- United Kingdom

- /

- Personal Products

- /

- LSE:ULVR

Is There an Opportunity in Unilever After Recent Portfolio Reshaping and Share Price Weakness?

Reviewed by Bailey Pemberton

- Wondering if Unilever is quietly turning into a value opportunity, or if it is just treading water while the rest of the market moves on? Let us unpack what the current share price might really be telling you.

- Despite being a defensive staple, Unilever's stock is down around 2% over the last week, roughly 4.4% over the past month, and is still slightly negative year to date, even though the 3 year and 5 year returns sit at 18% and 20.4% respectively.

- Recent headlines have focused on Unilever's ongoing portfolio reshaping, from sharpening its focus on higher growth brands to simplifying its structure and trimming non core operations. At the same time, markets have been reassessing large consumer staples as interest rate expectations shift and investors rotate between growth and defensive names.

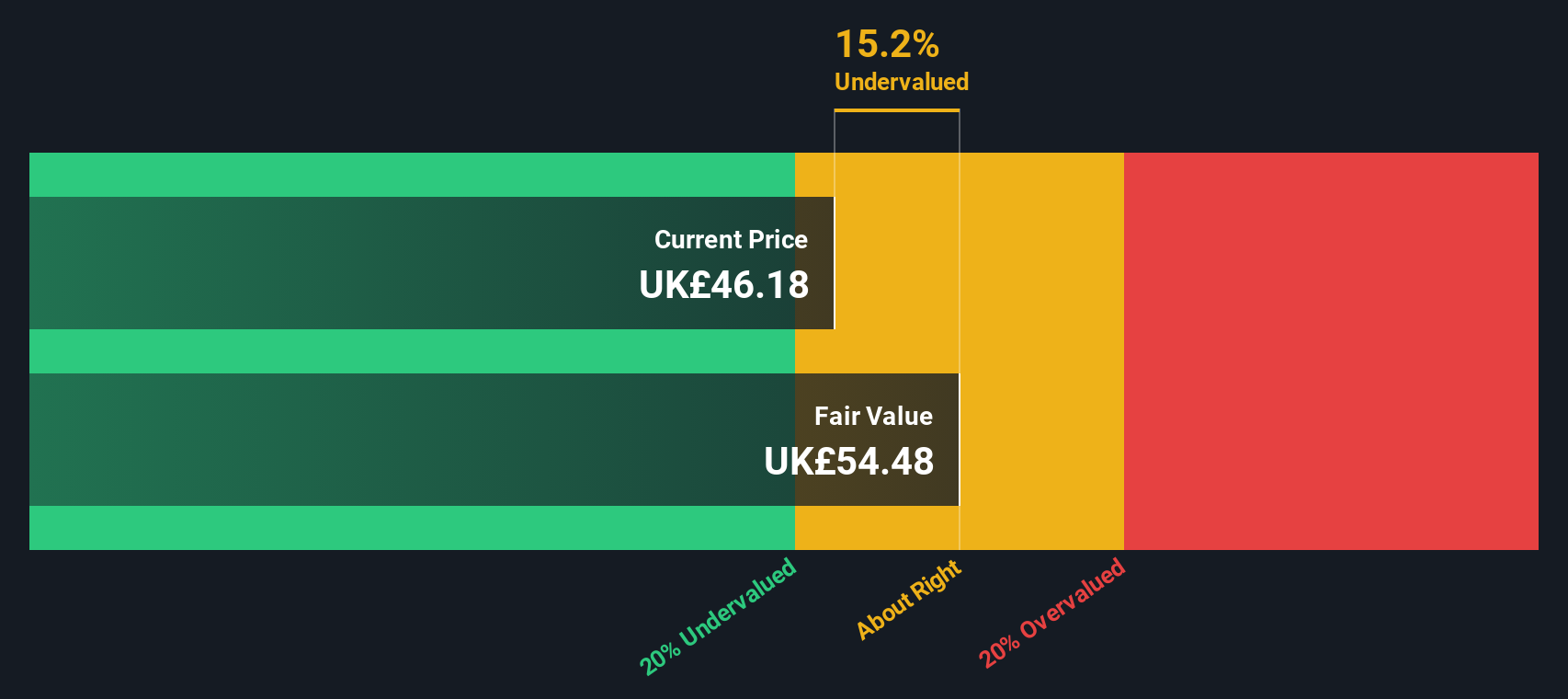

- On our framework, Unilever scores a 3 out of 6 valuation checks, meaning it screens as undervalued on about half of the metrics we track. In the sections that follow, we will walk through those valuation lenses one by one, and then finish with a more holistic way to think about what the stock is really worth.

Approach 1: Unilever Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to a present value.

For Unilever, the latest twelve month free cash flow is about €6.6 billion. Analysts expect this to rise steadily, with Simply Wall St extending their forecasts beyond the analyst horizon so that projected free cash flow reaches roughly €10.6 billion by 2035. These projections are based on a 2 Stage Free Cash Flow to Equity model, where near term analyst estimates are followed by more modest, extrapolated growth further out.

When all those future cash flows are discounted back, the DCF model arrives at an estimated intrinsic value of around €53 per share. This means the shares are trading at roughly a 16.5% discount to that estimate. This indicates the market is applying a relatively cautious view to Unilever's ability to grow cash flows from here.

Result: Potentially undervalued based on this DCF estimate

Our Discounted Cash Flow (DCF) analysis suggests Unilever is undervalued by 16.5%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Unilever Price vs Earnings

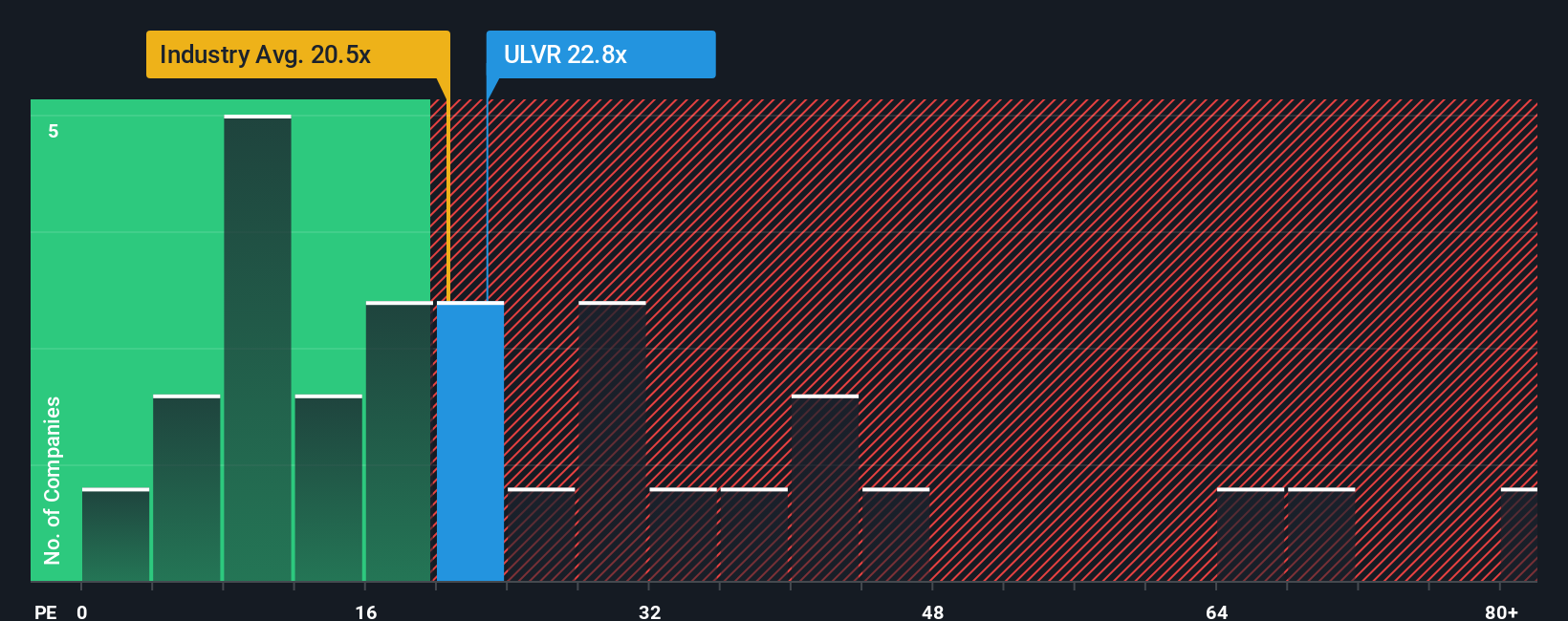

For profitable, established businesses like Unilever, the price to earnings, or PE, ratio is a useful way to gauge what investors are willing to pay for each unit of current earnings. It naturally captures how the market is weighing near term profitability against growth prospects and perceived risk.

In general, companies with stronger, more reliable growth and lower risk profiles tend to justify higher PE multiples, while slower growing or more volatile businesses usually trade on lower multiples. Unilever currently trades on about 22.7x earnings, which is roughly in line with the broader Personal Products industry average of around 22.5x, but meaningfully below the 35.2x average of its global peer group.

Simply Wall St also calculates a proprietary Fair Ratio for each company, which blends in factors like expected earnings growth, profit margins, industry dynamics, company size and specific risk indicators. For Unilever, this Fair PE Ratio is estimated at about 24.1x. This suggests that, given its fundamentals, the market could reasonably value it a little higher than today, but not dramatically so. On this lens, the stock screens as modestly undervalued rather than a deep bargain.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Unilever Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple, story driven explanations of what you believe about a company, translated into concrete forecasts for its future revenue, earnings and margins, and then into a Fair Value you can compare to the current share price.

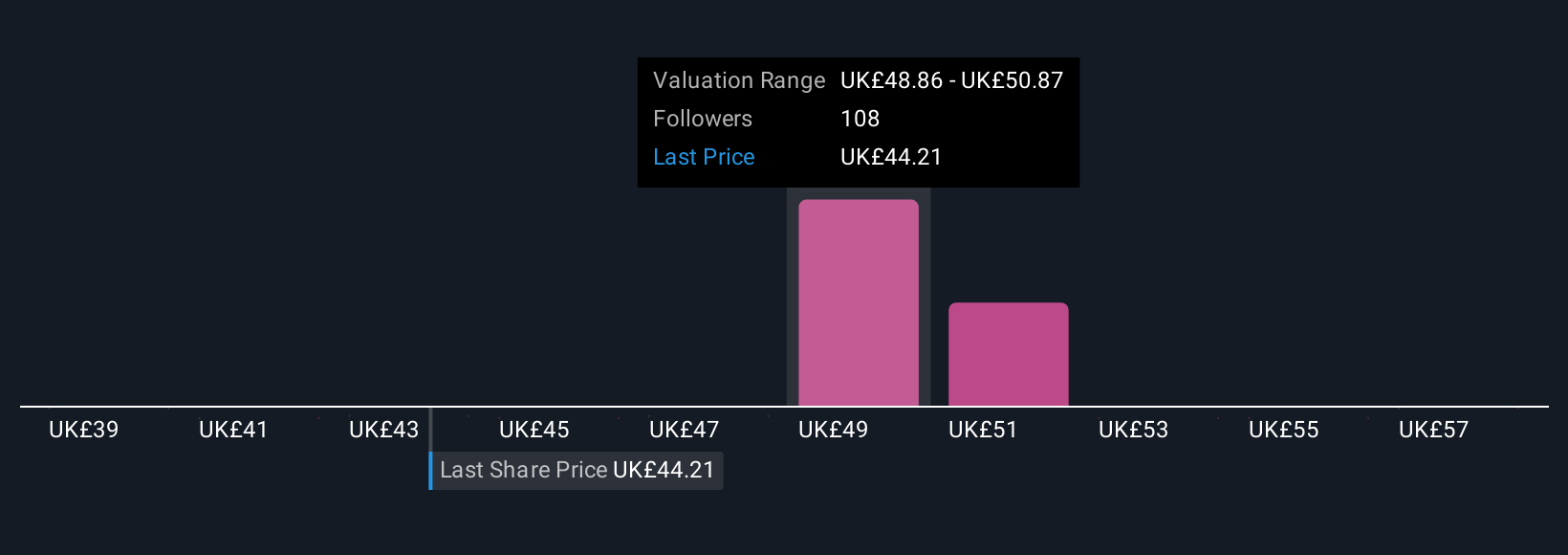

On Simply Wall St, Narratives live inside the Community page and are used by millions of investors as an accessible tool to connect a company’s story, like Unilever’s push into premium, science led brands or concerns about competition and regulation, to a dynamic financial model that updates as new news, results or guidance arrive.

For Unilever, one investor might build a bullish Narrative that assumes faster emerging market growth, expanding margins toward about 12.6%, and a higher future PE multiple near 21.4x, leading to a Fair Value well above today’s price. A more cautious investor might focus on slower revenue growth near 2.3% and rising competitive pressure, resulting in a lower Fair Value closer to £39. These contrasting Narratives help each investor decide whether the current £47 to £48 share price looks like a buy, a hold, or a sell.

Do you think there's more to the story for Unilever? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ULVR

Unilever

Operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026