Insiders were net sellers of Hiscox Ltd's (LON:HSX ) stock during the past year. That is, insiders sold more stock than they bought.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

View our latest analysis for Hiscox

Hiscox Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Group CFO & Executive Director, Paul Cooper, for UK£260k worth of shares, at about UK£12.43 per share. That means that an insider was selling shares at around the current price of UK£11.50. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern. The only individual insider seller over the last year was Paul Cooper. Notably Paul Cooper was also the biggest buyer, having purchased UK£219k worth of shares.

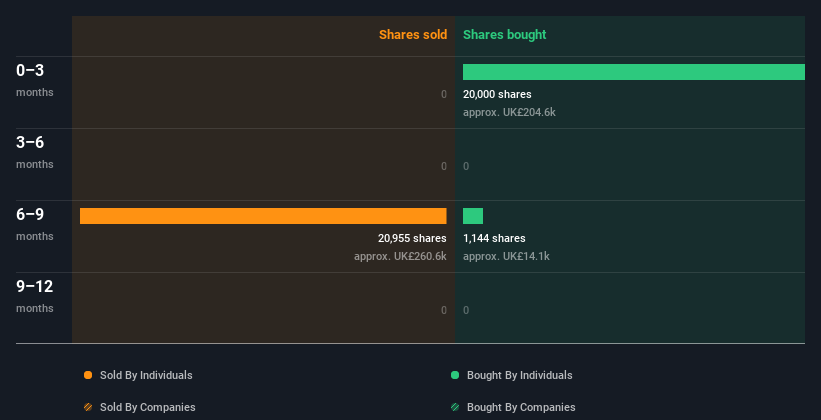

In the last twelve months insiders purchased 21.14k shares for UK£219k. On the other hand they divested 20.96k shares, for UK£260k. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Hiscox Insiders Bought Stock Recently

It's good to see that Hiscox insiders have made notable investments in the company's shares. In total, insiders bought UK£205k worth of shares in that time, and we didn't record any sales whatsoever. This could be interpreted as suggesting a positive outlook.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Hiscox insiders own about UK£19m worth of shares. That equates to 0.5% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Hiscox Insiders?

The recent insider purchases are heartening. But we can't say the same for the transactions over the last 12 months. The more recent transactions are a positive, but Hiscox insiders haven't shown the sustained enthusiasm that we look for, although they do own a decent number of shares, overall. In short they are likely aligned with shareholders. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Our analysis shows 2 warning signs for Hiscox (1 is a bit unpleasant!) and we strongly recommend you look at these before investing.

Of course Hiscox may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Hiscox might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HSX

Hiscox

Through its subsidiaries, provides insurance and reinsurance services worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives