- United Kingdom

- /

- Household Products

- /

- LSE:MCB

Discovering Three Undiscovered Gems in the United Kingdom

Reviewed by Simply Wall St

In the current climate, the United Kingdom's market has been facing challenges, as seen with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China impacting global sentiment. Amid these broader economic pressures, identifying promising small-cap stocks can offer unique opportunities for investors seeking growth potential in less crowded spaces.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.15% | 50.88% | 67.63% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Science Group (AIM:SAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Science Group plc is a science and technology consultancy and systems business with operations in the United Kingdom, other European countries, North America, and Asia, and has a market capitalization of approximately £247.55 million.

Operations: Science Group generates revenue primarily from professional services (£68.87 million) and systems related to submarine atmosphere management (£31.53 million) and audio chips and modules (£13.17 million). The company's freehold properties contribute £3.89 million in revenue, while inter-company property income is noted as -£3.31 million, indicating internal adjustments or eliminations in financial reporting.

Science Group, with a notable earnings growth of 410.1% over the past year, outpaced its industry peers who saw a -2.8% change. The company's debt to equity ratio improved significantly from 45.4% to 11.5% over five years, indicating stronger financial health. Despite this growth, recent results were influenced by a one-off gain of £24M in the last year ending June 2025, which may not be sustainable long-term. Trading at 16.8% below fair value estimation suggests potential undervaluation; however, earnings are forecasted to drop by an average of 60% annually in the next three years.

- Dive into the specifics of Science Group here with our thorough health report.

Evaluate Science Group's historical performance by accessing our past performance report.

McBride (LSE:MCB)

