- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:WINE

Discover 3 UK Penny Stocks With Market Caps Over £50M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. Amid these broader market fluctuations, investors often seek opportunities in areas that may offer growth potential despite economic headwinds. Penny stocks, though sometimes considered a relic of past eras, continue to attract attention for their affordability and potential for growth when backed by strong financials. In this article, we explore several UK penny stocks that stand out for their financial strength and long-term potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.185 | £480.11M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.90 | £153.5M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.305 | £334.01M | ✅ 5 ⚠️ 1 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.70 | £130.76M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.865 | £13.06M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6975 | $405.48M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.502 | £181.91M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.445 | £38.36M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £183.46M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 305 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Atlantic Lithium (AIM:ALL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlantic Lithium Limited is involved in the exploration and development of mineral properties across Australia, Ivory Coast, and Ghana with a market cap of £75.62 million.

Operations: The company generates revenue from its exploration activities for base and precious metals, amounting to A$0.69 million.

Market Cap: £75.62M

Atlantic Lithium Limited, with a market cap of £75.62 million, is pre-revenue and debt-free, making it a speculative yet potentially rewarding penny stock. The company recently raised A$4.06 million through an equity offering to bolster its cash position amidst ongoing regulatory discussions in Ghana regarding the Ewoyaa Lithium Project's mining lease. Despite the volatility in share price and high weekly volatility compared to other UK stocks, Atlantic Lithium's experienced management team continues to pursue strategic mineral exploration efforts across Africa and Australia while navigating legislative processes crucial for future growth prospects.

- Click here to discover the nuances of Atlantic Lithium with our detailed analytical financial health report.

- Assess Atlantic Lithium's future earnings estimates with our detailed growth reports.

Naked Wines (AIM:WINE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Naked Wines plc operates as a direct-to-consumer wine retailer in Australia, the United Kingdom, and the United States with a market cap of £52.07 million.

Operations: The company's revenue is derived from its operations in the UK (£105.44 million), USA (£97.26 million), and Australia (£28.25 million).

Market Cap: £52.07M

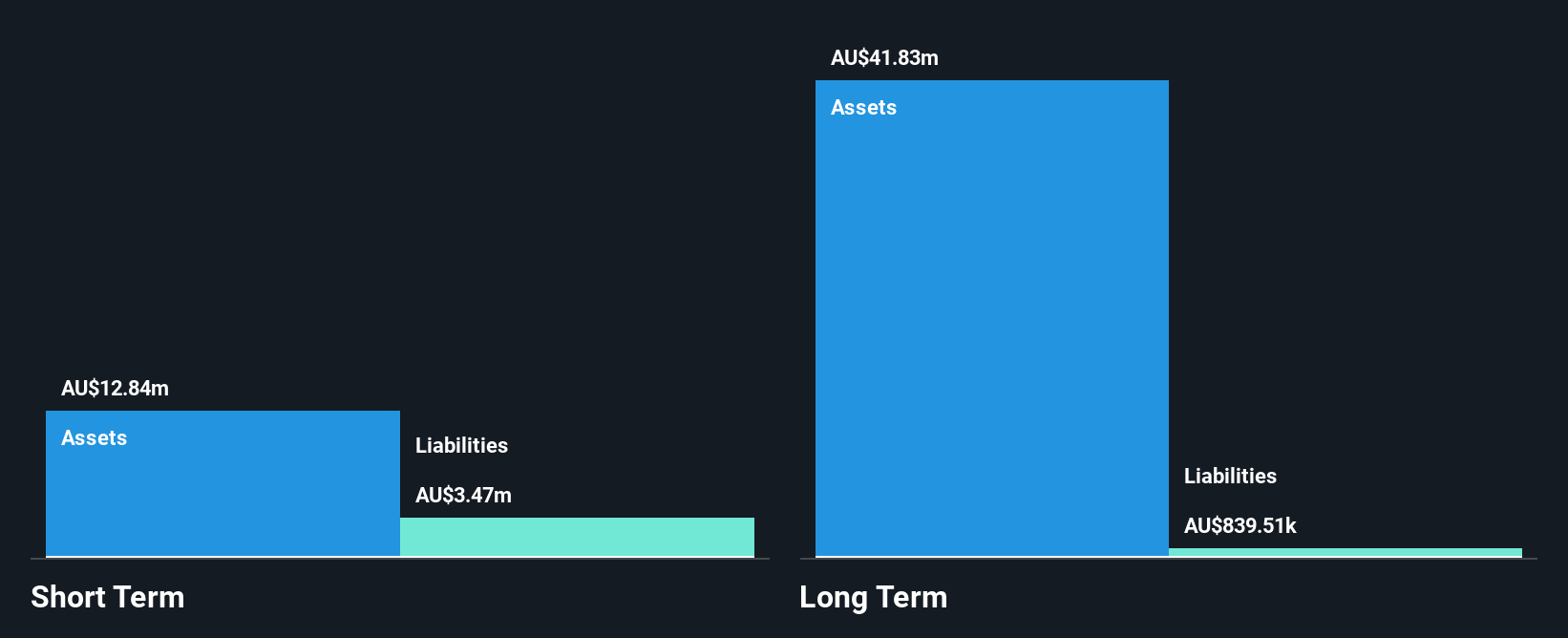

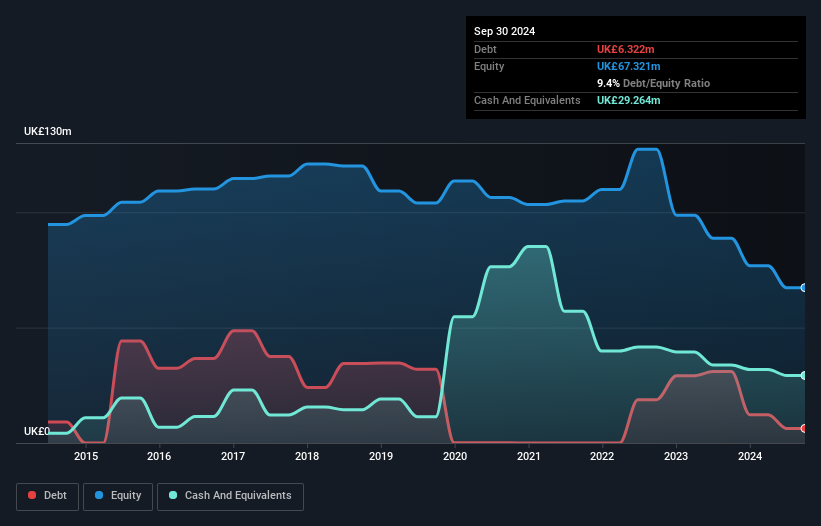

Naked Wines plc, with a market cap of £52.07 million, operates in the UK, USA, and Australia but remains unprofitable despite generating substantial revenue from these regions. The company trades significantly below its estimated fair value and has a stable cash runway exceeding three years due to positive free cash flow. Recent board changes include the appointment of Susan Hooper as Senior Independent Director, enhancing governance with her extensive experience. Despite high volatility and declining earnings over recent years, Naked Wines maintains sufficient short-term assets to cover liabilities while reducing its debt-to-equity ratio slightly over five years.

- Take a closer look at Naked Wines' potential here in our financial health report.

- Learn about Naked Wines' future growth trajectory here.

Trustpilot Group (LSE:TRST)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Trustpilot Group plc operates an online review platform connecting businesses and consumers across the United Kingdom, North America, Europe, and internationally, with a market cap of £647.18 million.

Operations: Trustpilot Group generates revenue of $233.80 million from its Internet Information Providers segment.

Market Cap: £647.18M

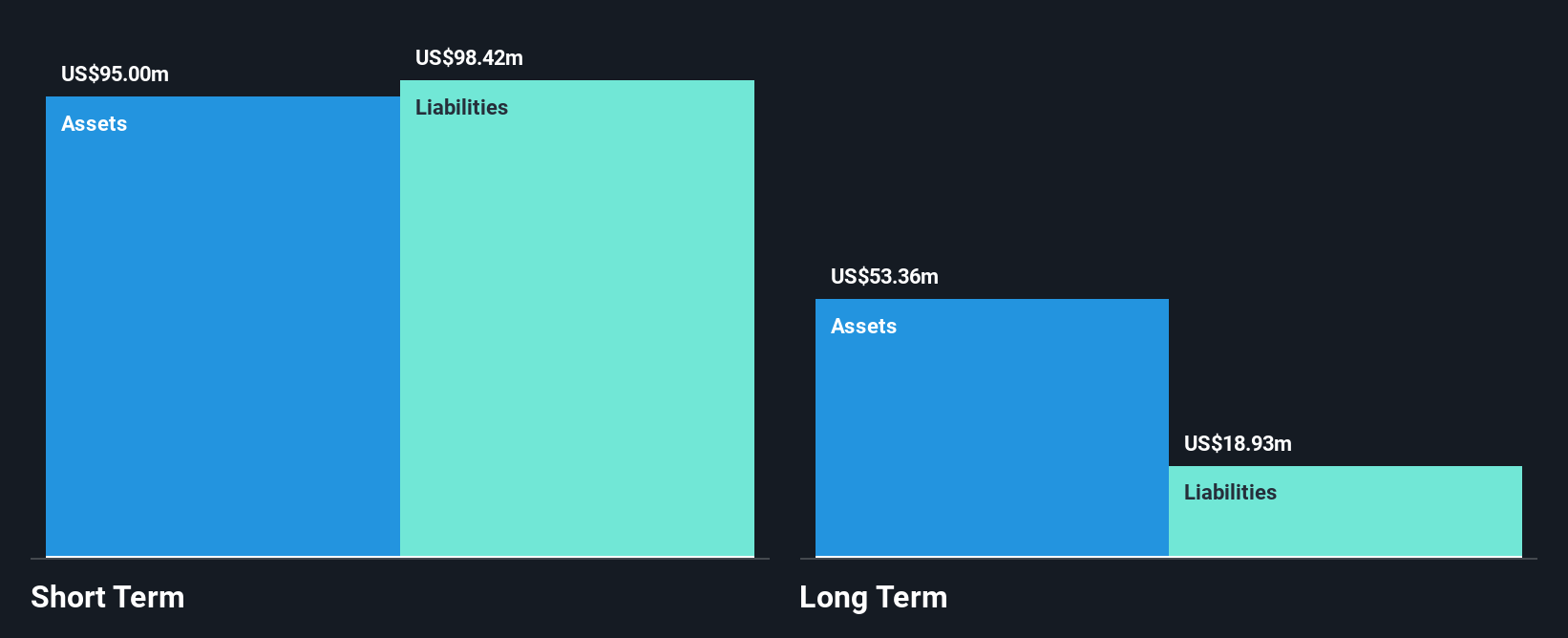

Trustpilot Group, with a market cap of £647.18 million, is debt-free and has high-quality earnings, yet it faces challenges such as a volatile share price and low return on equity at 3.5%. Despite becoming profitable over the past five years with significant earnings growth, recent performance shows negative earnings growth of -93.8% and shrinking profit margins from 9% to 0.5%. Short-term assets ($95M) do not fully cover short-term liabilities ($98.4M), although they exceed long-term liabilities ($18.9M). The management team is relatively new with an average tenure of 1.9 years, while the board remains experienced.

- Get an in-depth perspective on Trustpilot Group's performance by reading our balance sheet health report here.

- Explore Trustpilot Group's analyst forecasts in our growth report.

Summing It All Up

- Explore the 305 names from our UK Penny Stocks screener here.

- Curious About Other Options? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Naked Wines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:WINE

Naked Wines

Engages in the direct-to-consumer retailing of wines in Australia, the United Kingdom, and the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion