- United Kingdom

- /

- Metals and Mining

- /

- AIM:CAML

Central Asia Metals (LON:CAML) Has A Pretty Healthy Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Central Asia Metals plc (LON:CAML) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Central Asia Metals

What Is Central Asia Metals's Debt?

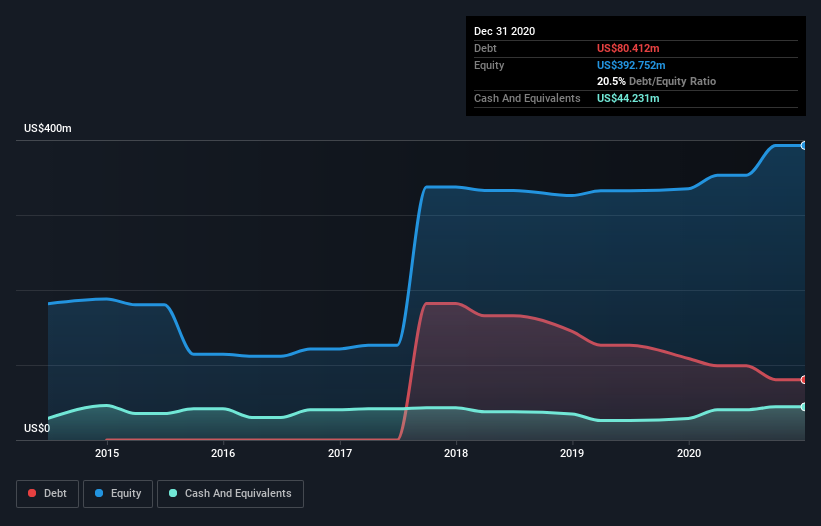

As you can see below, Central Asia Metals had US$80.4m of debt at December 2020, down from US$108.8m a year prior. However, it also had US$44.2m in cash, and so its net debt is US$36.2m.

How Strong Is Central Asia Metals' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Central Asia Metals had liabilities of US$65.5m due within 12 months and liabilities of US$85.2m due beyond that. Offsetting these obligations, it had cash of US$44.2m as well as receivables valued at US$6.32m due within 12 months. So its liabilities total US$100.2m more than the combination of its cash and short-term receivables.

Given Central Asia Metals has a market capitalization of US$687.4m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Central Asia Metals has a low net debt to EBITDA ratio of only 0.38. And its EBIT easily covers its interest expense, being 11.0 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. But the bad news is that Central Asia Metals has seen its EBIT plunge 15% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Central Asia Metals's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Central Asia Metals recorded free cash flow worth a fulsome 83% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that Central Asia Metals's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But we must concede we find its EBIT growth rate has the opposite effect. Looking at all the aforementioned factors together, it strikes us that Central Asia Metals can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Central Asia Metals you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Central Asia Metals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CAML

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives