Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Iofina (LON:IOF). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Iofina

How Fast Is Iofina Growing Its Earnings Per Share?

Over the last three years, Iofina has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Iofina's EPS soared from US$0.011 to US$0.018, over the last year. That's a commendable gain of 59%.

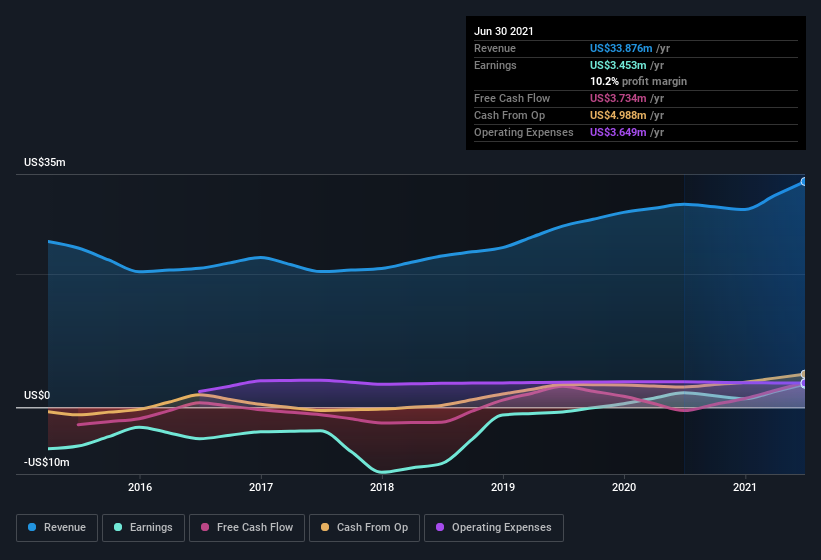

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). On the one hand, Iofina's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Iofina is no giant, with a market capitalization of UK£38m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Iofina Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Iofina shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Lance Baller, the Non-Executive Chairman of the company, paid US$36k for shares at around US$0.18 each.

On top of the insider buying, we can also see that Iofina insiders own a large chunk of the company. Actually, with 40% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about US$15m riding on the stock, at current prices. That's nothing to sneeze at!

Does Iofina Deserve A Spot On Your Watchlist?

For growth investors like me, Iofina's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for Iofina you should know about.

The good news is that Iofina is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IOF

Iofina

Explores for, develops, and produces iodine and halogen-based specialty chemical derivatives from oil and gas operations in North America, Asia, South America, Europe, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026