- United Kingdom

- /

- Healthcare Services

- /

- AIM:TRLS

Discover UK Penny Stocks: Netcall And Two Other Promising Picks

Reviewed by Simply Wall St

The recent performance of the FTSE 100 and FTSE 250 indices reflects broader global economic challenges, particularly influenced by weak trade data from China. In such a climate, investors often look for opportunities in less conventional areas of the market. Penny stocks, though an older term, still represent smaller or newer companies that can offer significant value when they possess strong financials and a clear path to growth. This article explores three UK penny stocks that present compelling opportunities for those interested in discovering potential hidden gems within the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Foresight Group Holdings (LSE:FSG) | £3.91 | £445.66M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.58 | £289.22M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.135 | £311.79M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.725 | £455.47M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.21 | £157.67M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.26 | £81.24M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.805 | £68.33M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.468 | £226.41M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Netcall (AIM:NET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Netcall plc is a UK-based company that designs, develops, sells, and supports software products and services with a market cap of £186.78 million.

Operations: The company generates revenue of £39.06 million from its operations in designing, developing, selling, and supporting software products and services.

Market Cap: £186.78M

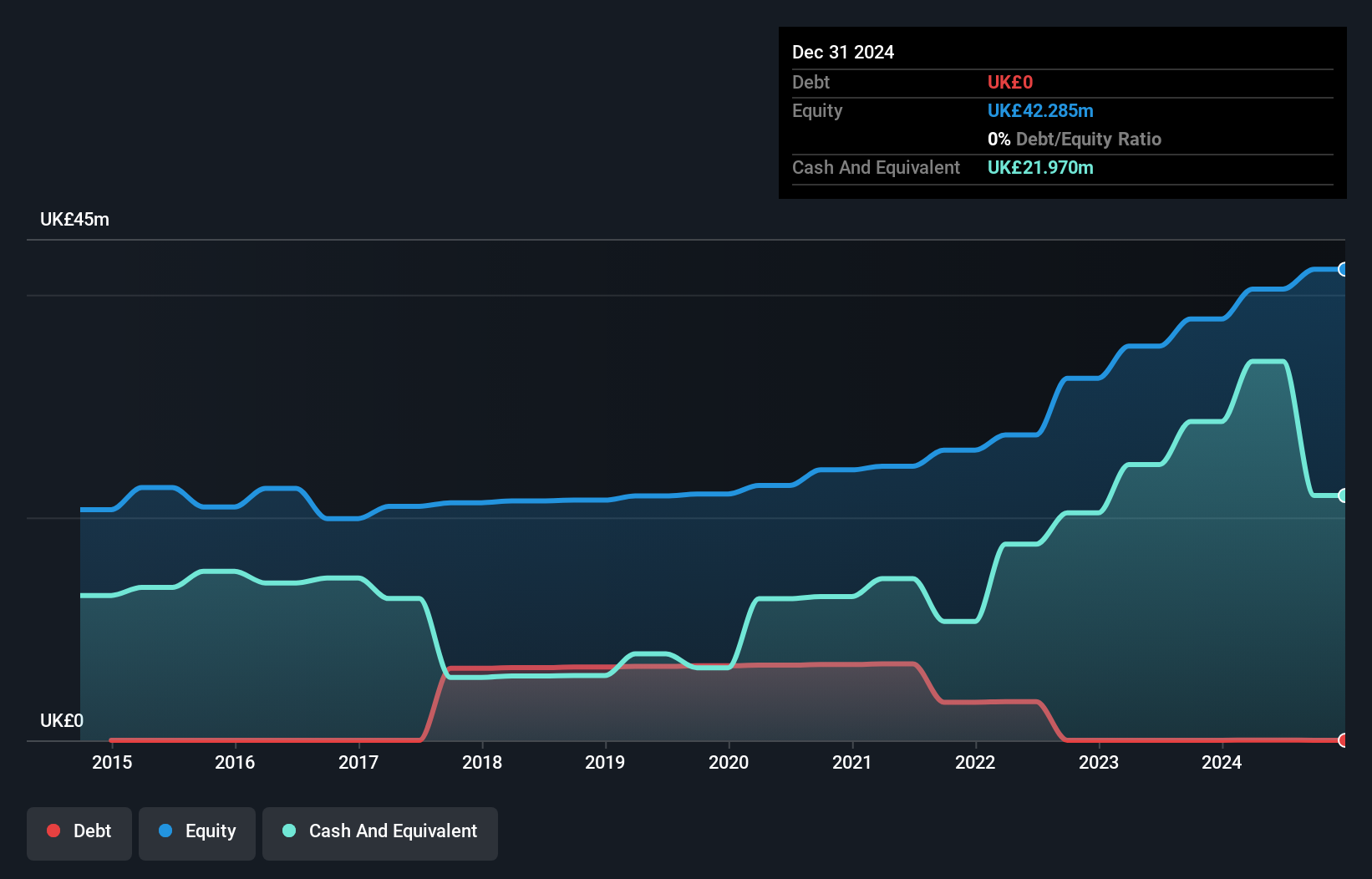

Netcall plc demonstrates robust financial health with more cash than debt and a significantly reduced debt to equity ratio over five years. Its earnings have grown substantially, though recent growth has decelerated compared to its 5-year average. The company benefits from high-quality earnings and strong interest coverage, with short-term assets comfortably covering liabilities. Despite low return on equity, Netcall's profit margins have improved, and revenue is forecasted to grow further. However, notable insider selling in the past quarter may warrant caution for potential investors in this penny stock segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Netcall.

- Learn about Netcall's future growth trajectory here.

Trellus Health (AIM:TRLS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Trellus Health plc offers digital chronic condition management solutions for employers and health plans, with a market cap of £4.68 million.

Operations: The company generates revenue from its digital health solution segment, amounting to $0.06 million.

Market Cap: £4.68M

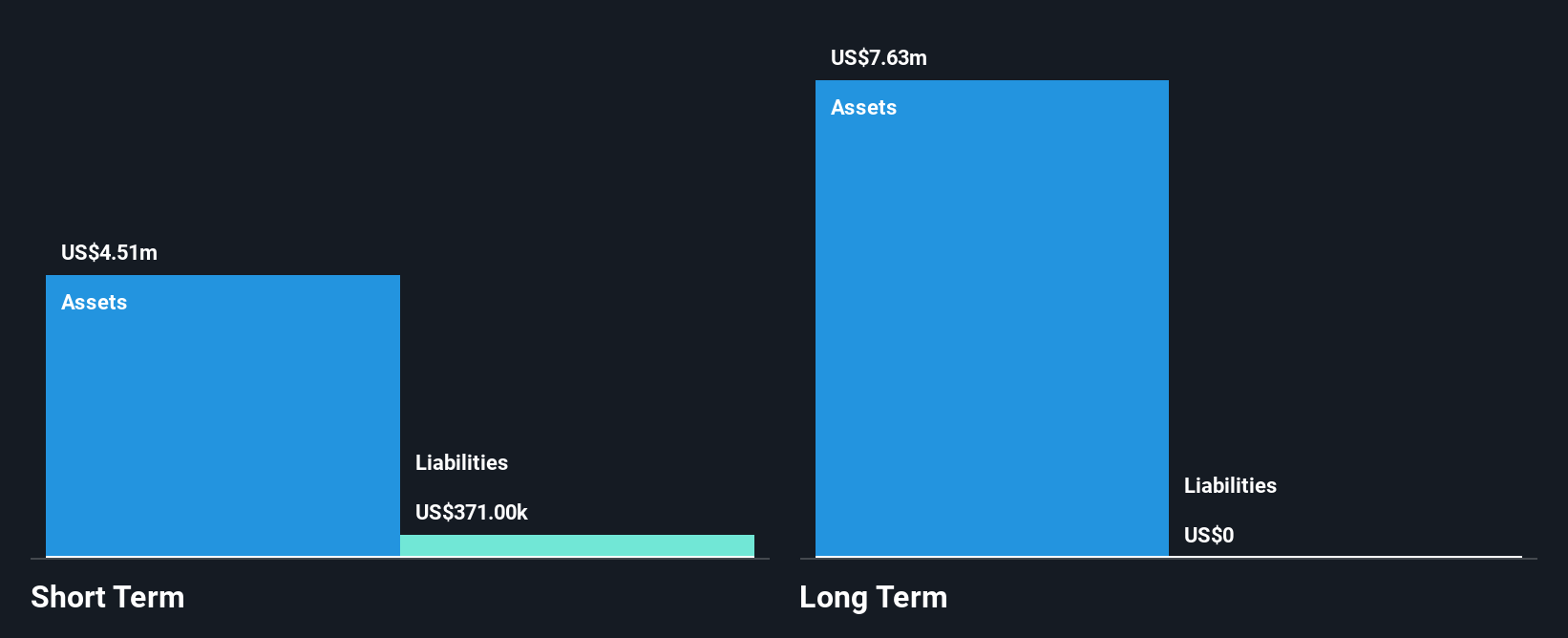

Trellus Health plc, with a market cap of £4.68 million, remains pre-revenue with its digital health solutions generating only US$0.06 million. The company is unprofitable, facing increased losses over the past five years at 10.9% annually and experiencing high share price volatility recently. Despite having no debt and short-term assets exceeding liabilities, Trellus has less than a year of cash runway if cash flow reductions persist. Recent developments include a collaboration with Johnson & Johnson to pilot the Trellus Elevate program for inflammatory bowel disease patients in the US, potentially offering new revenue streams through licensing and management fees.

- Click to explore a detailed breakdown of our findings in Trellus Health's financial health report.

- Learn about Trellus Health's historical performance here.

Zinnwald Lithium (AIM:ZNWD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zinnwald Lithium Plc is a mineral exploration and development company operating in the United Kingdom and Germany, with a market cap of £29.90 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration and development company.

Market Cap: £29.9M

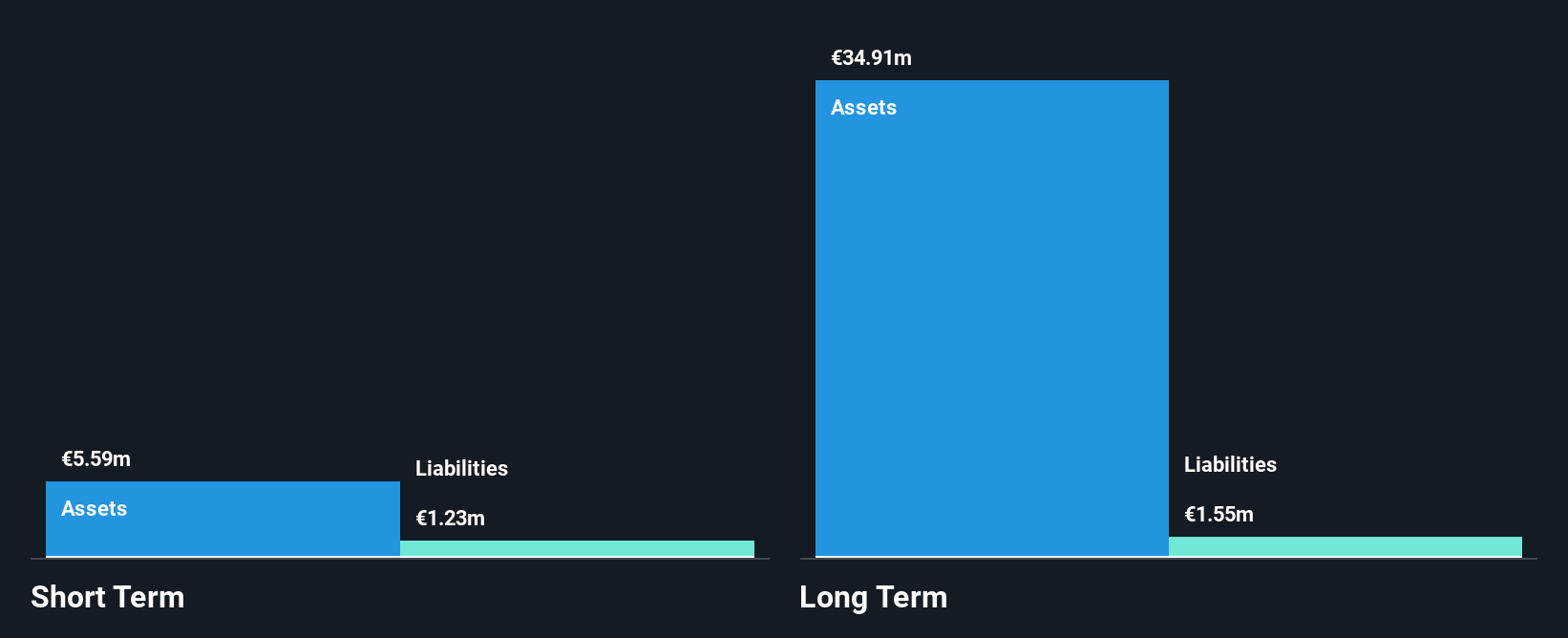

Zinnwald Lithium Plc, with a market cap of £29.90 million, is pre-revenue and unprofitable, experiencing a 20.1% annual increase in losses over the past five years. The company benefits from an experienced management team and board of directors, with average tenures of 3.5 and 6.7 years respectively. Despite being debt-free and having short-term assets (€9.8M) exceeding both short-term (€608.9K) and long-term liabilities (€1.6M), Zinnwald faces financial challenges with less than a year of cash runway based on current free cash flow trends, though it has sufficient runway for 2.6 years if reductions continue at historical rates.

- Get an in-depth perspective on Zinnwald Lithium's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Zinnwald Lithium's track record.

Where To Now?

- Navigate through the entire inventory of 445 UK Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trellus Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRLS

Trellus Health

Provides digital chronic condition management solutions for employers and health plans.

Moderate with adequate balance sheet.

Market Insights

Community Narratives