- United Kingdom

- /

- Personal Products

- /

- AIM:PXS

Top UK Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Amidst these broader market fluctuations, investors often seek opportunities in smaller companies that may offer growth potential not always found in larger firms. Penny stocks, while an older term, still represent a niche investment area where strong financials can indicate promising prospects for long-term success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.59M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.27 | £855.25M | ★★★★★★ |

| Shoe Zone (AIM:SHOE) | £1.525 | £70.5M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.80 | £377.93M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.75 | £204.07M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.93 | £70.43M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.45 | £355.58M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.325 | £206.09M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Calnex Solutions (AIM:CLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Calnex Solutions plc specializes in designing, producing, and marketing test instrumentation and solutions for network synchronization and emulation across telecoms networks, enterprise networks, and data centers globally, with a market cap of £51.66 million.

Operations: The company generates revenue of £16.27 million from its Electronic Test & Measurement Instruments segment.

Market Cap: £51.66M

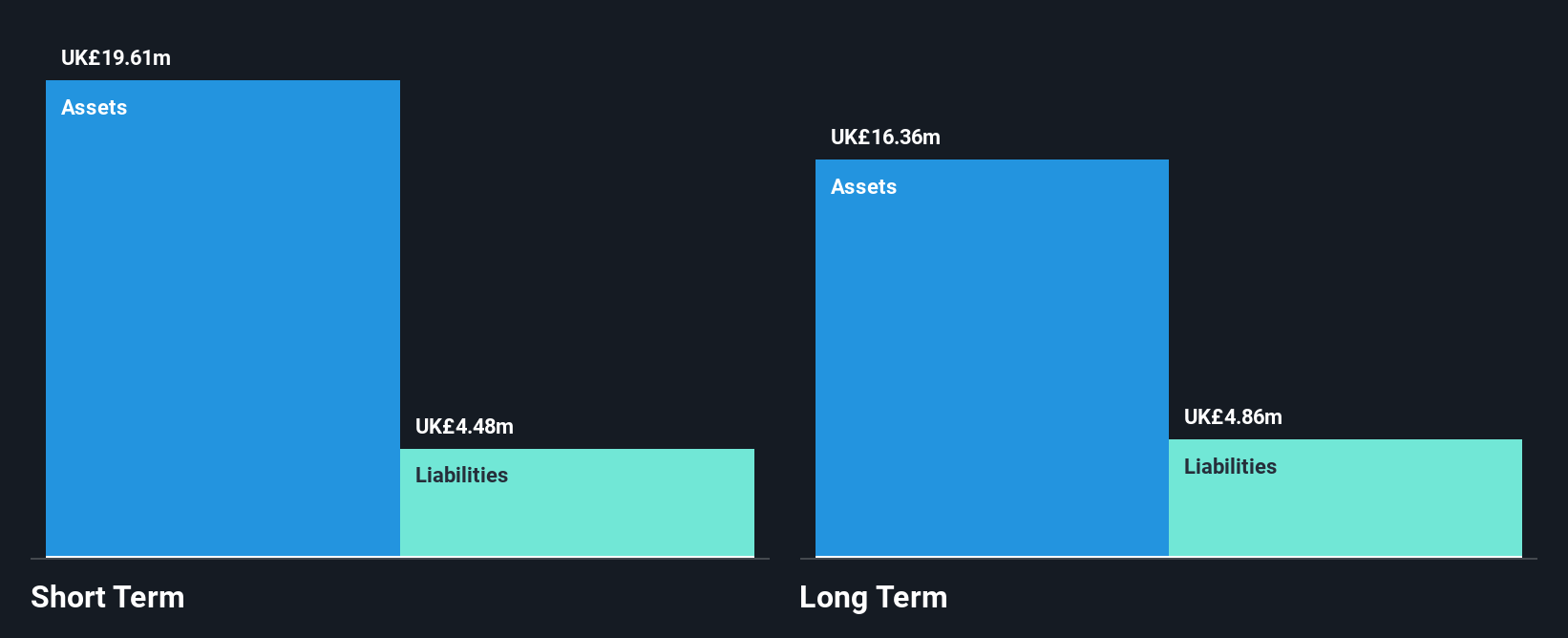

Calnex Solutions plc, with a market cap of £51.66 million, presents an intriguing case in the penny stock domain. Despite being debt-free and having short-term assets (£21.0M) that exceed both its long-term (£4.6M) and short-term liabilities (£5.1M), the company faces challenges such as a significant drop in profit margins from 21.5% to 0.2% over the past year and negative earnings growth (-99.3%). However, it trades at 46.6% below estimated fair value, suggesting potential undervaluation if profitability can improve alongside forecasted earnings growth of 72.39%. The board is experienced with an average tenure of 3.7 years.

- Click here to discover the nuances of Calnex Solutions with our detailed analytical financial health report.

- Evaluate Calnex Solutions' prospects by accessing our earnings growth report.

Induction Healthcare Group (AIM:INHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Induction Healthcare Group PLC offers software solutions to healthcare professionals in the United Kingdom and has a market cap of £9.38 million.

Operations: Induction Healthcare Group PLC does not report any specific revenue segments.

Market Cap: £9.38M

Induction Healthcare Group PLC, with a market cap of £9.38 million, has experienced increased losses over the past five years and remains unprofitable, reporting a net loss of £2.33 million for the recent half year. Despite this, it trades at good value compared to peers and maintains a stable cash runway exceeding three years based on current free cash flow. The company is debt-free with short-term assets (£7.2M) surpassing both short-term (£5M) and long-term liabilities (£3.9M). However, its management team and board are relatively inexperienced with average tenures under three years each.

- Click here and access our complete financial health analysis report to understand the dynamics of Induction Healthcare Group.

- Gain insights into Induction Healthcare Group's outlook and expected performance with our report on the company's earnings estimates.

Provexis (AIM:PXS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Provexis plc, with a market cap of £13.01 million, develops, licenses, and sells functional foods, medical foods, and dietary supplements globally.

Operations: The company's revenue is derived entirely from its Vitamins & Nutrition Products segment, totaling £0.80 million.

Market Cap: £13.01M

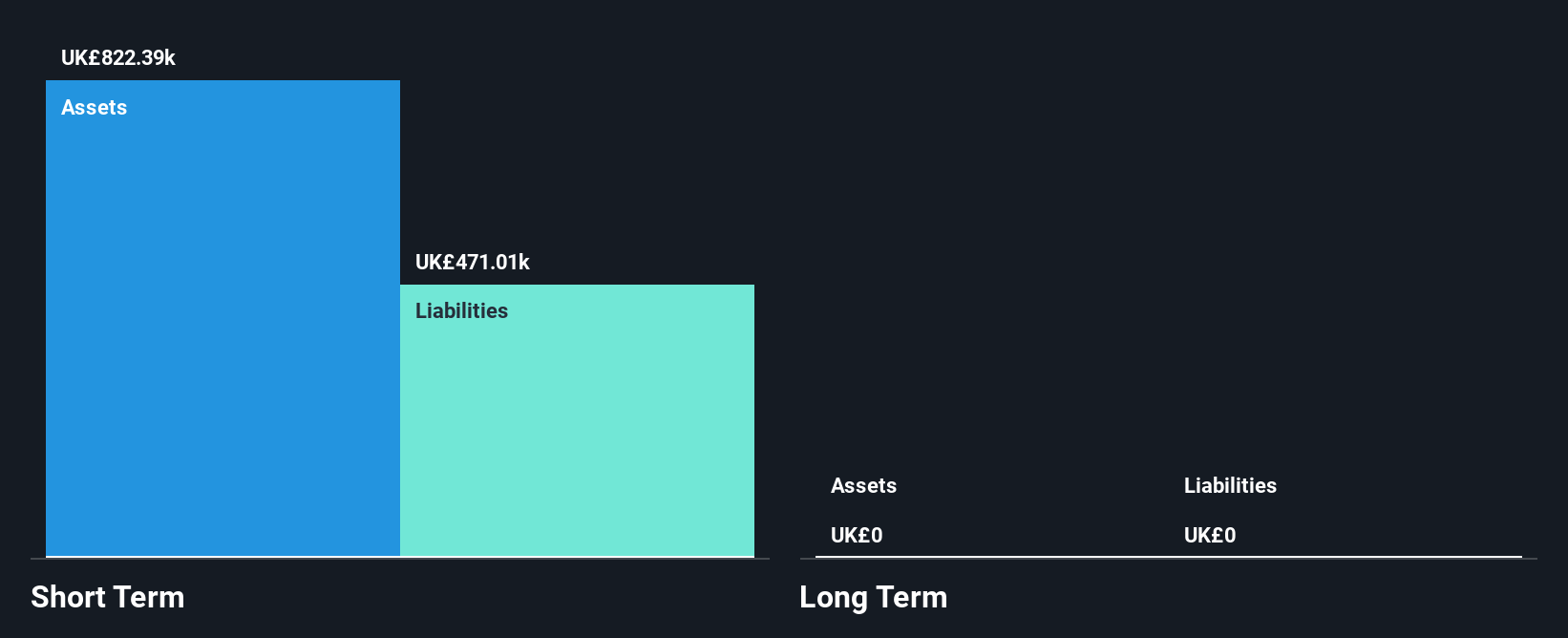

Provexis plc, with a market cap of £13.01 million, operates in the functional foods and dietary supplements sector but remains pre-revenue with sales at £0.80 million. The company is debt-free and its short-term assets (£498K) exceed liabilities (£307.4K), providing some financial stability despite having less than a year of cash runway based on current free cash flow trends. Shareholder dilution occurred over the past year with shares outstanding increasing by 2%. The board is experienced, averaging 13.6 years in tenure, although management experience data is insufficient to assess fully. Recent earnings showed an increased net loss of £0.59 million for the year ending March 2024 compared to the previous period.

- Take a closer look at Provexis' potential here in our financial health report.

- Understand Provexis' track record by examining our performance history report.

Taking Advantage

- Click here to access our complete index of 472 UK Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PXS

Provexis

Develops, licenses, and sells functional foods, medical foods, and dietary supplements worldwide.

Flawless balance sheet slight.