- United Kingdom

- /

- Personal Products

- /

- AIM:SIS

If You Had Bought Science in Sport's (LON:SIS) Shares Three Years Ago You Would Be Down 59%

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of Science in Sport plc (LON:SIS) have had an unfortunate run in the last three years. Sadly for them, the share price is down 59% in that time. And more recent buyers are having a tough time too, with a drop of 34% in the last year.

See our latest analysis for Science in Sport

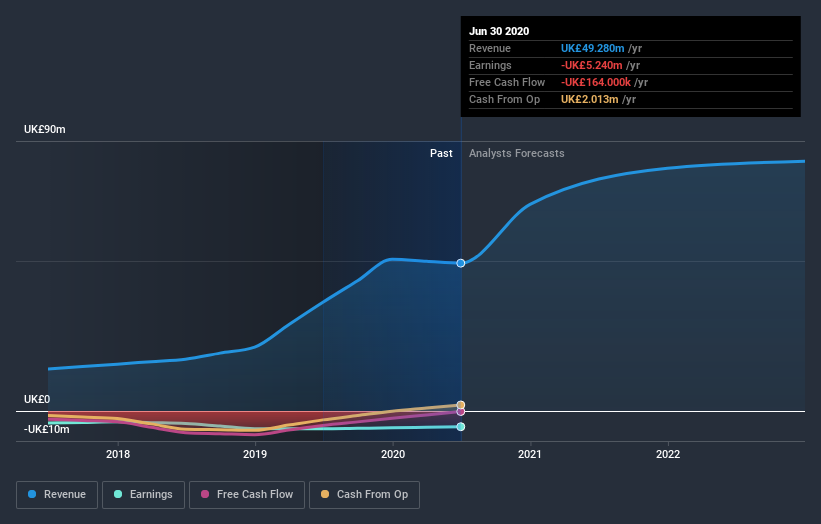

Because Science in Sport made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Science in Sport grew revenue at 50% per year. That's well above most other pre-profit companies. In contrast, the share price is down 17% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Science in Sport stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Science in Sport shareholders are down 34% for the year. Unfortunately, that's worse than the broader market decline of 7.4%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Science in Sport better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Science in Sport (of which 1 shouldn't be ignored!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Science in Sport, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Science in Sport, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:SIS

Science in Sport

Develops, manufactures, and markets sports nutrition products for professional athletes and sports enthusiasts in the United Kingdom, the United States, Europe, and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives