- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

Promising UK Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. In such fluctuating conditions, identifying stocks with strong financial foundations becomes crucial for investors seeking potential growth opportunities. While the term "penny stocks" may seem outdated, these smaller or newer companies can still offer surprising value and stability.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.76 | £542.84M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.10 | £169.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.95 | £14.34M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.685 | $398.21M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.798 | £295.08M | ✅ 5 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.455 | £70.28M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.51 | £43.96M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.15 | £183.54M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 302 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Anglo Asian Mining (AIM:AAZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anglo Asian Mining PLC, with a market cap of £264.13 million, owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

Operations: The company generates revenue of $67.14 million from its mining operations.

Market Cap: £264.13M

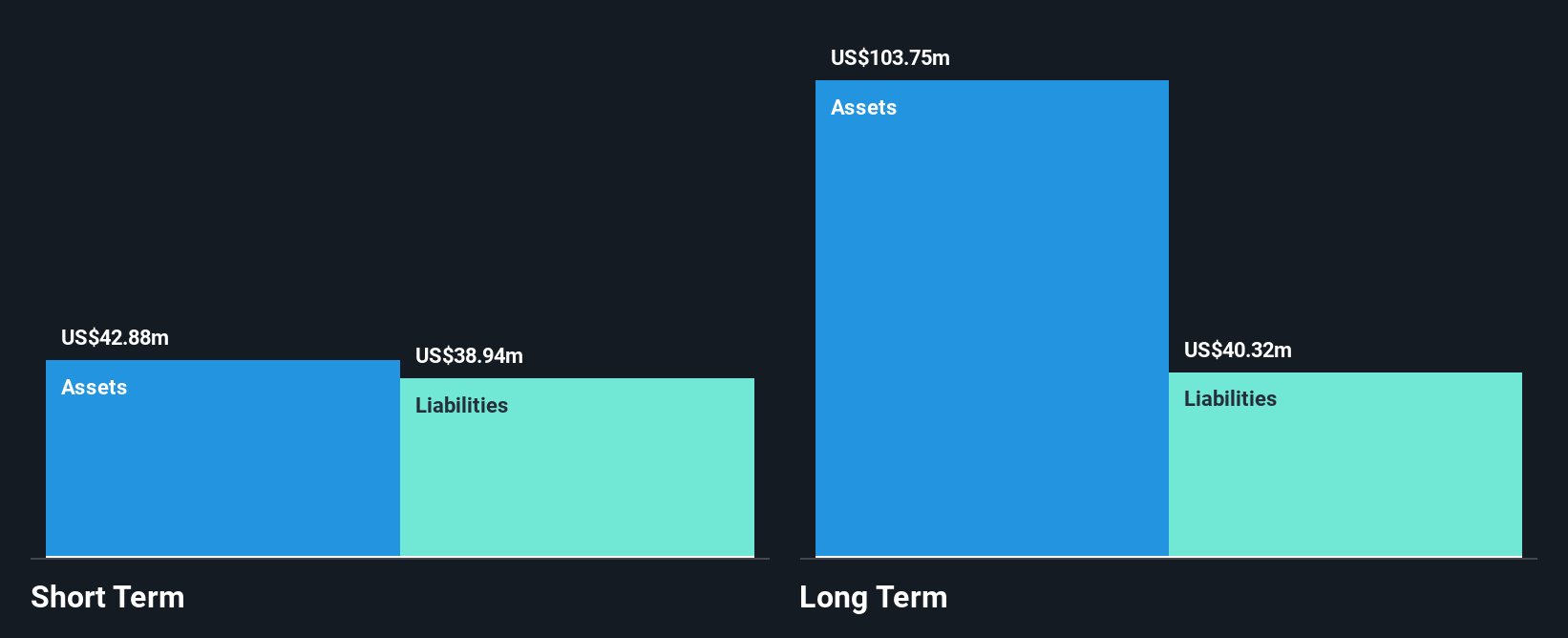

Anglo Asian Mining PLC, with a market cap of £264.13 million and generating US$67.14 million in revenue, is drawing interest due to M&A rumors involving ACG Metals Limited. The company has recently secured a sales contract with Trafigura for copper concentrate from its Demirli mine, supported by a revolving prepayment facility of up to US$25 million. Despite being unprofitable and facing high volatility, Anglo Asian's short-term assets exceed both short- and long-term liabilities, indicating financial stability amidst its operational expansion in Azerbaijan's mining sector. However, the company's negative return on equity highlights ongoing profitability challenges.

- Take a closer look at Anglo Asian Mining's potential here in our financial health report.

- Understand Anglo Asian Mining's earnings outlook by examining our growth report.

Filtronic (AIM:FTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology globally, with a market cap of £288.12 million.

Operations: The company generates revenue from its Wireless Communications Equipment segment, amounting to £56.32 million.

Market Cap: £288.12M

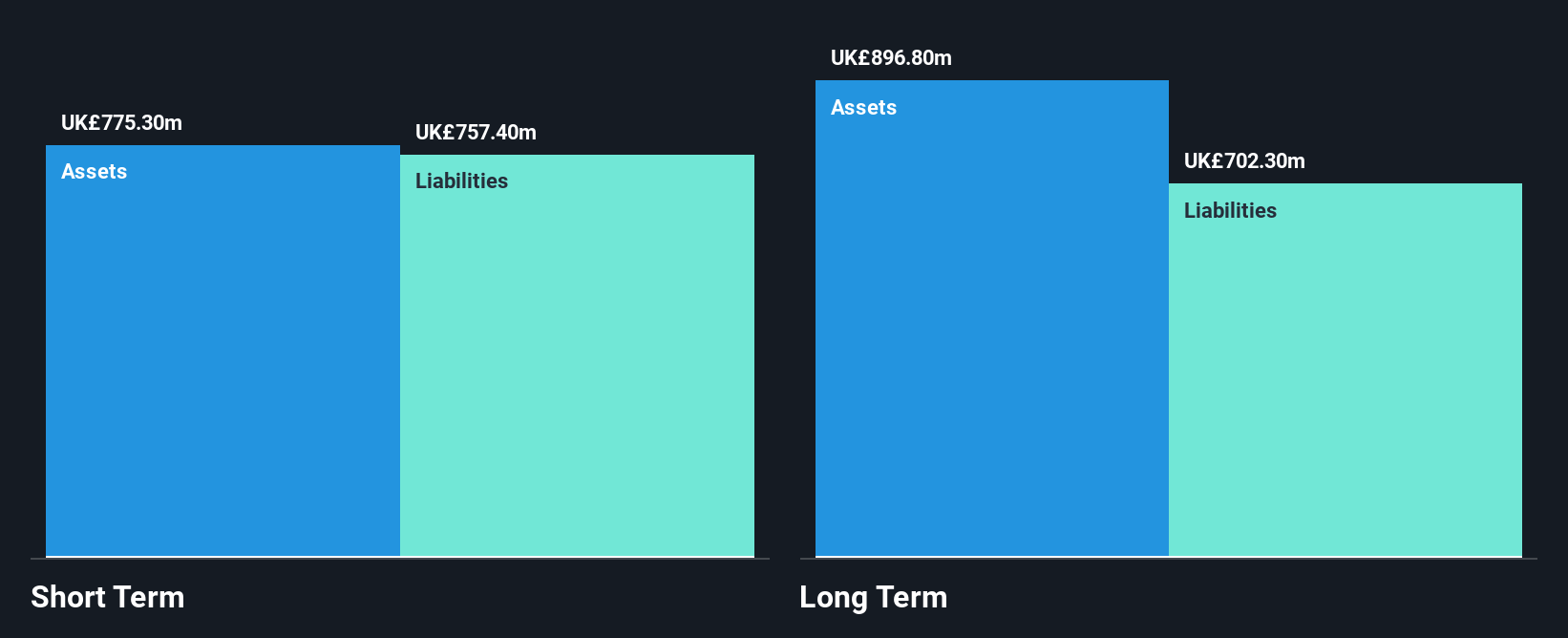

Filtronic plc, with a market cap of £288.12 million and revenue of £56.32 million, has shown impressive earnings growth of 347.3% over the past year, outpacing the Communications industry. The company is debt-free and its short-term assets surpass liabilities, indicating solid financial health. Filtronic's recent contract with a European aerospace manufacturer for RF assemblies in a satellite constellation program underscores its technical prowess and market position in RF innovation. Despite an inexperienced management team, Filtronic is poised for growth with upcoming high-frequency product launches targeting space ground station opportunities in 2026.

- Navigate through the intricacies of Filtronic with our comprehensive balance sheet health report here.

- Examine Filtronic's earnings growth report to understand how analysts expect it to perform.

ASOS (LSE:ASC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ASOS Plc, along with its subsidiaries, is an online fashion retailer serving the United Kingdom, European Union, United States, and other international markets with a market cap of approximately £0.29 billion.

Operations: The company generates revenue primarily from its online retail operations, amounting to £2.48 billion.

Market Cap: £289.42M

ASOS Plc, with a market cap of £0.29 billion and revenue of £2.48 billion, faces challenges as it navigates a multi-year turnaround strategy amidst financial difficulties. The company recently reported a net loss of £298.4 million for the year ending August 2025, though it has improved its balance sheet through refinancing efforts that provide increased liquidity and reduced interest costs. Despite high debt levels and ongoing unprofitability, ASOS maintains over three years of cash runway due to positive free cash flow growth. Recent board changes aim to leverage experienced leadership for strategic progress in the competitive online fashion retail sector.

- Click here and access our complete financial health analysis report to understand the dynamics of ASOS.

- Review our growth performance report to gain insights into ASOS' future.

Taking Advantage

- Get an in-depth perspective on all 302 UK Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AAZ

Anglo Asian Mining

Owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026