- United Kingdom

- /

- Metals and Mining

- /

- AIM:CAML

Most Shareholders Will Probably Agree With Central Asia Metals plc's (LON:CAML) CEO Compensation

Despite positive share price growth of 12% for Central Asia Metals plc (LON:CAML) over the last few years, earnings growth has been disappointing, which suggests something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 21 May 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

View our latest analysis for Central Asia Metals

How Does Total Compensation For Nigel Robinson Compare With Other Companies In The Industry?

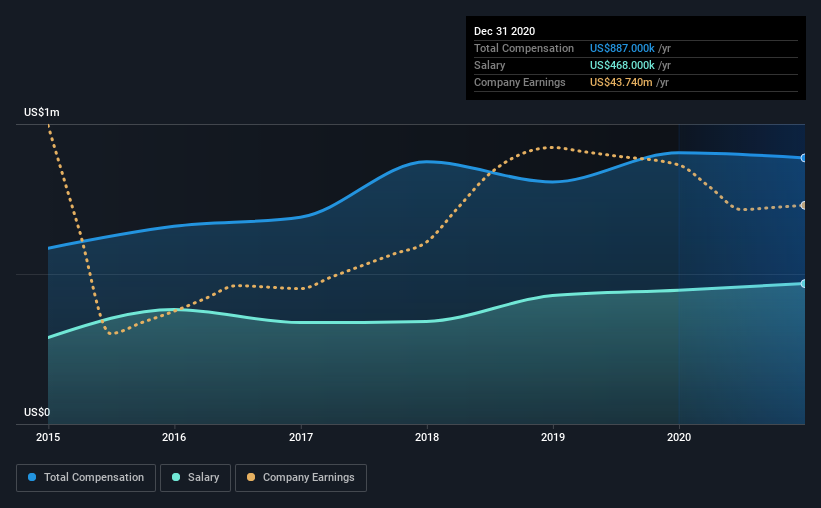

At the time of writing, our data shows that Central Asia Metals plc has a market capitalization of UK£477m, and reported total annual CEO compensation of US$887k for the year to December 2020. That is, the compensation was roughly the same as last year. We note that the salary of US$468.0k makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from UK£284m to UK£1.1b, we found that the median CEO total compensation was US$959k. From this we gather that Nigel Robinson is paid around the median for CEOs in the industry. What's more, Nigel Robinson holds UK£1.8m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$468k | US$446k | 53% |

| Other | US$419k | US$458k | 47% |

| Total Compensation | US$887k | US$904k | 100% |

Talking in terms of the industry, salary represented approximately 63% of total compensation out of all the companies we analyzed, while other remuneration made up 38% of the pie. Central Asia Metals pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Central Asia Metals plc's Growth Numbers

Central Asia Metals plc has reduced its earnings per share by 5.2% a year over the last three years. It saw its revenue drop 6.7% over the last year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Central Asia Metals plc Been A Good Investment?

Central Asia Metals plc has generated a total shareholder return of 12% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Central Asia Metals that investors should look into moving forward.

Switching gears from Central Asia Metals, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Central Asia Metals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CAML

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026