- United Kingdom

- /

- Medical Equipment

- /

- AIM:SPEC

INSPECS Group (LON:SPEC) shareholders are up 10% this past week, but still in the red over the last year

It's nice to see the INSPECS Group plc (LON:SPEC) share price up 10% in a week. But that hardly compensates for the shocking decline over the last twelve months. Specifically, the stock price nose-dived 88% in that time. It's not uncommon to see a bounce after a drop like that. The real question is whether the company can turn around its fortunes. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the last year has been tough for INSPECS Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for INSPECS Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the INSPECS Group share price fell, it actually saw its earnings per share (EPS) improve by 27%. It's quite possible that growth expectations may have been unreasonable in the past. In fact, we can see extraordinary items impacting earnings in the last twelve months.

It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

INSPECS Group managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

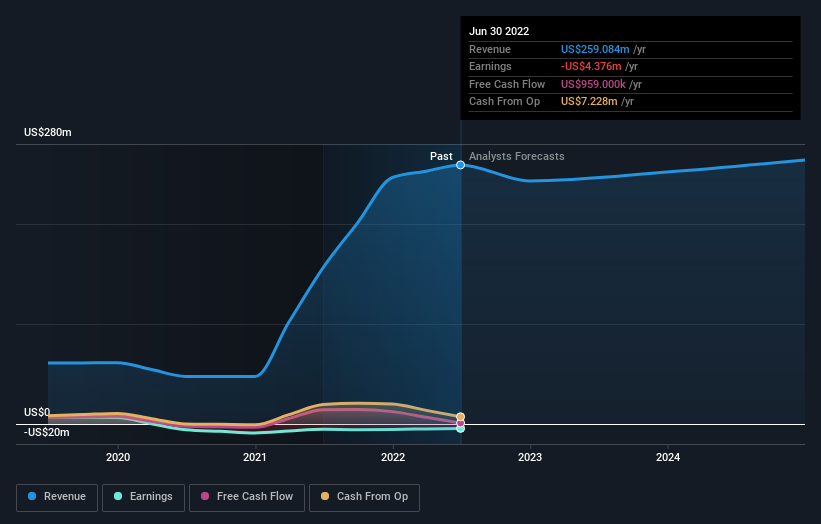

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We doubt INSPECS Group shareholders are happy with the loss of 88% over twelve months (even including dividends). That falls short of the market, which lost 3.4%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 60%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that INSPECS Group is showing 4 warning signs in our investment analysis , and 3 of those can't be ignored...

INSPECS Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SPEC

INSPECS Group

Designs, produces, sells, markets, and distributes fashion eyewear, lenses, and OEM products in the United Kingdom, Europe, North America, South America, Asia, Africa, and Australia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives