- United Kingdom

- /

- Chemicals

- /

- AIM:PHC

Plant Health Care plc's (LON:PHC) P/S Is Still On The Mark Following 76% Share Price Bounce

Plant Health Care plc (LON:PHC) shares have continued their recent momentum with a 76% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

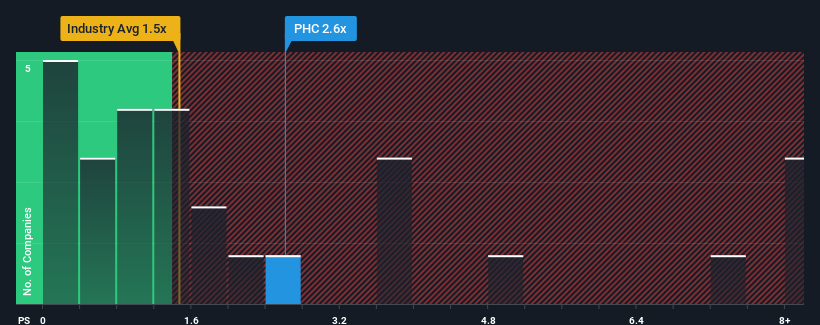

After such a large jump in price, given close to half the companies operating in the United Kingdom's Chemicals industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Plant Health Care as a stock to potentially avoid with its 2.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Plant Health Care

What Does Plant Health Care's P/S Mean For Shareholders?

With only a limited decrease in revenue compared to most other companies of late, Plant Health Care has been doing relatively well. The P/S ratio is probably high because investors think this comparatively better revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price, especially if revenue continues to dissolve.

Keen to find out how analysts think Plant Health Care's future stacks up against the industry? In that case, our free report is a great place to start.How Is Plant Health Care's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Plant Health Care's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 4.8% decrease to the company's top line. Even so, admirably revenue has lifted 70% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 36% as estimated by the one analyst watching the company. With the rest of the industry predicted to shrink by 14%, that would be a fantastic result.

With this in consideration, we understand why Plant Health Care's P/S is a cut above its industry peers. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Final Word

The large bounce in Plant Health Care's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Plant Health Care's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

Before you settle on your opinion, we've discovered 4 warning signs for Plant Health Care (1 is potentially serious!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PHC

Plant Health Care

Provides agricultural biological products and technology solutions in the United Kingdom, the United States, Mexico, Spain, and Brazil.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives