- United Kingdom

- /

- Capital Markets

- /

- LSE:BAF

Unveiling Finseta And 2 More Prominent Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index declining amid weak trade data from China, highlighting global economic interdependencies. Despite these broader market fluctuations, investors often seek opportunities in lesser-known areas like penny stocks. Although the term may seem outdated, it still represents smaller or newer companies that can offer significant potential when backed by strong financials. In this article, we explore three such penny stocks on the UK exchange that combine balance sheet strength with promising growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.75 | £182.42M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £780M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.85M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.885 | £491.62M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £432.46M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.70 | £343.12M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.33 | £85.44M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.025 | £90.69M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.425 | £180.84M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Finseta (AIM:FIN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Finseta Plc, with a market cap of £19.52 million, is a foreign exchange and payment company that provides multi-currency accounts to businesses and individuals.

Operations: The company generates £11.11 million in revenue from its data processing segment.

Market Cap: £19.52M

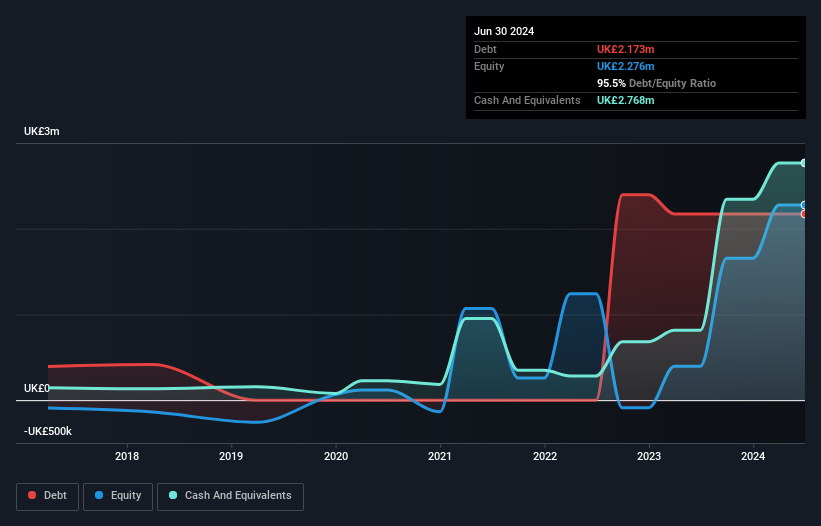

Finseta Plc, with a market cap of £19.52 million, has recently turned profitable and exhibits strong financial health with short-term assets exceeding both short and long-term liabilities. The company trades at a favorable price-to-earnings ratio of 8x compared to the UK market average. Despite its high weekly volatility relative to most UK stocks, Finseta's return on equity is outstanding at 112.1%, reflecting efficient profit generation from shareholders' investments. While debt levels have increased over five years, they remain well-covered by operating cash flow, indicating prudent financial management amidst an evolving board and experienced management team.

- Get an in-depth perspective on Finseta's performance by reading our balance sheet health report here.

- Understand Finseta's earnings outlook by examining our growth report.

Oriole Resources (AIM:ORR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oriole Resources PLC is involved in the exploration and development of gold and other base metals across Turkey, East Africa, and West Africa, with a market cap of £9.47 million.

Operations: Oriole Resources PLC does not currently report any revenue segments.

Market Cap: £9.47M

Oriole Resources PLC, with a market cap of £9.47 million, is pre-revenue and focuses on gold exploration projects in Africa and Turkey. Recent updates highlight progress in Cameroon, where BCM International is investing US$8 million to advance the Bibemi and Mbe gold projects. At Bibemi, significant drill results include intersections like 5.30m at 1.68g/t Au, enhancing resource potential beyond the current estimate of 375,000 ounces at 2.30g/t Au. The Mbe project has commenced a maiden drilling program targeting promising zones identified through trenching and soil sampling. The company remains debt-free with sufficient cash runway for over two years.

- Navigate through the intricacies of Oriole Resources with our comprehensive balance sheet health report here.

- Learn about Oriole Resources' historical performance here.

British & American Investment Trust (LSE:BAF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: British & American Investment Trust plc is a publicly owned investment manager with a market cap of £5 million.

Operations: The company generates revenue primarily from its Investment Business segment, which amounts to £2.34 million.

Market Cap: £5M

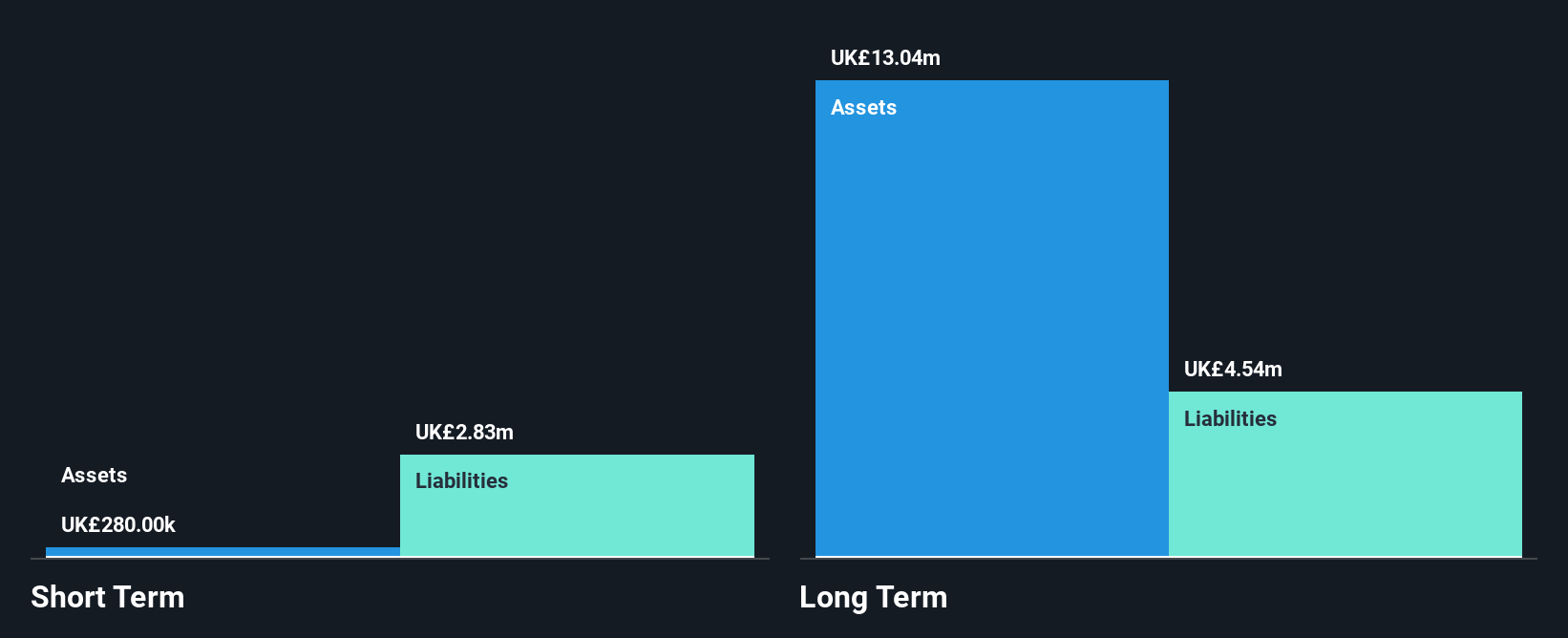

British & American Investment Trust plc, with a market cap of £5 million, has seen profitability grow over the past five years despite recent negative earnings growth. Its net debt to equity ratio stands at a satisfactory 12.6%, and its interest payments are well covered by EBIT. However, the company's short-term assets (£376K) fall short of covering both its short-term (£2.9M) and long-term liabilities (£3.9M). The stock trades significantly below estimated fair value but faces challenges with high share price volatility and an unstable dividend track record, alongside lower current profit margins compared to last year.

- Jump into the full analysis health report here for a deeper understanding of British & American Investment Trust.

- Gain insights into British & American Investment Trust's historical outcomes by reviewing our past performance report.

Taking Advantage

- Access the full spectrum of 446 UK Penny Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if British & American Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BAF

British & American Investment Trust

British & American Investment Trust plc is a publically owned investment manager.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives