- United Kingdom

- /

- Capital Markets

- /

- LSE:PBEE

November 2024 UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic interdependencies. Amid such market conditions, investors often seek opportunities in areas like penny stocks—smaller or less-established companies that can offer unique value propositions. Despite their vintage name, penny stocks remain relevant due to their potential for growth and financial resilience, making them an intriguing option for those looking to explore beyond the usual investment avenues.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £402.8M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.925 | £70.05M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.65 | £192.41M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.255 | £107.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.27 | £195.87M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.41 | £179.57M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.325 | £425.48M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.40 | £209.85M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company offering a range of medical diagnostics services, with a market cap of $229.91 million.

Operations: The company's revenue is primarily derived from its operations in Egypt (EGP 3.97 billion), followed by Jordan (EGP 699.61 million) and Nigeria (EGP 77.09 million).

Market Cap: $229.91M

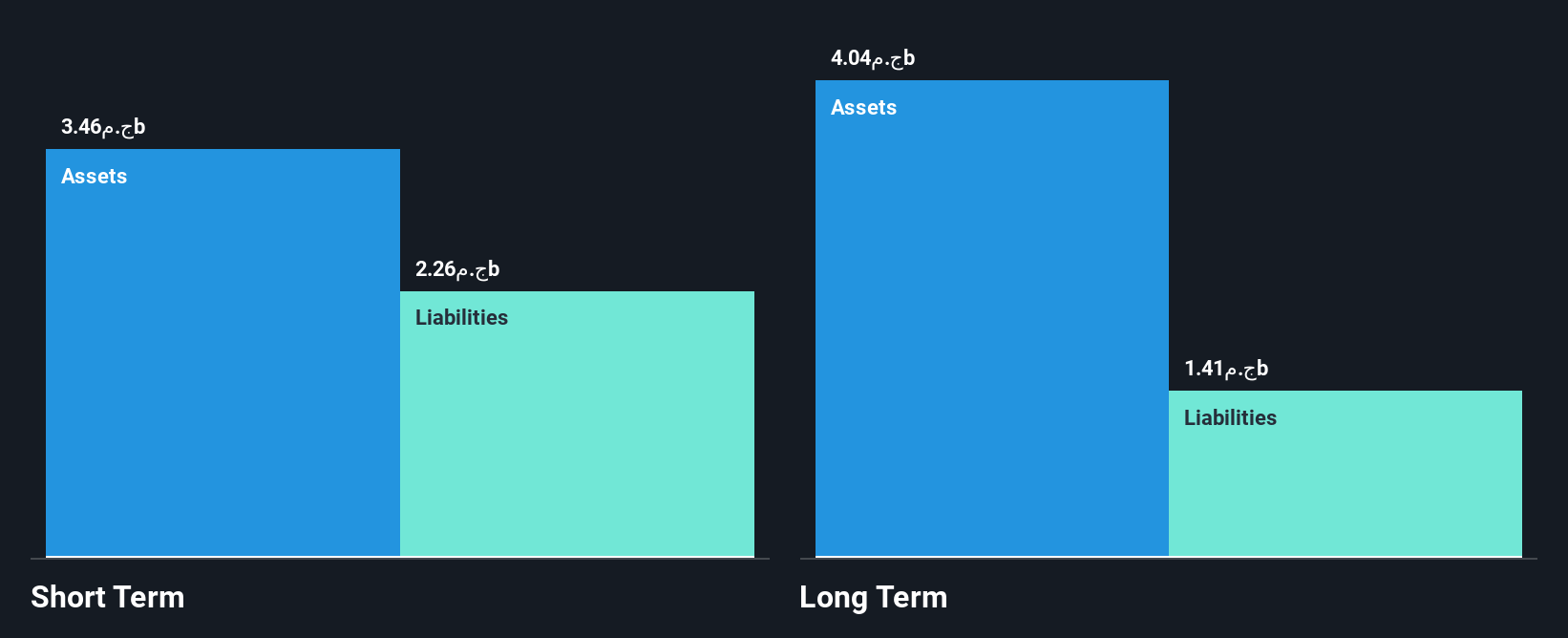

Integrated Diagnostics Holdings plc, with a market cap of $229.91 million, has shown strong financial performance with significant earnings growth of 138.6% over the past year and high-quality earnings. The company’s debt is well-covered by operating cash flow, and its short-term assets exceed both short- and long-term liabilities. Despite a volatile share price recently, the stock trades at a good value compared to peers. Recent strategic moves include delisting from the Egyptian Exchange while maintaining its listing on the London Stock Exchange, alongside executing a share buyback program to enhance shareholder value.

- Get an in-depth perspective on Integrated Diagnostics Holdings' performance by reading our balance sheet health report here.

- Examine Integrated Diagnostics Holdings' earnings growth report to understand how analysts expect it to perform.

PensionBee Group (LSE:PBEE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PensionBee Group plc is a direct-to-consumer financial technology company offering online pension services in the United Kingdom and the United States, with a market cap of £358.80 million.

Operations: The company generates revenue from its Internet Information Providers segment, amounting to £28.32 million.

Market Cap: £358.8M

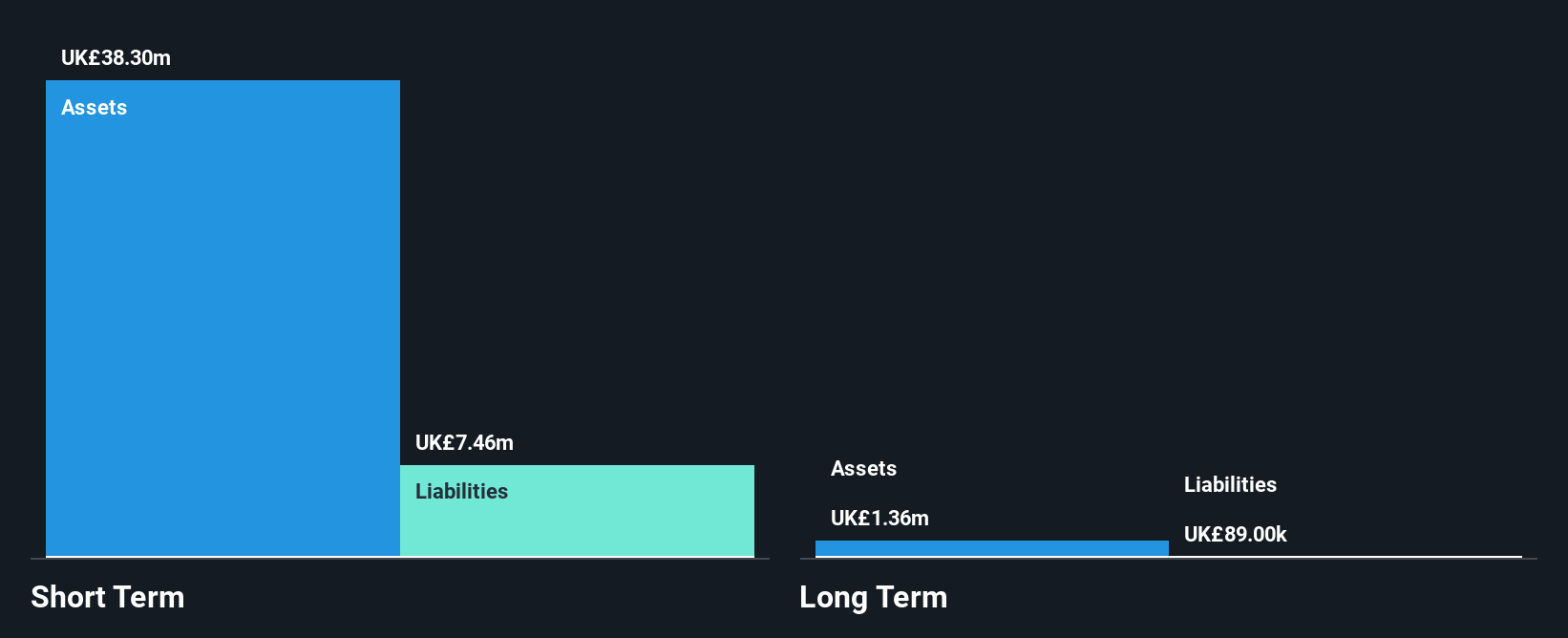

PensionBee Group plc, with a market cap of £358.80 million, has been navigating challenges typical of penny stocks. Despite being unprofitable, the company has reduced its losses over the past five years and maintains a cash runway exceeding three years. Recent strategic moves include completing a £20 million follow-on equity offering to bolster financial flexibility. The firm projects group revenue to surpass £30 million for 2024, indicating potential growth. While shareholders have experienced dilution with a 5.4% increase in shares outstanding, PensionBee remains debt-free and benefits from an experienced management team and board of directors.

- Click here and access our complete financial health analysis report to understand the dynamics of PensionBee Group.

- Explore PensionBee Group's analyst forecasts in our growth report.

Mollyroe (OFEX:MOY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mollyroe Plc invests in commercial and residential properties, with a market cap of £8.06 million.

Operations: Mollyroe Plc has not reported any specific revenue segments.

Market Cap: £8.06M

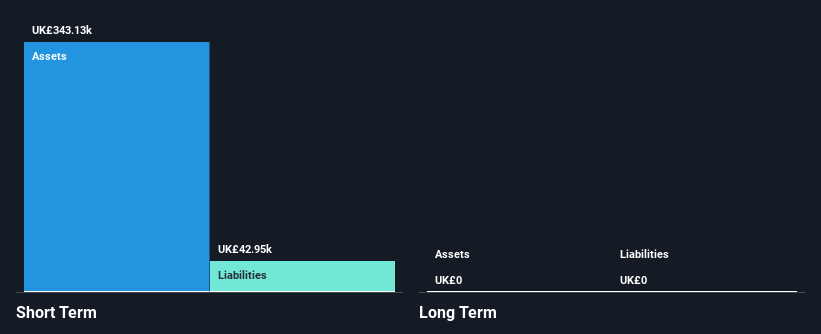

Mollyroe Plc, with a market cap of £8.06 million, is currently pre-revenue and unprofitable. The company has no long-term liabilities and remains debt-free, which can be seen as a financial strength. However, shareholders have been diluted over the past year with an increase in shares outstanding by 2.2%. Despite reducing losses at a rate of 17.4% annually over five years, Mollyroe's share price has been highly volatile recently, with weekly volatility increasing significantly from last year. Short-term assets of £343.1K comfortably cover short-term liabilities of £42.9K, providing some liquidity assurance amidst its challenges.

- Click to explore a detailed breakdown of our findings in Mollyroe's financial health report.

- Examine Mollyroe's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Get an in-depth perspective on all 464 UK Penny Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PBEE

PensionBee Group

A direct-to-consumer financial technology company, provides online pension services in the United Kingdom and the United States.

High growth potential with excellent balance sheet.