- United Kingdom

- /

- Personal Products

- /

- LSE:PZC

Why It Might Not Make Sense To Buy PZ Cussons Plc (LON:PZC) For Its Upcoming Dividend

It looks like PZ Cussons Plc (LON:PZC) is about to go ex-dividend in the next 2 days. You will need to purchase shares before the 13th of February to receive the dividend, which will be paid on the 6th of April.

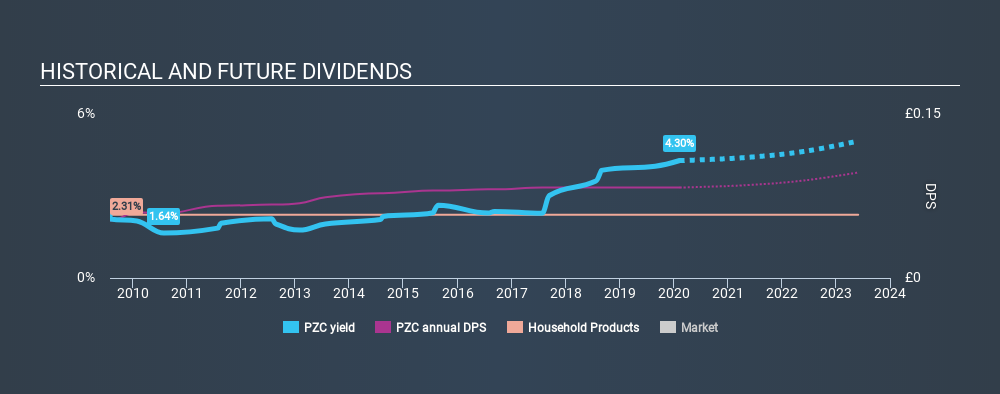

PZ Cussons's next dividend payment will be UK£0.027 per share, on the back of last year when the company paid a total of UK£0.083 to shareholders. Based on the last year's worth of payments, PZ Cussons stock has a trailing yield of around 4.3% on the current share price of £1.926. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for PZ Cussons

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Last year PZ Cussons paid out 93% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 88% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's good to see that while PZ Cussons's dividends were not well covered by profits, at least they are affordable from a cash perspective. Still, if the company continues paying out such a high percentage of its profits, the dividend could be at risk if business turns sour.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings fall far enough, the company could be forced to cut its dividend. PZ Cussons's earnings per share have fallen at approximately 16% a year over the previous five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last ten years, PZ Cussons has lifted its dividend by approximately 4.6% a year on average. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. PZ Cussons is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

To Sum It Up

From a dividend perspective, should investors buy or avoid PZ Cussons? It's never fun to see a company's earnings per share in retreat. What's more, PZ Cussons is paying out a majority of its earnings and over half its free cash flow. It's hard to say if the business has the financial resources and time to turn things around without cutting the dividend. It's not that we think PZ Cussons is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

Ever wonder what the future holds for PZ Cussons? See what the four analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:PZC

PZ Cussons

Manufactures, distributes, markets, and sells baby, beauty, and hygiene products in Europe, the Asia Pacific, the Americas, and Africa.

Very undervalued with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)