- United Kingdom

- /

- Metals and Mining

- /

- AIM:JLP

One Jubilee Metals Group PLC (LON:JLP) Analyst Just Slashed Their Estimates By A Considerable 31%

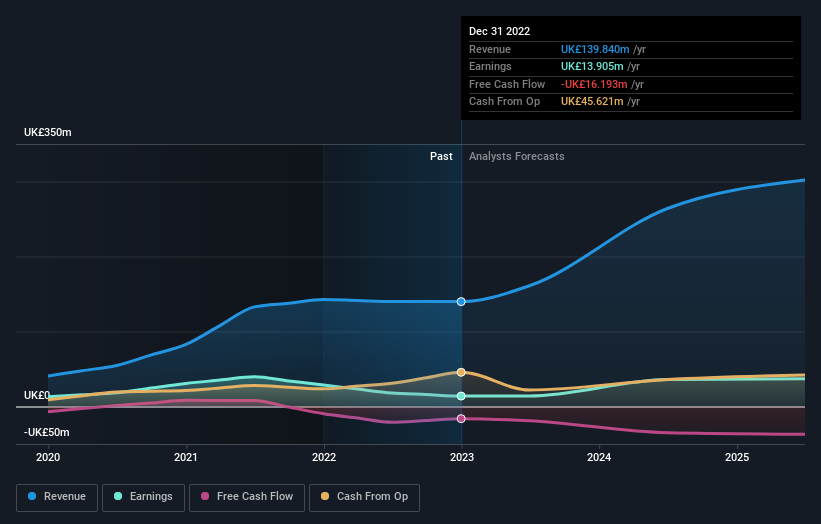

Market forces rained on the parade of Jubilee Metals Group PLC (LON:JLP) shareholders today, when the covering analyst downgraded their forecasts for this year. Revenue estimates were cut sharply as the analyst signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

Following the downgrade, the latest consensus from Jubilee Metals Group's solitary analyst is for revenues of UK£161m in 2023, which would reflect a notable 15% improvement in sales compared to the last 12 months. Before the latest update, the analyst was foreseeing UK£234m of revenue in 2023. The consensus view seems to have become more pessimistic on Jubilee Metals Group, noting the pretty serious reduction to revenue estimates in this update.

See our latest analysis for Jubilee Metals Group

Notably, the analyst has cut their price target 15% to UK£0.17, suggesting concerns around Jubilee Metals Group's valuation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Jubilee Metals Group's revenue growth is expected to slow, with the forecast 15% annualised growth rate until the end of 2023 being well below the historical 46% p.a. growth over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue shrink 1.3% per year. So it's clear that despite the slowdown in growth, Jubilee Metals Group is still expected to grow meaningfully faster than the wider industry.

The Bottom Line

The clear low-light was that the analyst slashing their revenue forecasts for Jubilee Metals Group this year. The analyst also expects revenues to perform better than the wider market. The consensus price target fell measurably, with the analyst seemingly not reassured by recent business developments, leading to a lower estimate of Jubilee Metals Group's future valuation. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Jubilee Metals Group after today.

Thirsting for more data? We have forecasts for Jubilee Metals Group from one covering analyst, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:JLP

Jubilee Metals Group

Jubilee Metals Group plc operates as a diversified metals processing and recovery company.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026