- United Kingdom

- /

- Personal Products

- /

- AIM:REVB

There's No Escaping Revolution Beauty Group plc's (LON:REVB) Muted Revenues Despite A 39% Share Price Rise

Those holding Revolution Beauty Group plc (LON:REVB) shares would be relieved that the share price has rebounded 39% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

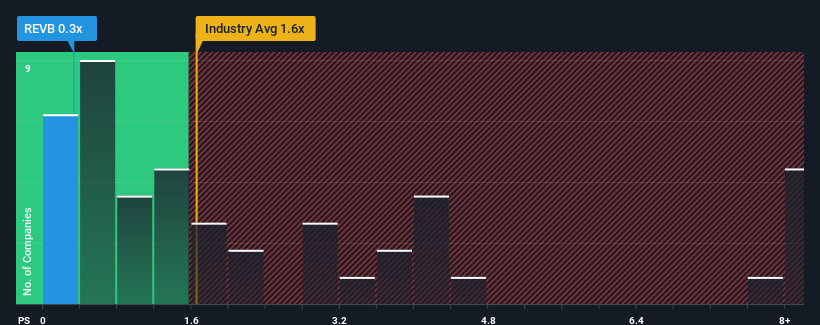

Even after such a large jump in price, Revolution Beauty Group's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a strong buy right now compared to the wider Personal Products industry in the United Kingdom, where around half of the companies have P/S ratios above 2.7x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Revolution Beauty Group

What Does Revolution Beauty Group's Recent Performance Look Like?

Recent times haven't been great for Revolution Beauty Group as its revenue has been falling quicker than most other companies. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. You'd much rather the company improve its revenue performance if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Revolution Beauty Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Revolution Beauty Group would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 10% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 7.9% during the coming year according to the three analysts following the company. With the industry predicted to deliver 2.4% growth, that's a disappointing outcome.

With this information, we are not surprised that Revolution Beauty Group is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Revolution Beauty Group's recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Revolution Beauty Group maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Revolution Beauty Group is showing 3 warning signs in our investment analysis, and 2 of those don't sit too well with us.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:REVB

Revolution Beauty Group

Engages in the development, production, wholesale, and retail of beauty products in the United Kingdom, the United States, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives