- United Kingdom

- /

- Personal Products

- /

- AIM:W7L

Undiscovered Gems in the United Kingdom for September 2024

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China and broader global economic uncertainties. Despite these challenges, the search for promising small-cap stocks remains crucial as they often offer unique growth opportunities even in fluctuating markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £447.02 million, produces and sells cosmetics through its subsidiaries.

Operations: Revenue for Warpaint London PLC is primarily derived from its Own Brand segment (£96.72 million) and Close-Out segment (£2.12 million).

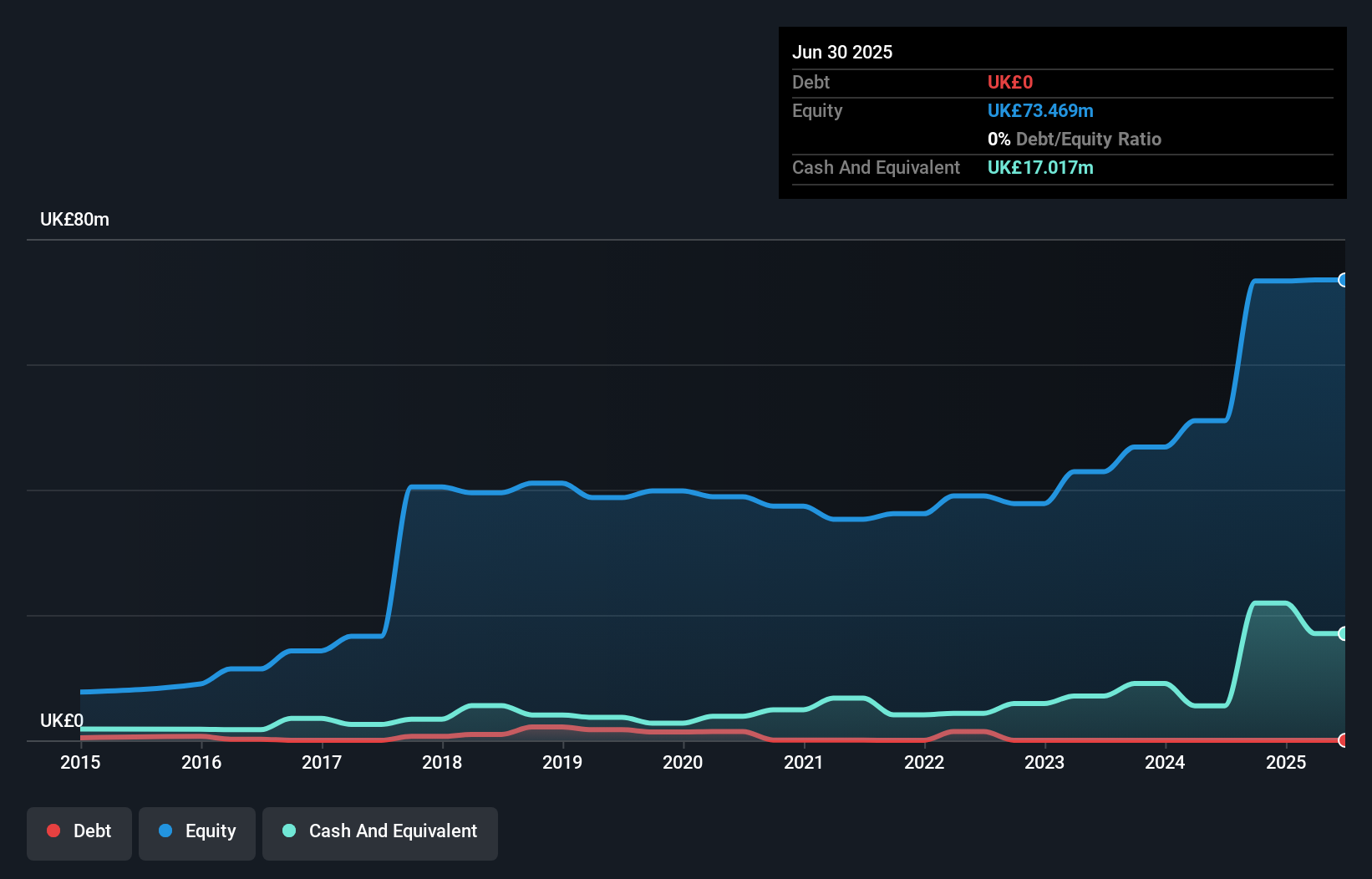

Warpaint London has shown impressive performance, with earnings growing 106.1% over the past year, outpacing the Personal Products industry’s 9.4% growth. The company reported sales of £45.85M for H1 2024 compared to £36.69M a year ago and net income of £8.02M up from £4.78M last year. Notably, Warpaint is debt-free now versus a debt-to-equity ratio of 4.4% five years ago and declared an increased interim dividend of 3.5 pence per share for November 2024 payments.

- Delve into the full analysis health report here for a deeper understanding of Warpaint London.

Understand Warpaint London's track record by examining our Past report.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector with a market cap of £1.20 billion.

Operations: The company's primary revenue stream comes from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

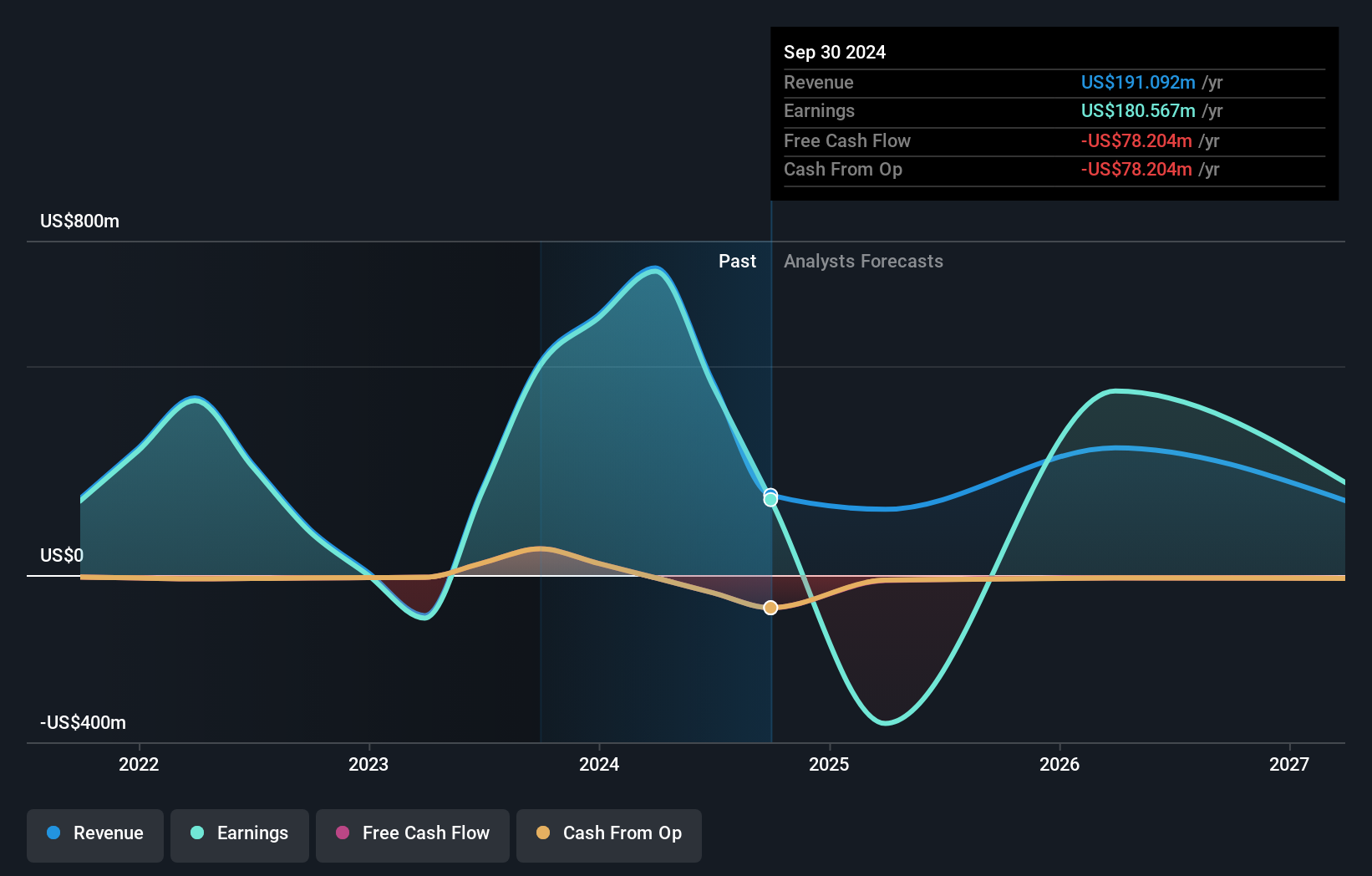

Yellow Cake, a uranium-focused investment company, has shown remarkable turnaround by becoming profitable this year. The firm reported net income of US$727 million for the fiscal year ending March 31, 2024, compared to a net loss of US$102.94 million the previous year. Its price-to-earnings ratio stands at an attractive 2.2x against the UK market's 16.9x average. Despite shareholder dilution over the past year, Yellow Cake's debt-free status and high-quality non-cash earnings make it a compelling prospect in its sector.

Raspberry Pi Holdings (LSE:RPI)

Simply Wall St Value Rating: ★★★★★★

Overview: Raspberry Pi Holdings plc designs and develops single board computers and compute modules worldwide, with a market cap of £673.47 million.

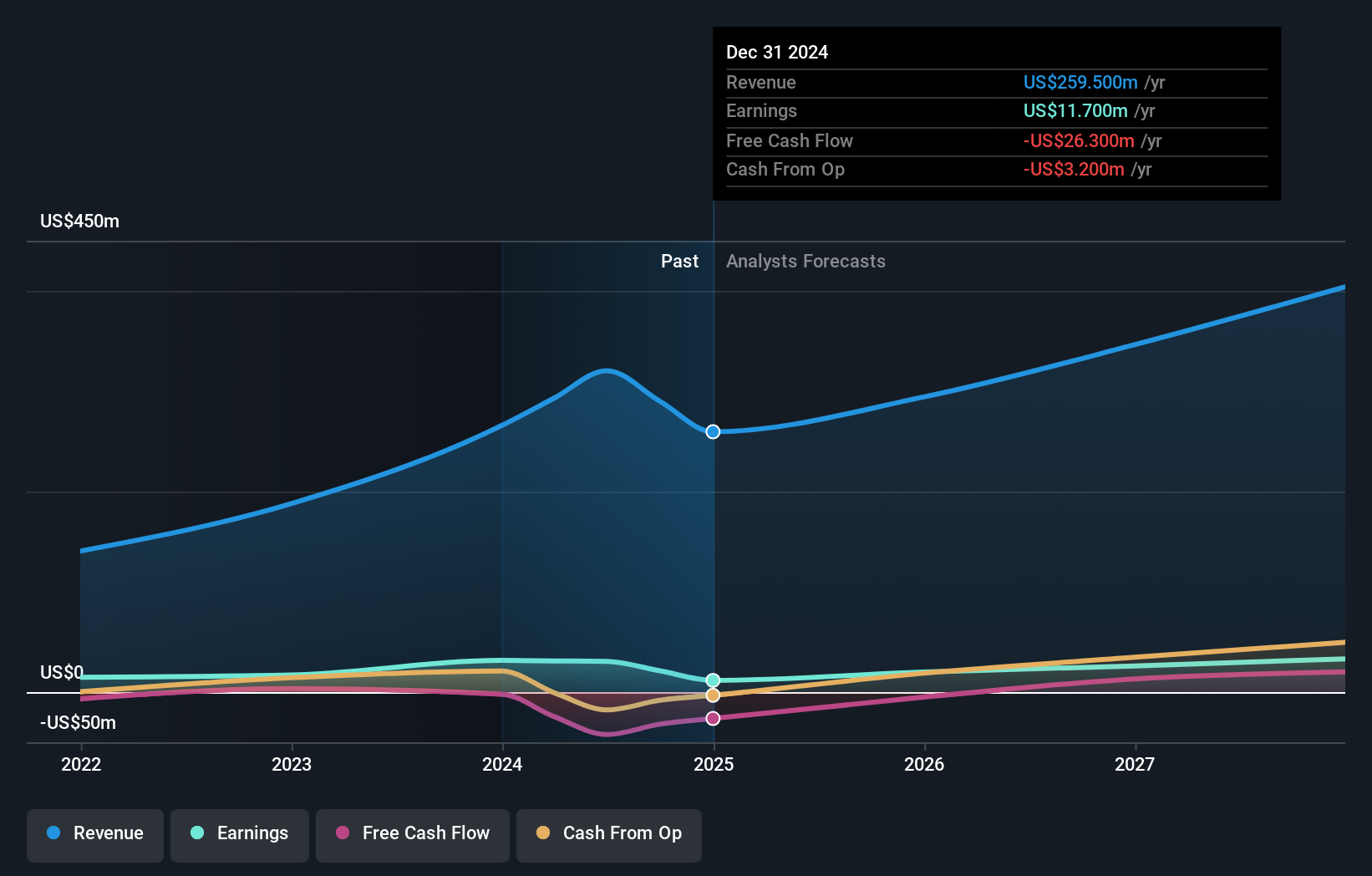

Operations: The company generates revenue primarily from its computer hardware segment, which reported $265.80 million.

Raspberry Pi Holdings, a tech company with no debt for the past five years, saw its earnings grow by 85% last year, outpacing the Tech industry’s 52.7%. The recent launch of Raspberry Pi Pico 2 aims to boost volumes in various markets. Despite being added to multiple FTSE indices recently, its share price has been highly volatile over the past three months. Revenue is expected to grow annually by 11.36%, reflecting strong future prospects.

- Dive into the specifics of Raspberry Pi Holdings here with our thorough health report.

Explore historical data to track Raspberry Pi Holdings' performance over time in our Past section.

Make It Happen

- Delve into our full catalog of 81 UK Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warpaint London might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:W7L

Flawless balance sheet with solid track record.