- United Kingdom

- /

- Insurance

- /

- LSE:AV.

Is Aviva’s Share Price Growth in 2025 Justified After Recent Earnings Surge?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Aviva shares? You are not alone. Many investors are eyeing this stock, weighing up the potential after a remarkable few years of gains. If you have been holding on, you have likely enjoyed some significant upside, with Aviva’s share price up a massive 228.6% over the last five years and doubling in just three. While there has been a tiny dip of -0.6% over the past week, this follows a solid 3.3% gain in the past month and an extraordinary 53.1% jump over the previous year.

Much of this momentum is tied to broader shifts in the UK insurance and savings sector. As markets recalibrated around changing interest rates and investor demand for stable returns, Aviva emerged as a leader by managing risk, adapting its portfolio, and capitalizing on renewed investor confidence. That long-term growth streak has certainly turned heads, but it also calls for a closer look at whether the stock is now too hot or still has value left for new investors.

Here is where it gets interesting. Based on six key valuation checks, Aviva earns a value score of 2, suggesting it is currently undervalued in just two of the six categories we track. So, while the share price is riding high, the story on whether Aviva is truly a bargain is far from clear-cut.

Next, we will break down how Aviva looks through various valuation lenses, then wrap up with a smarter and perhaps more useful way to think about what this stock is really worth.

Aviva scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Aviva Excess Returns Analysis

The Excess Returns model focuses on a company's ability to consistently generate returns above its cost of capital. This is often seen as a strong indicator of long-term value creation. For Aviva, this model evaluates the difference between the company’s return on equity (ROE) and its cost of equity to determine the true economic profit generated for shareholders.

Aviva has a book value of £3.16 per share and a stable earnings per share (EPS) estimate of £0.58, as projected by a consensus of seven analysts. With a cost of equity at £0.25 per share and an average ROE of 16.32%, Aviva produces an excess return of £0.33 for every share of equity, indicating effective deployment of capital. The stable book value projection stands at £3.55 per share, supported by analysis from four separate sources.

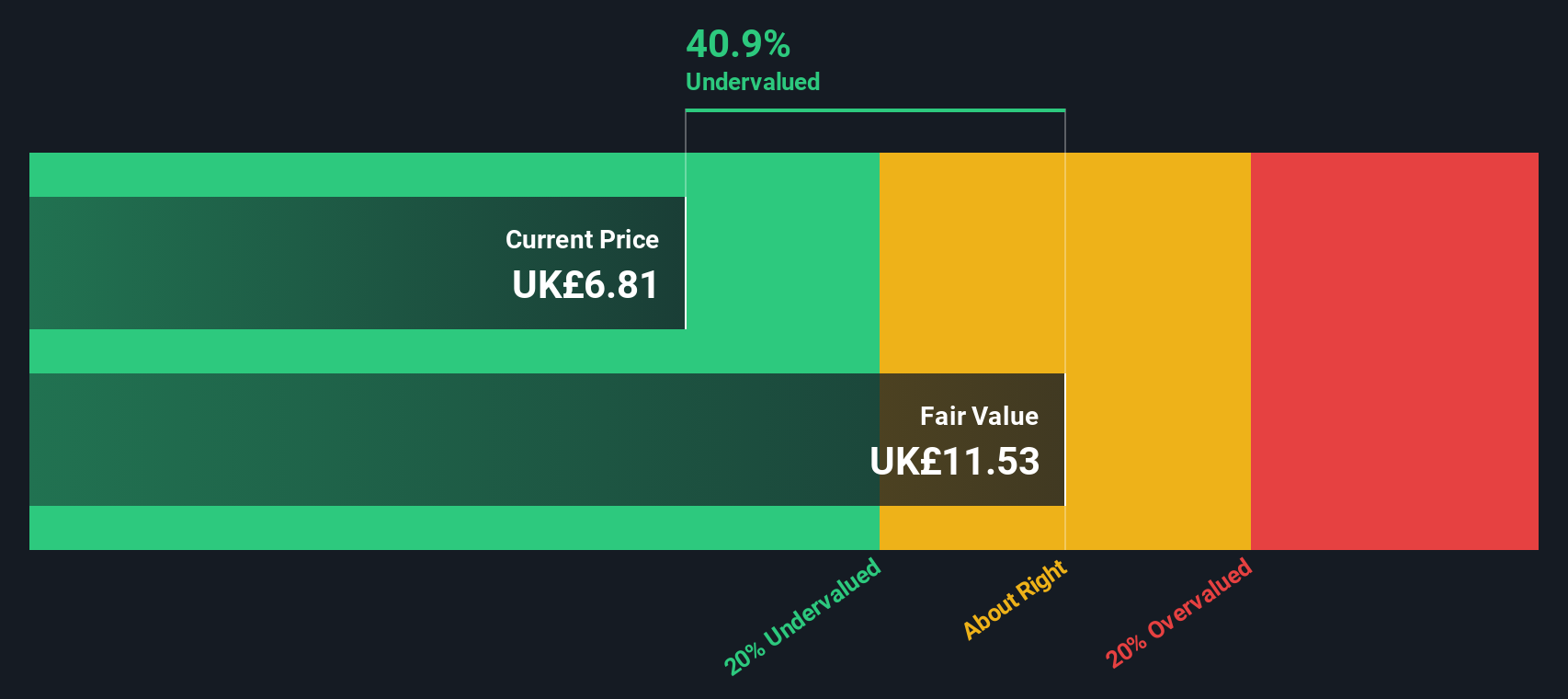

Considering these factors, the Excess Returns model estimates Aviva's intrinsic value at £11.52 per share. The current share price reflects a 41.2% discount to this fair value, suggesting that Aviva's stock may be materially undervalued according to this analysis.

Result: UNDERVALUED

Our Excess Returns analysis suggests Aviva is undervalued by 41.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Aviva Price vs Earnings

For profitable companies like Aviva, the price-to-earnings (PE) ratio is often considered the most direct and meaningful valuation metric. It tells investors how much they are paying today for each pound of company earnings, making it particularly useful for established businesses with solid, recurring profits.

What represents a “normal” or “fair” PE ratio varies depending on growth prospects and risk factors. Companies expected to grow earnings quickly, or those with more resilient business models, command higher PE ratios. Slower-growing or riskier businesses generally trade at lower multiples.

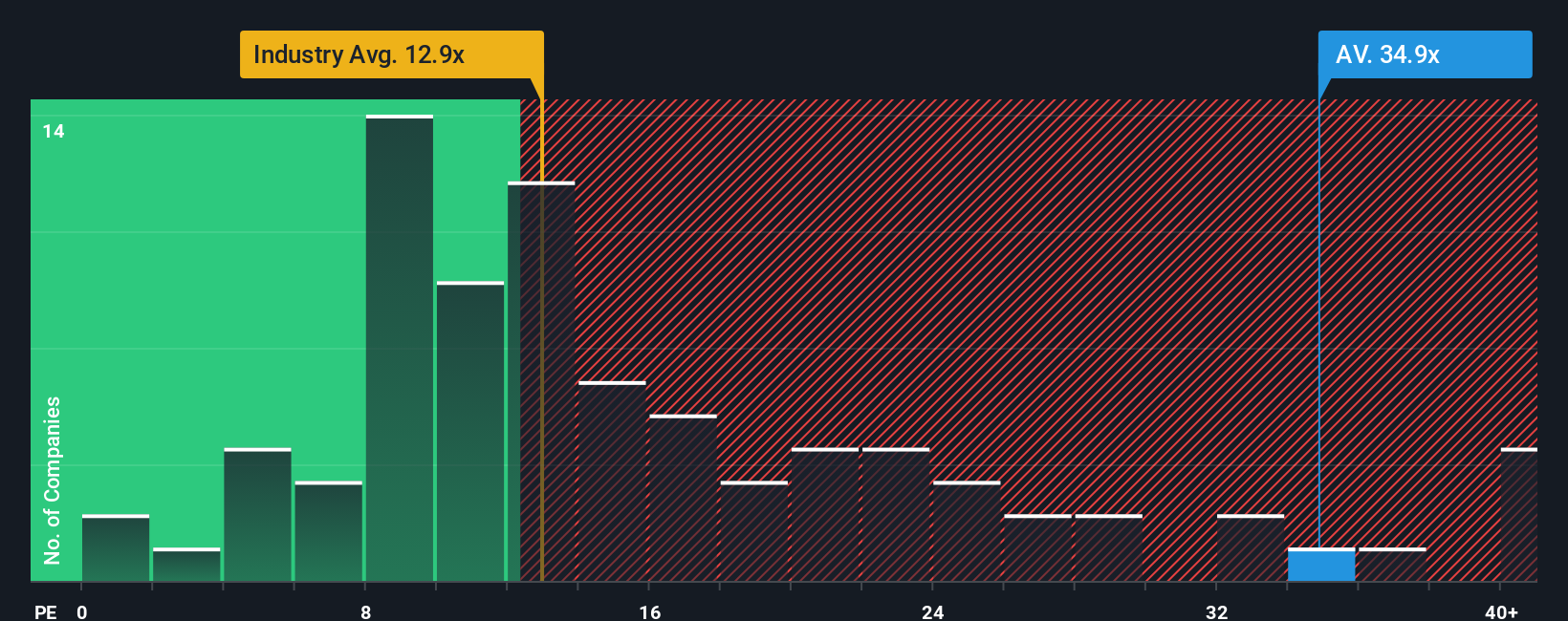

Aviva currently trades at a PE ratio of 34.7x, which is notably higher than both the industry average of 12.3x and the average of its peers at 20.2x. This premium suggests that the market is pricing in either strong earnings potential, lower risk, or a combination of both. However, relying solely on these comparisons does not account for Aviva’s specific strengths, risks, and prospects.

This is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric estimates what the PE ratio should be for a company, taking into account important factors like growth forecasts, risk profile, profit margins, size, and the company’s industry context. This makes it a more tailored and insightful comparison than simply looking at peers or the sector.

According to Simply Wall St, Aviva’s Fair Ratio is 20.9x. Since this is meaningfully below the company’s current PE of 34.7x, it suggests the shares are trading above what fundamentals justify at this time.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Aviva Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is the story you create about a company, your perspective on its future revenue, earnings, margins, and fair value, which sits behind the numbers and assumptions you use in your investment decisions.

Narratives bridge the gap between a company's story and its financial outlook, connecting your view of Aviva’s business to concrete forecasts and a personal fair value target. This tool makes it easy for anyone, from new investors to seasoned pros, to articulate their expectations and track them in the real world. You can access Narratives directly on Simply Wall St's Community page, used by millions of investors globally, where you can see, compare, and update your own outlook on companies like Aviva.

With Narratives, you can make smarter buy-or-sell decisions by monitoring how your calculated fair value compares to the current share price, and see how your thinking stacks up against others. Plus, these stories update automatically whenever there is new news or earnings, so your view always stays relevant.

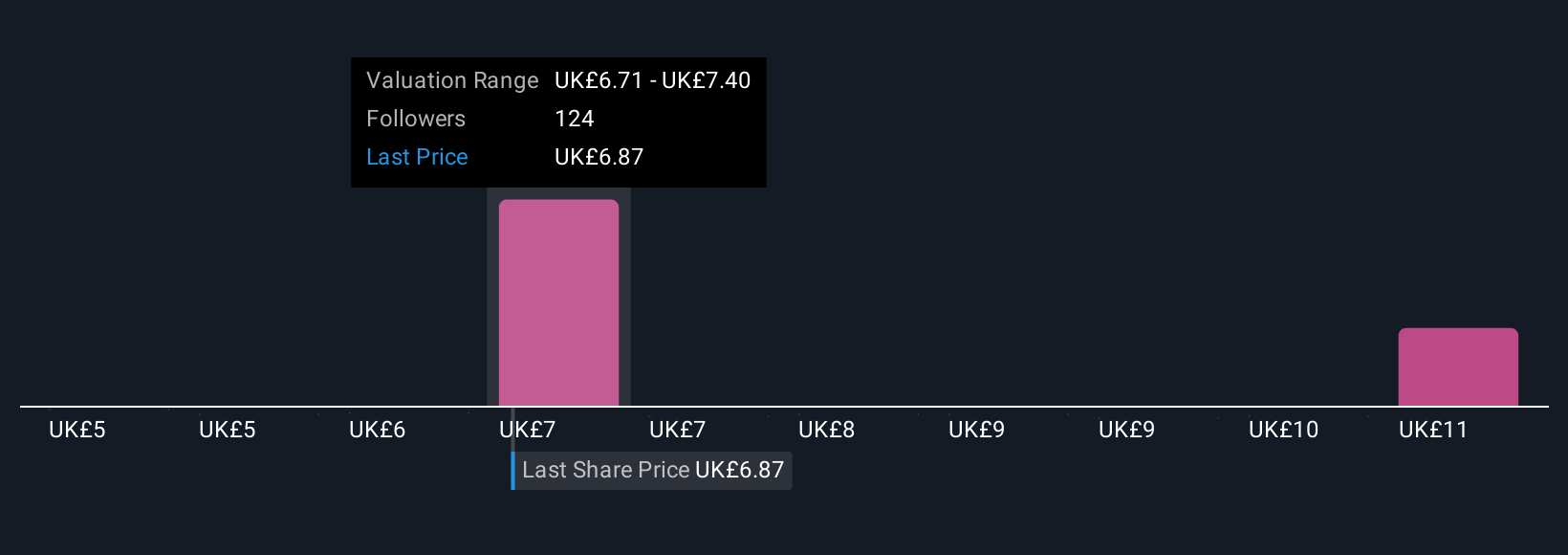

For example, some Aviva investors, forecasting ambitious growth and margin expansion, see a fair value above £7.4, while others, more cautious about risks, put the value closer to £5.43. The share price today sits in between.

Do you think there's more to the story for Aviva? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AV.

Aviva

Provides various insurance, retirement, and wealth products in the United Kingdom, Ireland, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives