- United Kingdom

- /

- Healthcare Services

- /

- LSE:SPI

Is Spire Healthcare Group's (LON:SPI) 120% Share Price Increase Well Justified?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the Spire Healthcare Group plc (LON:SPI) share price has soared 120% in the last year. Most would be very happy with that, especially in just one year! In more good news, the share price has risen 2.3% in thirty days. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report. Unfortunately the longer term returns are not so good, with the stock falling 19% in the last three years.

See our latest analysis for Spire Healthcare Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Spire Healthcare Group saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

Spire Healthcare Group's revenue actually dropped 6.2% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

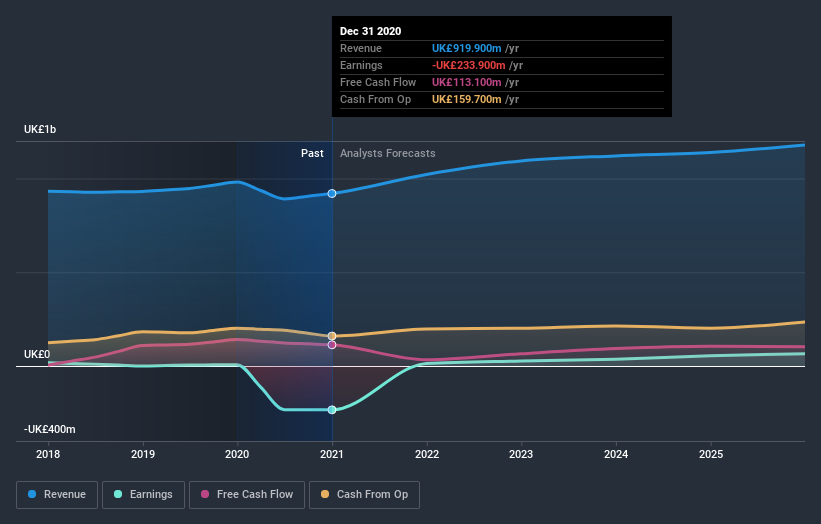

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Spire Healthcare Group in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Spire Healthcare Group shareholders have received a total shareholder return of 120% over the last year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Spire Healthcare Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading Spire Healthcare Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:SPI

Spire Healthcare Group

Owns and operates private hospitals and clinics in the United Kingdom.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026