- United Kingdom

- /

- Healthcare Services

- /

- LSE:IDHC

UK Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. Despite these broader market pressures, there remain opportunities for investors willing to explore smaller or newer companies. Penny stocks, although an older term, continue to represent a segment where strong financials and potential growth can offer intriguing investment possibilities.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.20 | £301.38M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £508.81M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.15 | £347.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.396 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.25 | £53.93M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.05 | £313.01M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.255 | £198.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.31 | £69.82M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.17 | £819.53M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pebble Group (AIM:PEBB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Pebble Group plc, with a market cap of £77.25 million, provides technology solutions, products, and services to the promotional merchandise industry across the United Kingdom, Continental Europe, North America, and internationally.

Operations: Pebble Group's revenue is derived from two main segments: Facilis Group, contributing £17.60 million, and Brand Addition, generating £107.67 million.

Market Cap: £77.25M

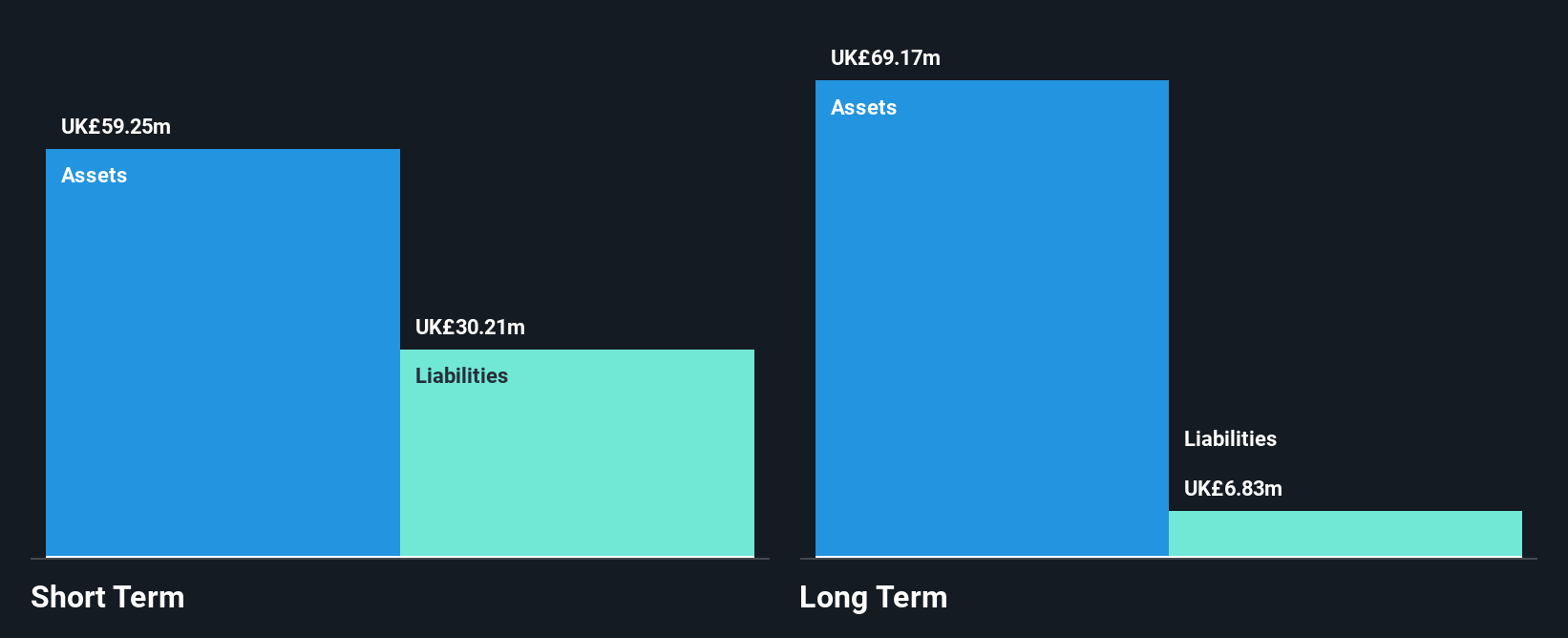

The Pebble Group plc, with a market cap of £77.25 million, operates profitably in the promotional merchandise industry. It has no debt and its short-term assets (£59.3M) comfortably cover both short-term (£30.2M) and long-term liabilities (£6.8M). Despite past earnings growth at 40.1% annually over five years, recent growth slowed to 9.9%, trailing the Media industry's 10.2%. Current forecasts suggest a slight decline in earnings by 2.1% annually over the next three years, though management remains experienced with an average tenure of 4.5 years and stable weekly volatility at 6%.

- Jump into the full analysis health report here for a deeper understanding of Pebble Group.

- Gain insights into Pebble Group's future direction by reviewing our growth report.

Braemar (LSE:BMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Braemar Plc offers shipbroking services across various regions including the United Kingdom, Singapore, Australia, Switzerland, the United States, and Germany with a market cap of £69.82 million.

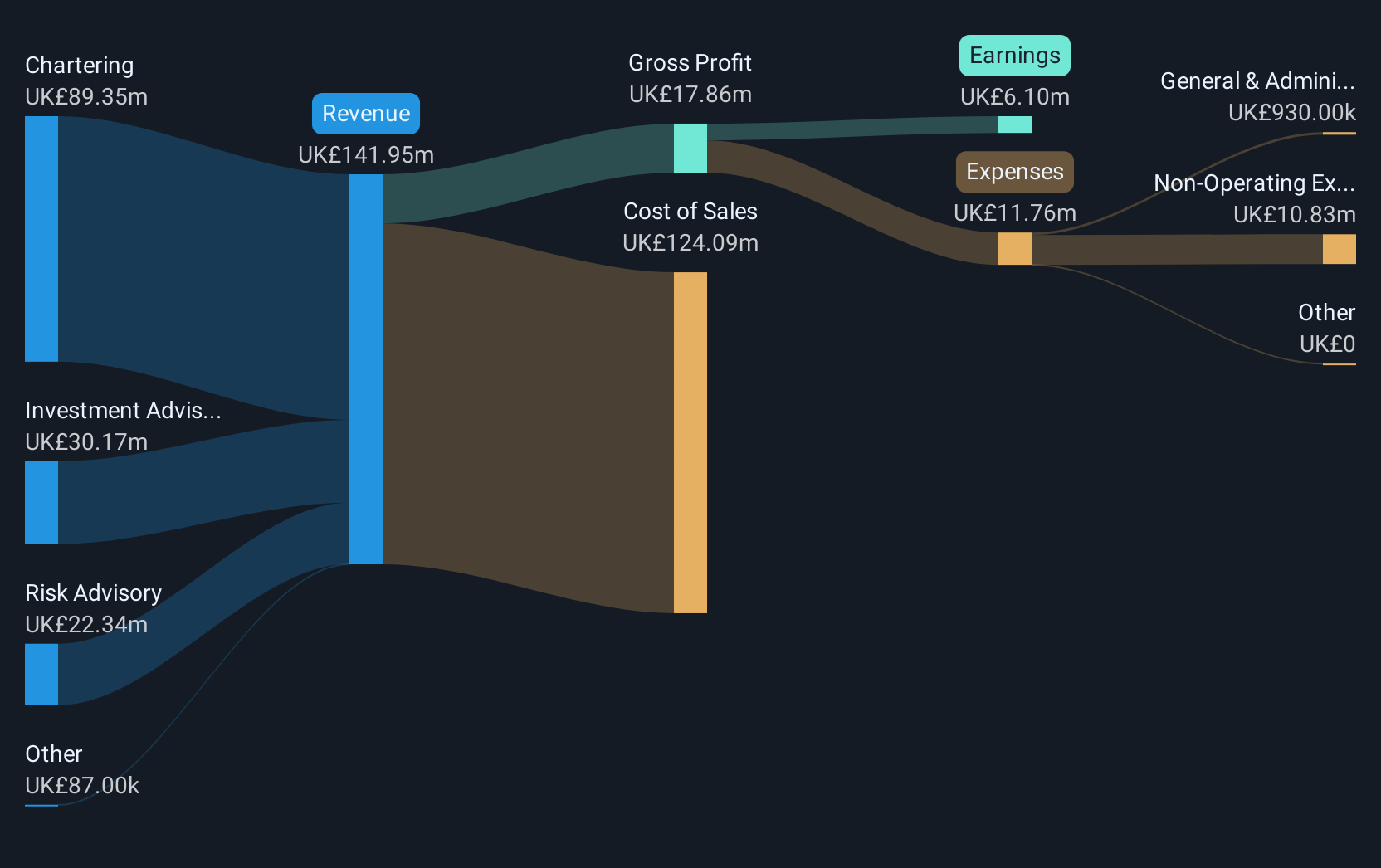

Operations: The company generates revenue through three main segments: Chartering (£89.35 million), Risk Advisory (£22.34 million), and Investment Advisory (£30.17 million).

Market Cap: £69.82M

Braemar Plc, with a market cap of £69.82 million, has shown resilience in the shipbroking sector by maintaining a stable financial position despite past challenges. Its recent earnings growth of 33.1% contrasts with a historical decline over five years, suggesting potential recovery momentum. The company's strategic expansion into Africa aligns with its diversification goals, enhancing global presence to 19 offices across 14 countries. However, Braemar faces regulatory scrutiny following an investigation into past transactions and has set aside $2.5 million as provisioned funds now frozen by authorities. Despite these hurdles, its debt levels are satisfactory and interest coverage is strong at 7.3x EBIT.

- Get an in-depth perspective on Braemar's performance by reading our balance sheet health report here.

- Understand Braemar's earnings outlook by examining our growth report.

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company offering medical diagnostics services, with a market cap of $189.51 million.

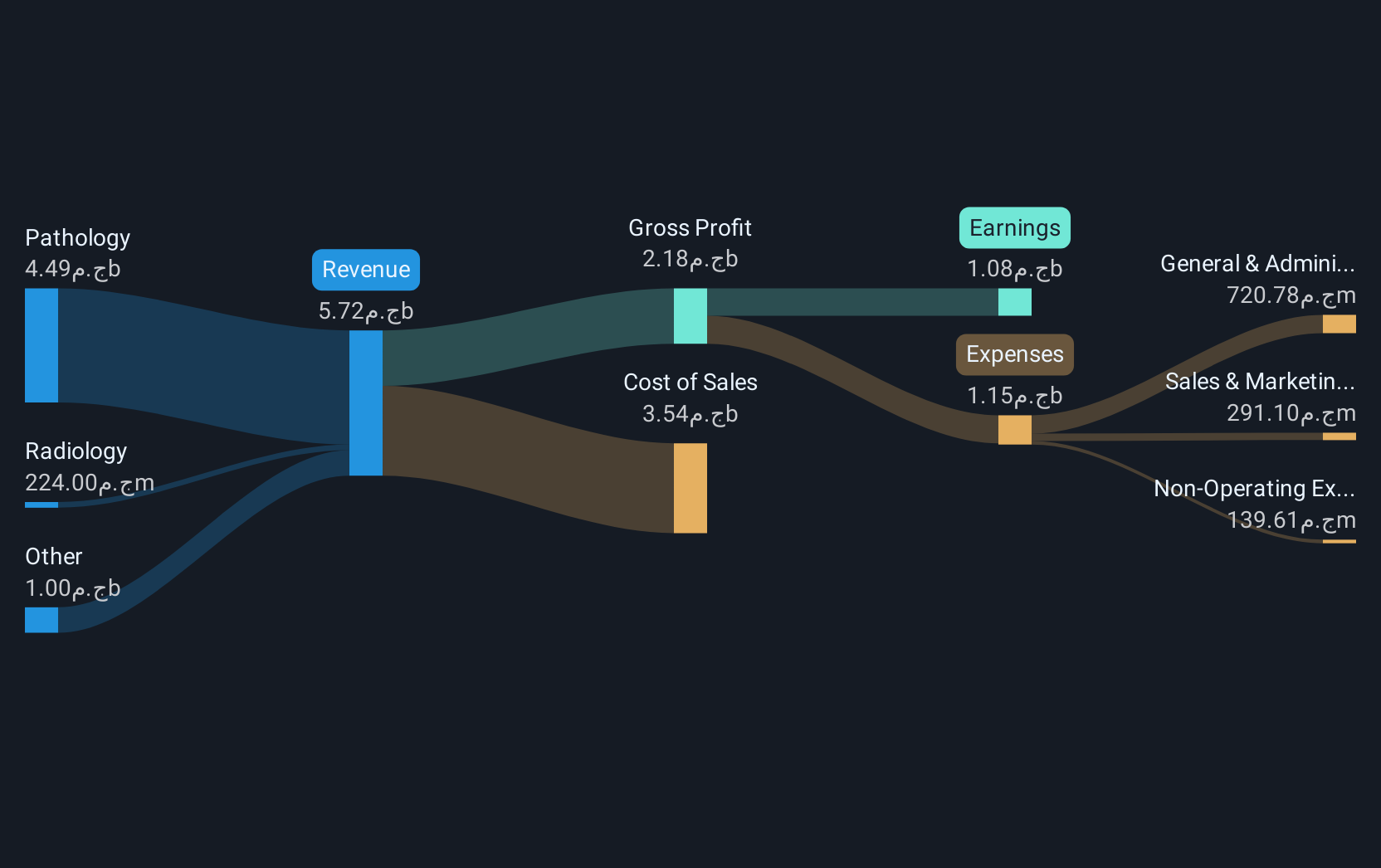

Operations: The company generates revenue primarily from its Pathology segment, which accounts for EGP 4.49 billion, and its Radiology segment, contributing EGP 224 million.

Market Cap: $189.51M

Integrated Diagnostics Holdings plc, with a market cap of $189.51 million, is strengthening its position in the Egyptian healthcare sector through strategic expansion and robust financial health. The recent acquisition of CAIRO RAY for Radiotherapy enhances its radiology offerings, complementing its leading pathology business and expanding Al Borg Scan's network to eight branches in Greater Cairo. Financially, IDH demonstrates strong performance with a high Return on Equity of 28.8%, well-covered debt by operating cash flow at 591.9%, and earnings growth exceeding industry averages at 111.1% over the past year, indicating solid operational efficiency and potential for further growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Integrated Diagnostics Holdings.

- Explore Integrated Diagnostics Holdings' analyst forecasts in our growth report.

Summing It All Up

- Access the full spectrum of 296 UK Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IDHC

Integrated Diagnostics Holdings

Operates as a consumer healthcare company that provides medical diagnostics services to patients.

Undervalued with high growth potential and pays a dividend.

Market Insights

Community Narratives