The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, impacting companies closely tied to its economy. Amidst these broader market fluctuations, investors often look for opportunities that balance affordability and growth potential. Penny stocks, though an older term, continue to represent such opportunities by offering access to smaller or newer companies with strong financial foundations that might outperform in the long run.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.01 | £757.4M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.966 | £152.38M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.87 | £469.45M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £425.03M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.20 | £185.07M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.63 | £361.03M | ★★★★☆☆ |

| On the Beach Group (LSE:OTB) | £2.35 | £392.43M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.25 | £202.69M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Brave Bison Group (AIM:BBSN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brave Bison Group plc offers digital advertising and technology services across the United Kingdom, Europe, the Asia-Pacific, and globally with a market cap of £29.45 million.

Operations: The company generates revenue of £34.38 million from monetising online video content.

Market Cap: £29.45M

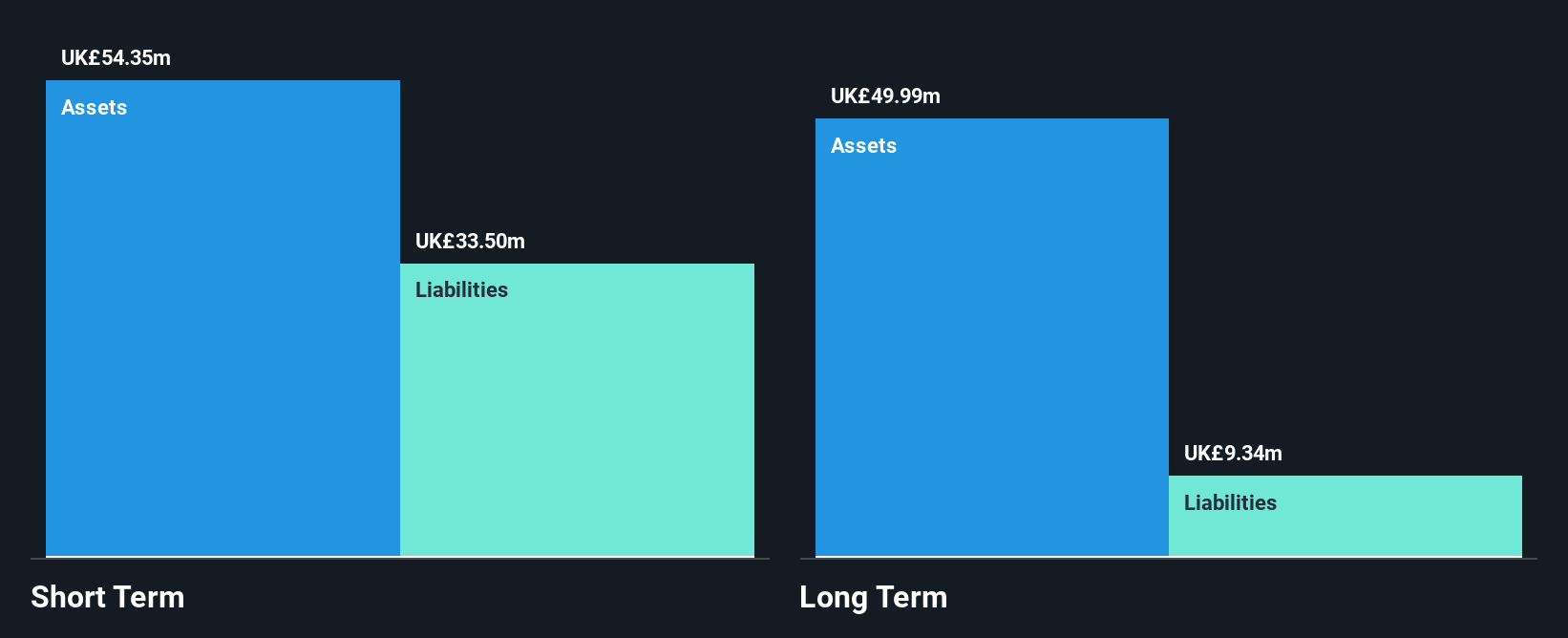

Brave Bison Group plc, with a market cap of £29.45 million, generates £34.38 million in revenue from digital advertising and technology services globally. The company boasts a high return on equity at 24.1% and has more cash than total debt, indicating strong financial health. Its short-term assets significantly cover both short- and long-term liabilities, while its earnings have grown substantially by 481.8% over the past year despite forecasts of declining earnings ahead. Trading at a good value relative to peers, Brave Bison's management team is experienced with stable weekly volatility at 6%.

- Get an in-depth perspective on Brave Bison Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Brave Bison Group's future.

Solid State (AIM:SOLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solid State plc, with a market cap of £92.98 million, designs, manufactures, and supplies electronic equipment across the United Kingdom, Europe, Asia, North America, and other international markets.

Operations: The company generates revenue through its Systems Division, which accounts for £81.69 million, and its Components Division, contributing £55.26 million.

Market Cap: £92.98M

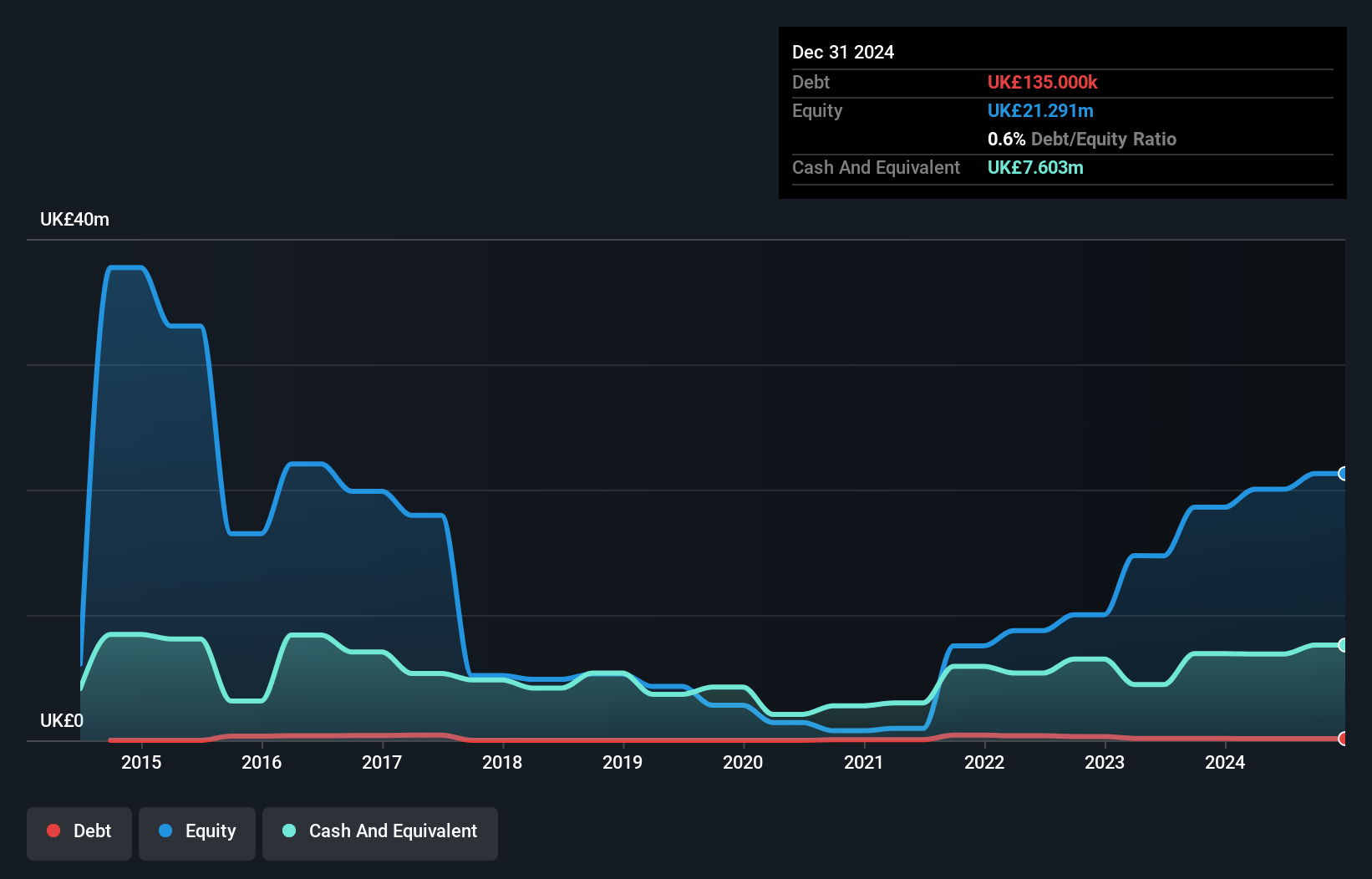

Solid State plc, with a market cap of £92.98 million, experienced a challenging year with declining sales and net income for the half-year ended September 2024. Despite this, the company maintains a satisfactory net debt to equity ratio of 3.2% and covers interest payments well with EBIT at 9.1x coverage. The management team is seasoned, contributing to strategic stability amidst increased weekly volatility from 7% to 13%. Although earnings growth has been negative recently, past five-year earnings grew significantly by an average of 20.3% annually. Solid State's short-term assets effectively cover its liabilities, ensuring financial resilience.

- Click to explore a detailed breakdown of our findings in Solid State's financial health report.

- Learn about Solid State's future growth trajectory here.

Totally (AIM:TLY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Totally plc, with a market cap of £16.71 million, operates healthcare services in the United Kingdom and Ireland through its subsidiaries.

Operations: The company generates £92.58 million in revenue from its operations in the United Kingdom.

Market Cap: £16.71M

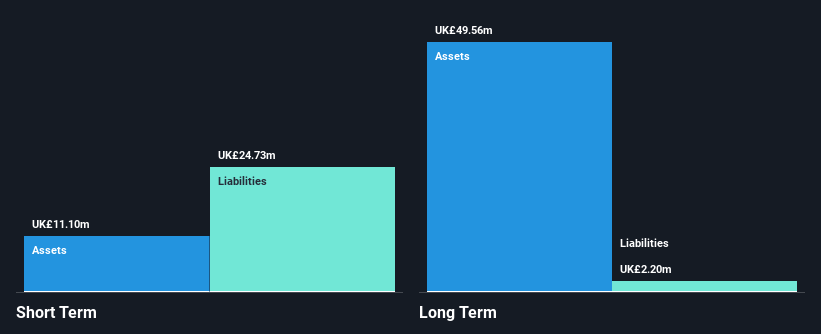

Totally plc, with a market cap of £16.71 million, has been reducing its losses at an annual rate of 8.1% over the past five years despite being unprofitable. The company reported half-year sales of £41.71 million, down from £55.8 million the previous year, but managed to achieve a small net income improvement from a significant loss last year. Its net debt to equity ratio is satisfactory at 3.3%, and it has renewed its Revolving Credit Facility for two years at £3.5 million to align with business size adjustments, ensuring financial flexibility amidst high share price volatility and stable cash runway projections exceeding three years.

- Click here to discover the nuances of Totally with our detailed analytical financial health report.

- Examine Totally's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Jump into our full catalog of 468 UK Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SOLI

Solid State

Designs, manufactures, and supplies electronic equipment in the United Kingdom, rest of Europe, Asia, North America, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives