coupled with strategic investments in brownfield expansions, positions the company for significant production growth and operational efficiency. However, the high Price-To-Earnings Ratio compared to peers, operational uncertainties, and local inflation present notable challenges. The company's focus on expanding its desalination plant and exploration activities in Peru and Chile, along with strategic partnerships, offers promising growth prospects. Despite these opportunities, external market challenges and regulatory risks necessitate vigilant risk management. Trading at £18.25, significantly below its estimated fair value of £76.96, suggests potential for future appreciation, provided the company effectively navigates its operational and market challenges.

Taking Advantage

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:ANTO

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives