- United Kingdom

- /

- Insurance

- /

- LSE:SBRE

Sabre Insurance Group (LON:SBRE) Is Paying Out Less In Dividends Than Last Year

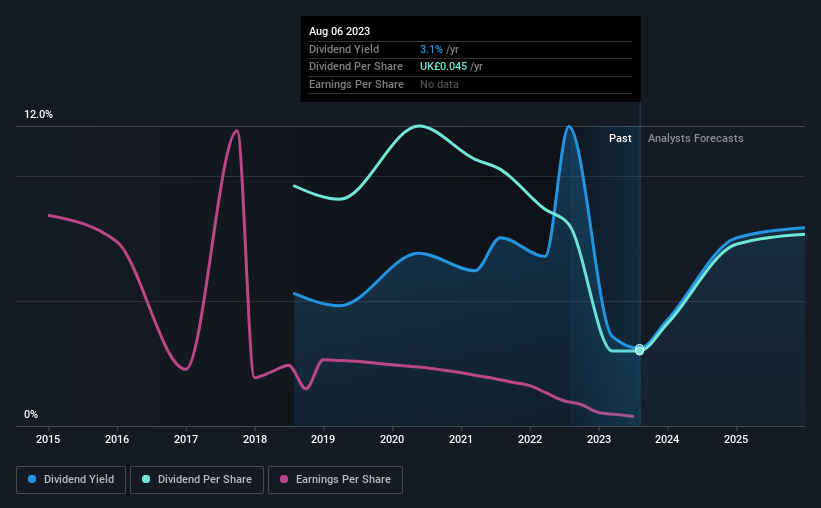

Sabre Insurance Group plc's (LON:SBRE) dividend is being reduced by 68% to £0.009 per share on 20th of September, in comparison to last year's comparable payment of £0.028. This means that the dividend yield is 3.1%, which is a bit low when comparing to other companies in the industry.

See our latest analysis for Sabre Insurance Group

Sabre Insurance Group's Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Before making this announcement, Sabre Insurance Group's was paying out quite a large proportion of earnings and 91% of free cash flows. This is usually an indication that the focus of the company is returning cash to shareholders rather than reinvesting it for growth.

Analysts expect a massive rise in earnings per share in the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 9.5% which is fairly sustainable.

Sabre Insurance Group's Dividend Has Lacked Consistency

Sabre Insurance Group has been paying dividends for a while, but the track record isn't stellar. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. Since 2018, the annual payment back then was £0.144, compared to the most recent full-year payment of £0.045. Dividend payments have fallen sharply, down 69% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Over the past five years, it looks as though Sabre Insurance Group's EPS has declined at around 31% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Sabre Insurance Group's Dividend Doesn't Look Sustainable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments are bit high to be considered sustainable, and the track record isn't the best. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 2 warning signs for Sabre Insurance Group that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SBRE

Sabre Insurance Group

Through its subsidiaries, engages in writing of general insurance for motor vehicles in the United Kingdom.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives