- United Kingdom

- /

- Medical Equipment

- /

- AIM:RUA

The Rua Life Sciences (LON:RUA) Share Price Is Up 481% And Shareholders Are Delighted

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. For example, the Rua Life Sciences Plc (LON:RUA) share price is up a whopping 481% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 14% gain in the last three months.

Check out our latest analysis for Rua Life Sciences

Rua Life Sciences wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years Rua Life Sciences saw its revenue grow at 2.4% per year. Put simply, that growth rate fails to impress. So shareholders should be pretty elated with the 42% increase per year, in that time. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

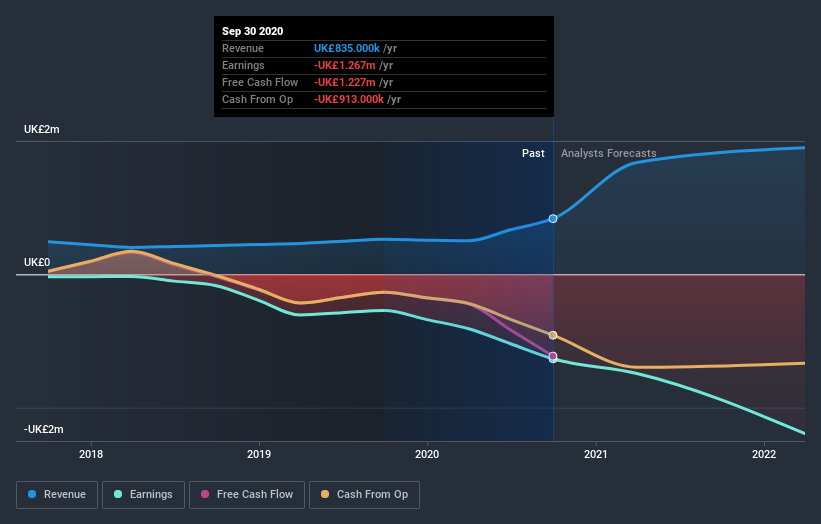

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Rua Life Sciences stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're pleased to report that Rua Life Sciences shareholders have received a total shareholder return of 109% over one year. That's better than the annualised return of 42% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 6 warning signs for Rua Life Sciences you should be aware of, and 3 of them are concerning.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Rua Life Sciences, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:RUA

RUA Life Sciences

Engages in the provision of polymers, services, and products to the medical device industry in Europe, the United States, and internationally.

High growth potential slight.