Simply Wall St Value Rating: ★★★★☆☆

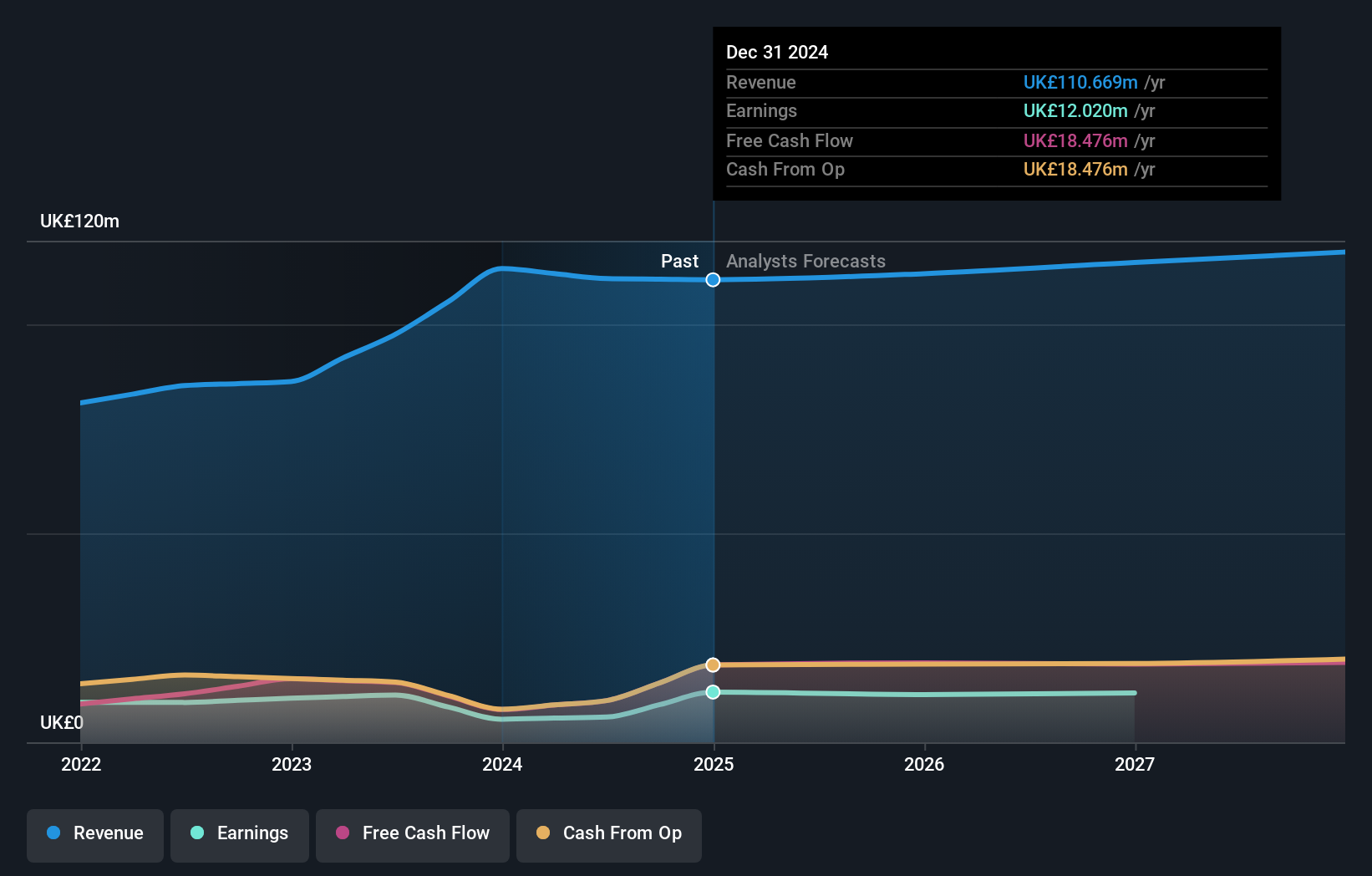

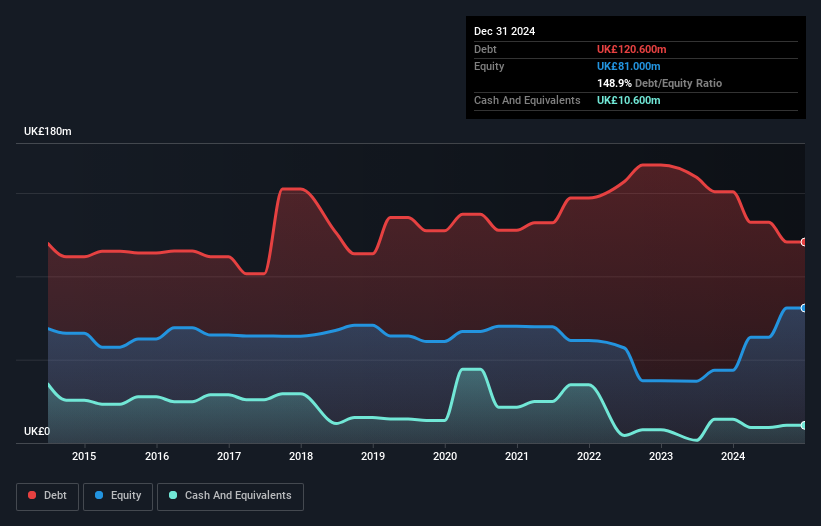

Overview: McBride plc manufactures and sells private label household and personal care products to retailers and brand owners across various international markets, with a market cap of approximately £199.82 million.

Operations: McBride plc generates revenue primarily from its Liquids segment, contributing £535.30 million, and its Unit Dosing segment, which adds £235.20 million. The company also earns from Powders (£89.60 million), Aerosols (£54.20 million), and the Asia Pacific region (£23.90 million).

In the UK market, McBride stands out with its impressive earnings growth of 122.2% over the past year, significantly outperforming the Household Products industry average of 17.1%. Despite a high net debt to equity ratio at 135.8%, interest payments are well covered by EBIT at 7.8 times coverage, indicating strong operational efficiency. The company's debt to equity ratio has improved from 209% to 148.9% in five years, reflecting better financial management. Trading at a substantial discount of 56.3% below fair value estimates suggests potential for upside if current trends continue favorably for this niche player in household products.

- Unlock comprehensive insights into our analysis of McBride stock in this health report.

Explore historical data to track McBride's performance over time in our Past section.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★★★

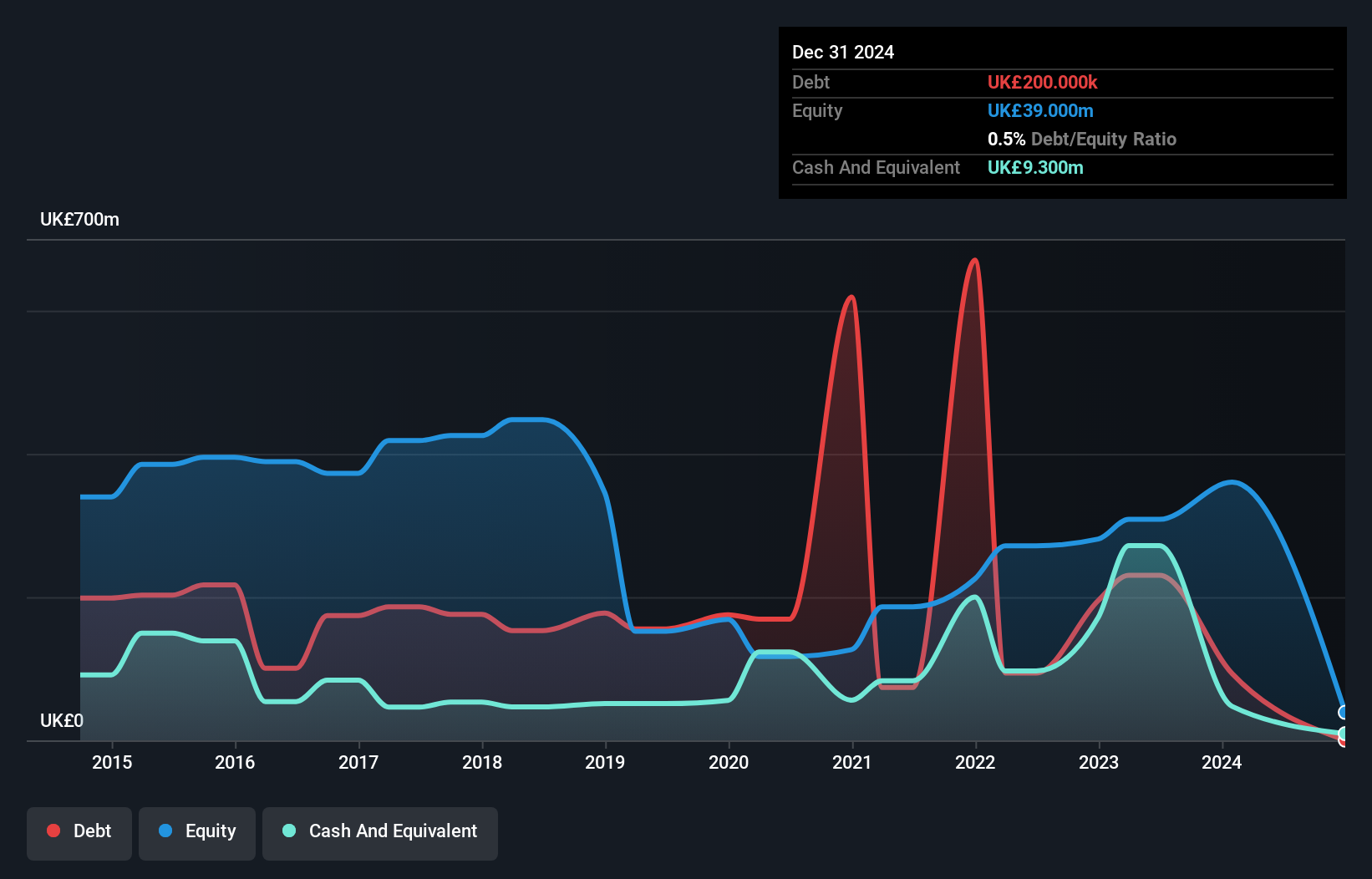

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider operating in the United Kingdom and internationally, with a market capitalization of £510.73 million.

Operations: Pinewood Technologies Group generates revenue primarily from its cloud-based dealer management software services across multiple regions, including the UK, Europe, Africa, Asia, and the Middle East. The company focuses on optimizing its cost structure to enhance operational efficiency. Notably, Pinewood's net profit margin stands at 15%, reflecting its profitability in managing expenses relative to revenue generation.

Pinewood Technologies Group, a nimble player in the automotive software sector, has seen earnings soar by 53% over the past year, outpacing the industry average of 15%. The company's debt-to-equity ratio impressively shrank from 104% to just 0.5% over five years, and it holds more cash than its total debt. Despite a £2.4M one-off loss affecting recent results, Pinewood remains profitable with free cash flow turning positive. Its acquisition of Seez AI is set to bolster growth and expand market reach globally; however, integration challenges may arise as Pinewood navigates new markets with differing regulations and cultures.

Where To Now?

- Investigate our full lineup of 63 UK Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MCB

McBride

Manufactures and sells private label household and personal care products to retailers and brand owners in the United Kingdom, Germany, France, Italy, Spain, rest of Europe, Asia-Pacific, and internationally.It operates through five segments: Liquids, Powders, Unit dosing, Aerosols, and Asia Pacific.

Very undervalued with solid track record.

Market Insights

Community Narratives