- United Kingdom

- /

- IT

- /

- AIM:TIA

UK Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has been under pressure, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic challenges. Despite these broader market concerns, penny stocks remain an intriguing area of interest for investors seeking affordability and potential growth. Though often associated with smaller or newer companies, these stocks can offer unique opportunities when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £511.64M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.88 | £232.67M | ✅ 5 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.405 | £43.82M | ✅ 4 ⚠️ 3 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.43 | £427.07M | ✅ 4 ⚠️ 1 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.914 | £337.98M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.66 | £273.37M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.225 | £115.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.18 | £187.83M | ✅ 4 ⚠️ 3 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.685 | £270.98M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.34 | £71.91M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

James Cropper (AIM:CRPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: James Cropper PLC is a company that manufactures and sells paper products and advanced materials, with a market cap of £25.80 million.

Operations: The company generates revenue from two main segments: Paper & Packaging (£63.66 million) and Advanced Materials (£35.69 million).

Market Cap: £25.8M

James Cropper PLC, with a market cap of £25.80 million, is navigating challenges typical for penny stocks. The company reported sales of £99.34 million for the year ending March 2025 but remains unprofitable with a net loss of £5.27 million, up from the previous year's loss of £4 million. Despite its financial struggles, James Cropper's operating cash flow covers 41.7% of its debt, and short-term assets exceed both short and long-term liabilities, indicating some financial stability. Recent strategic debt restructuring aims to improve liquidity headroom without altering interest rates or covenants; however, dividends are suspended until September 2026 as part of this strategy shift.

- Click to explore a detailed breakdown of our findings in James Cropper's financial health report.

- Review our growth performance report to gain insights into James Cropper's future.

Manolete Partners (AIM:MANO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Manolete Partners Plc is a UK-based insolvency litigation financing company with a market cap of £46.00 million.

Operations: The company's revenue is derived entirely from its unclassified services, totaling £30.48 million.

Market Cap: £46M

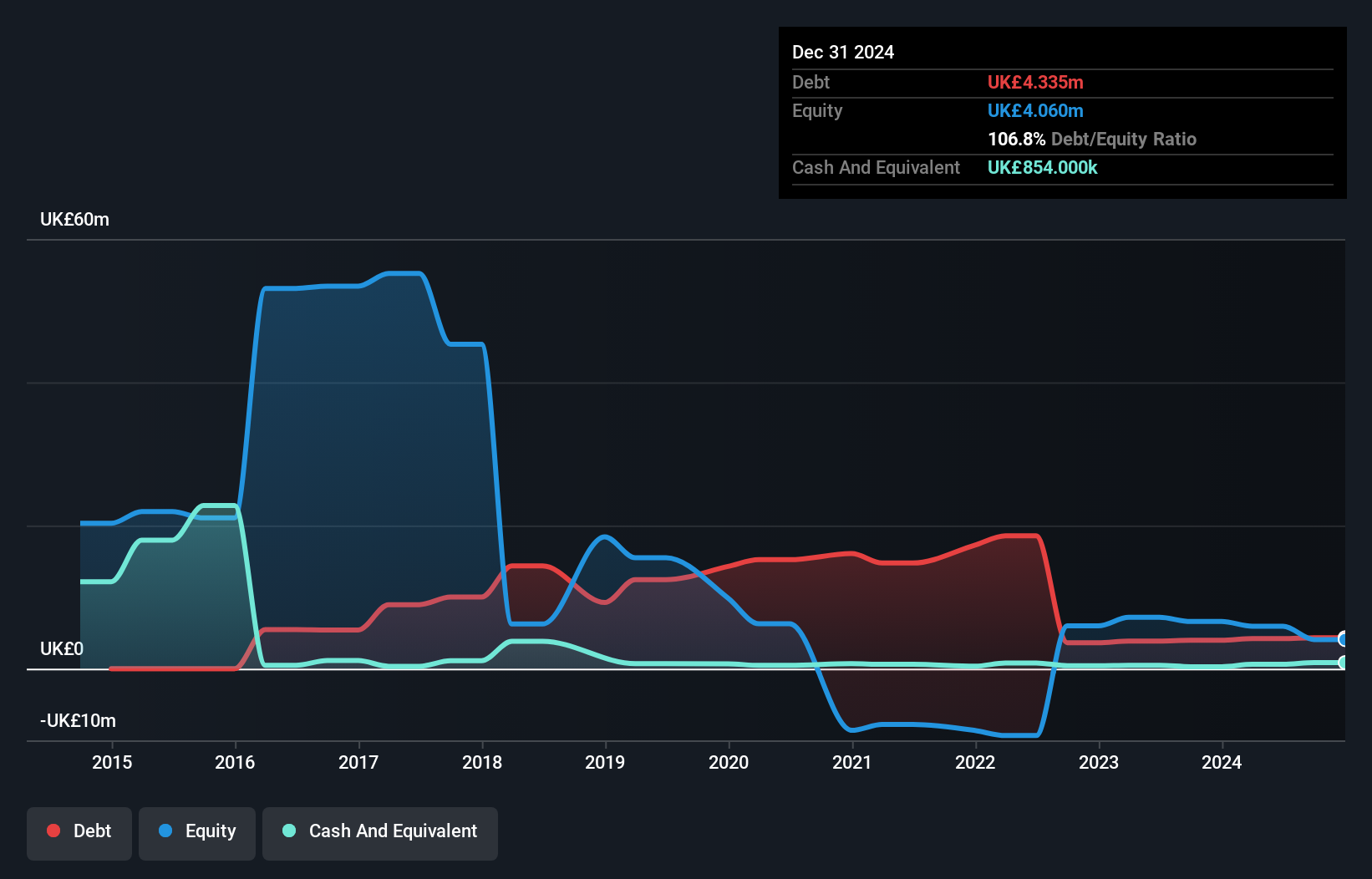

Manolete Partners Plc, with a market cap of £46 million, has reported sales of £30.48 million for the year ending March 2025, alongside a net income of £0.893 million. Despite a decline in earnings over the past five years and low return on equity at 2.2%, the company's debt is well covered by operating cash flow and interest payments are adequately managed with EBIT coverage at 21.8x. The recent executive changes include Mena Halton stepping up as CEO and Will Sawyer joining as CFO, indicating strategic leadership shifts following founder Steven Cooklin's departure from daily operations but remaining a significant shareholder.

- Jump into the full analysis health report here for a deeper understanding of Manolete Partners.

- Gain insights into Manolete Partners' outlook and expected performance with our report on the company's earnings estimates.

Tialis Essential IT (AIM:TIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tialis Essential IT PLC, with a market cap of £18.40 million, offers network, cloud, and IT managed services to public and private companies in the United Kingdom through its subsidiaries.

Operations: The company generates £20.84 million in revenue from its Manage Business segment, focusing on network, cloud, and IT managed services for public and private entities in the UK.

Market Cap: £18.4M

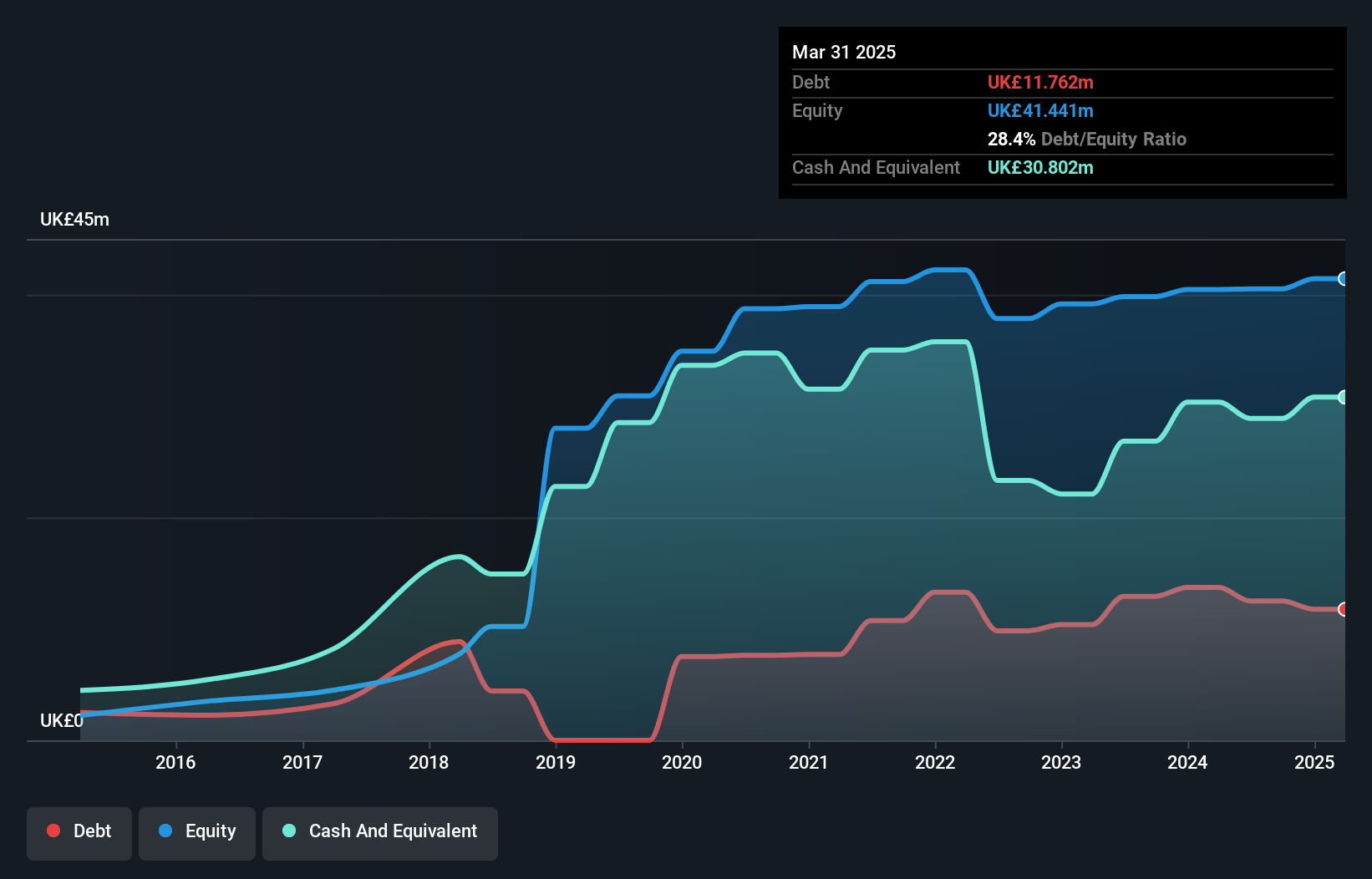

Tialis Essential IT PLC, with a market cap of £18.40 million, offers network, cloud, and IT managed services in the UK. Despite being unprofitable and not forecasted to achieve profitability in the next three years, it maintains a strong cash runway due to positive free cash flow. The company's short-term assets cover its long-term liabilities but not its short-term ones. Recently, Tialis led an investment round in Digital Petcare UK Limited by converting £500,000 debt into equity and refinancing £700,000 over 24 months at 12%. Shareholder dilution has been minimal over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Tialis Essential IT.

- Examine Tialis Essential IT's past performance report to understand how it has performed in prior years.

Taking Advantage

- Navigate through the entire inventory of 299 UK Penny Stocks here.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tialis Essential IT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TIA

Tialis Essential IT

Through its subsidiaries, provides network, cloud, and IT managed services to public and private companies in the United Kingdom.

Adequate balance sheet with low risk.

Market Insights

Community Narratives