- United Kingdom

- /

- Metals and Mining

- /

- AIM:HUM

Hummingbird Resources (LON:HUM investor three-year losses grow to 80% as the stock sheds UK£22m this past week

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of Hummingbird Resources PLC (LON:HUM), who have seen the share price tank a massive 80% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The falls have accelerated recently, with the share price down 40% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Since Hummingbird Resources has shed UK£22m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Hummingbird Resources

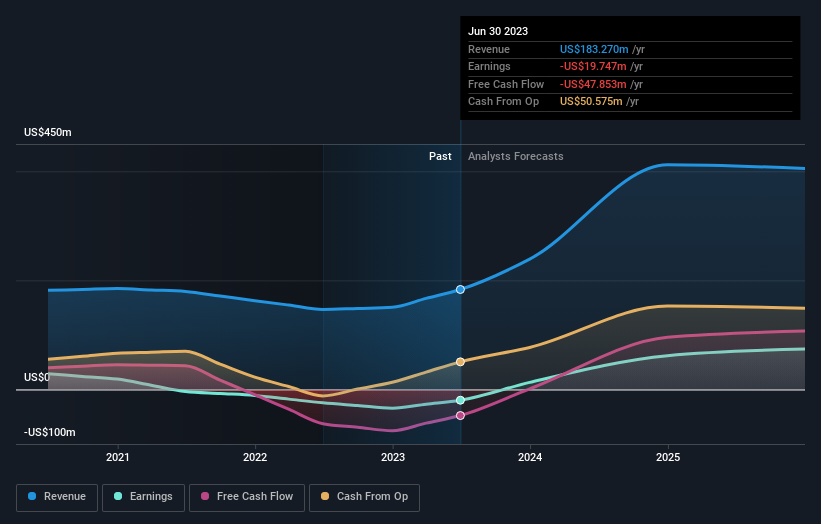

Because Hummingbird Resources made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Hummingbird Resources saw its revenue shrink by 5.1% per year. That is not a good result. The share price fall of 22% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Hummingbird Resources stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that Hummingbird Resources shareholders have received a total shareholder return of 8.1% over the last year. That certainly beats the loss of about 11% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Hummingbird Resources you should be aware of, and 1 of them is a bit concerning.

Hummingbird Resources is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hummingbird Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HUM

Hummingbird Resources

Engages in the exploration, evaluation, and development of mineral properties in Liberia, Mali, and Guinea.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives