- United Kingdom

- /

- Medical Equipment

- /

- AIM:NIOX

UK Market: NIOX Group And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In such uncertain times, identifying undervalued stocks can be crucial for investors seeking opportunities amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| tinyBuild (AIM:TBLD) | £0.07125 | £0.13 | 45.4% |

| SigmaRoc (AIM:SRC) | £1.188 | £2.32 | 48.7% |

| Norcros (LSE:NXR) | £3.00 | £5.52 | 45.6% |

| Likewise Group (AIM:LIKE) | £0.26 | £0.52 | 49.8% |

| Gooch & Housego (AIM:GHH) | £5.68 | £11.08 | 48.8% |

| Forterra (LSE:FORT) | £1.828 | £3.62 | 49.5% |

| Fevertree Drinks (AIM:FEVR) | £8.58 | £15.77 | 45.6% |

| Barratt Redrow (LSE:BTRW) | £4.037 | £7.54 | 46.5% |

| AstraZeneca (LSE:AZN) | £125.46 | £244.77 | 48.7% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.18 | £4.29 | 49.2% |

We'll examine a selection from our screener results.

NIOX Group (AIM:NIOX)

Overview: NIOX Group Plc designs, develops, and commercializes medical devices for asthma diagnosis, monitoring, and management globally, with a market cap of £293.35 million.

Operations: The company's revenue is primarily generated from its NIOX® segment, which accounts for £46 million.

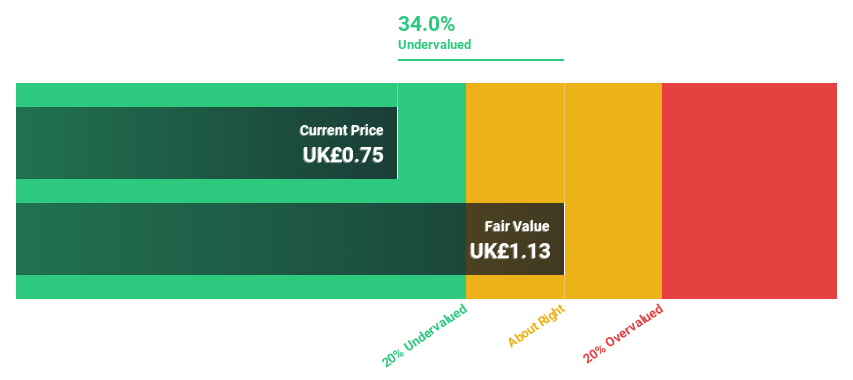

Estimated Discount To Fair Value: 39.6%

NIOX Group's recent earnings report shows strong financial performance, with sales rising to £25.2 million and net income increasing to £5.9 million for the half year ended June 30, 2025. The stock is trading at £0.7, significantly below its estimated fair value of £1.16, making it undervalued by over 20%. Despite a drop in profit margins from last year, its earnings are expected to grow significantly faster than the UK market average.

- Our earnings growth report unveils the potential for significant increases in NIOX Group's future results.

- Navigate through the intricacies of NIOX Group with our comprehensive financial health report here.

Moonpig Group (LSE:MOON)

Overview: Moonpig Group PLC operates as a data and technology platform specializing in online greeting cards and gifting across the Netherlands, Ireland, Australia, the United States, and the United Kingdom with a market capitalization of £710.99 million.

Operations: The company's revenue is primarily derived from its Moonpig segment (£262 million), followed by Greetz (£48.85 million) and Experiences (£39.21 million).

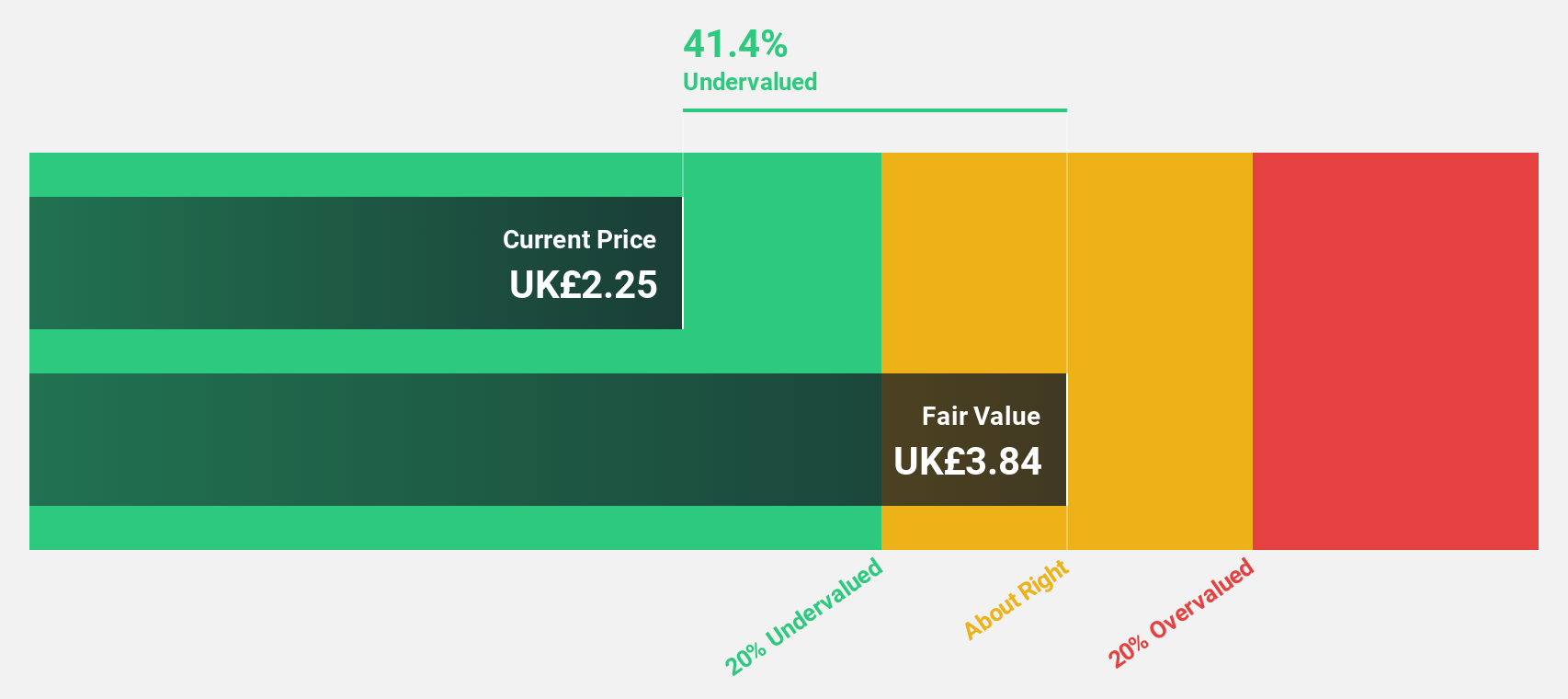

Estimated Discount To Fair Value: 37.5%

Moonpig Group is trading at £2.21, significantly below its estimated fair value of £3.53, suggesting it is undervalued by over 20%. Analysts anticipate a 37.2% stock price increase as earnings are forecast to grow 57.29% annually, despite revenue growth being slower than ideal at 7.1% per year and high debt levels. The company aims for profitability within three years, with a very high return on equity expected in that timeframe.

- Our growth report here indicates Moonpig Group may be poised for an improving outlook.

- Dive into the specifics of Moonpig Group here with our thorough financial health report.

S&U (LSE:SUS)

Overview: S&U plc operates in the United Kingdom, offering motor, property bridging, and specialist finance services with a market cap of £210.21 million.

Operations: The company generates revenue from motor finance (£70.07 million) and property bridging finance (£15.82 million) segments in the UK.

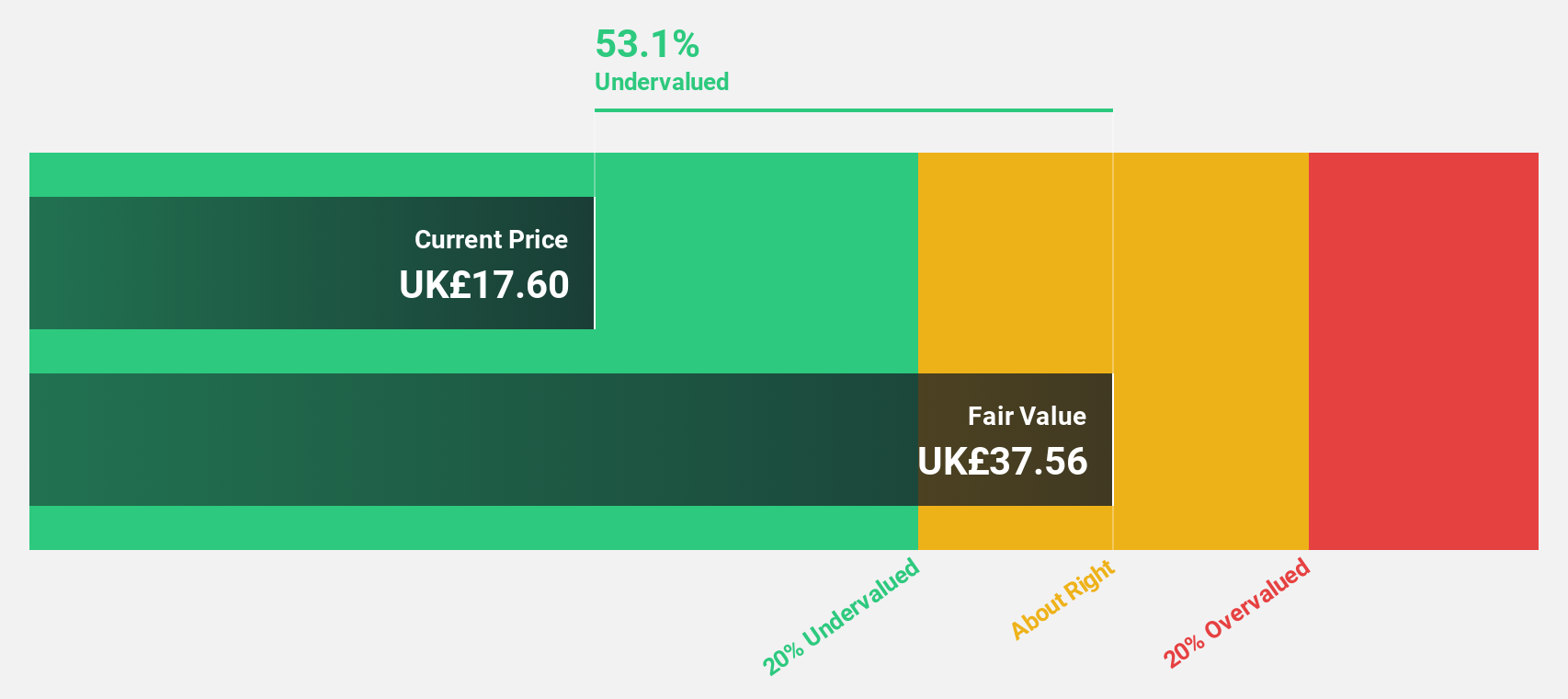

Estimated Discount To Fair Value: 34.4%

S&U is trading at £17.30, significantly below its estimated fair value of £26.37, highlighting its undervaluation by over 20%. Despite a high debt level, the company reported a net income increase to £11.6 million for the half year ended August 2025 and announced a dividend rise to 35p per share. Earnings are forecast to grow at 18% annually, outpacing the UK market's growth rate of 14.7%, with revenue expected to expand by over 24% per year.

- Insights from our recent growth report point to a promising forecast for S&U's business outlook.

- Click to explore a detailed breakdown of our findings in S&U's balance sheet health report.

Taking Advantage

- Click through to start exploring the rest of the 49 Undervalued UK Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIOX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NIOX

NIOX Group

Engages in the design, development, and commercialization of medical devices for asthma diagnosis, monitoring, and management worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives