- United Kingdom

- /

- Hospitality

- /

- LSE:SSPG

Discover 3 Undervalued Small Caps With Insider Activity In The European Market

Reviewed by Simply Wall St

As the European market navigates through a period of mixed economic signals, with the STOXX Europe 600 Index seeing modest gains amid hopes for interest rate cuts, investors are keenly observing small-cap stocks that might offer unique opportunities. In this environment, companies displaying insider activity can be particularly intriguing, as such movements may suggest confidence in the company's potential despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.3x | 0.7x | 43.53% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 36.84% | ★★★★★☆ |

| Cairn Homes | 12.7x | 1.6x | 27.09% | ★★★★★☆ |

| Eastnine | 11.6x | 7.3x | 49.46% | ★★★★★☆ |

| Senior | 24.7x | 0.8x | 27.59% | ★★★★★☆ |

| Eurocell | 16.4x | 0.3x | 39.81% | ★★★★☆☆ |

| Greencore Group | 18.8x | 0.6x | 48.92% | ★★★★☆☆ |

| Gooch & Housego | 45.2x | 1.1x | 24.27% | ★★★☆☆☆ |

| Kendrion | 29.3x | 0.7x | 41.90% | ★★★☆☆☆ |

| CVS Group | 45.6x | 1.3x | 26.92% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

NIOX Group (AIM:NIOX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NIOX Group focuses on developing and commercializing medical devices, specifically the NIOX® product line for asthma management, with a market capitalization of £0.25 billion.

Operations: The company generates revenue primarily from its NIOX® segment, with recent figures showing £46 million. Over the years, it has seen a gross profit margin trend reaching up to 72.25%. The cost structure includes significant allocations to R&D and sales & marketing expenses, which have been substantial components of operating expenses. Net income margins have varied significantly but recently showed positive trends.

PE: 59.9x

NIOX Group, a European company with sales of £25.2 million for the first half of 2025, saw net income rise to £5.9 million from £4.4 million year-on-year. Despite lower profit margins at 10.7%, earnings per share improved, indicating potential for growth in the small-cap segment. Insider confidence is evident with recent share purchases over the past year, suggesting belief in future prospects despite reliance on higher-risk external borrowing for funding needs.

- Dive into the specifics of NIOX Group here with our thorough valuation report.

Explore historical data to track NIOX Group's performance over time in our Past section.

SSP Group (LSE:SSPG)

Simply Wall St Value Rating: ★★★☆☆☆

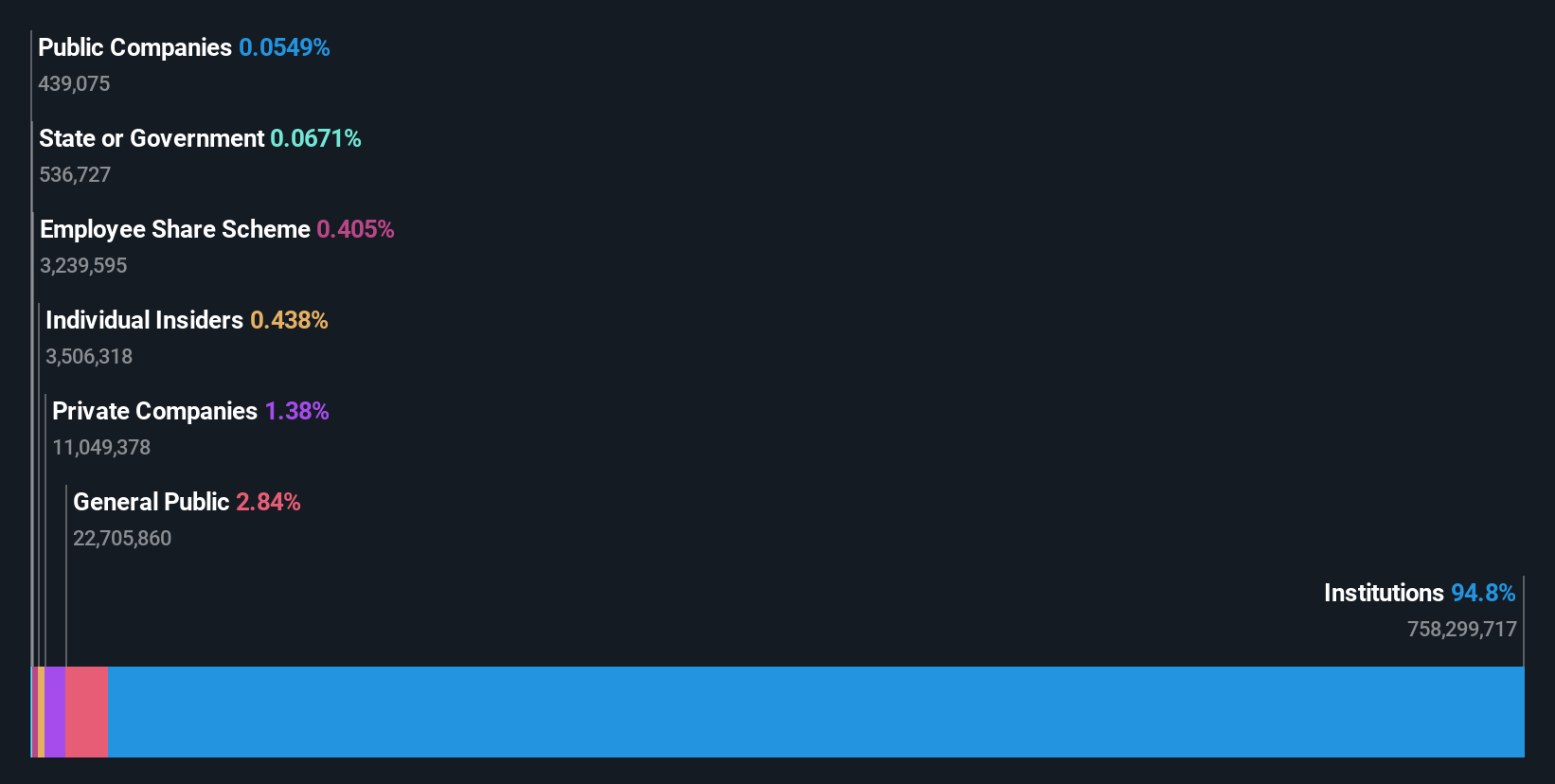

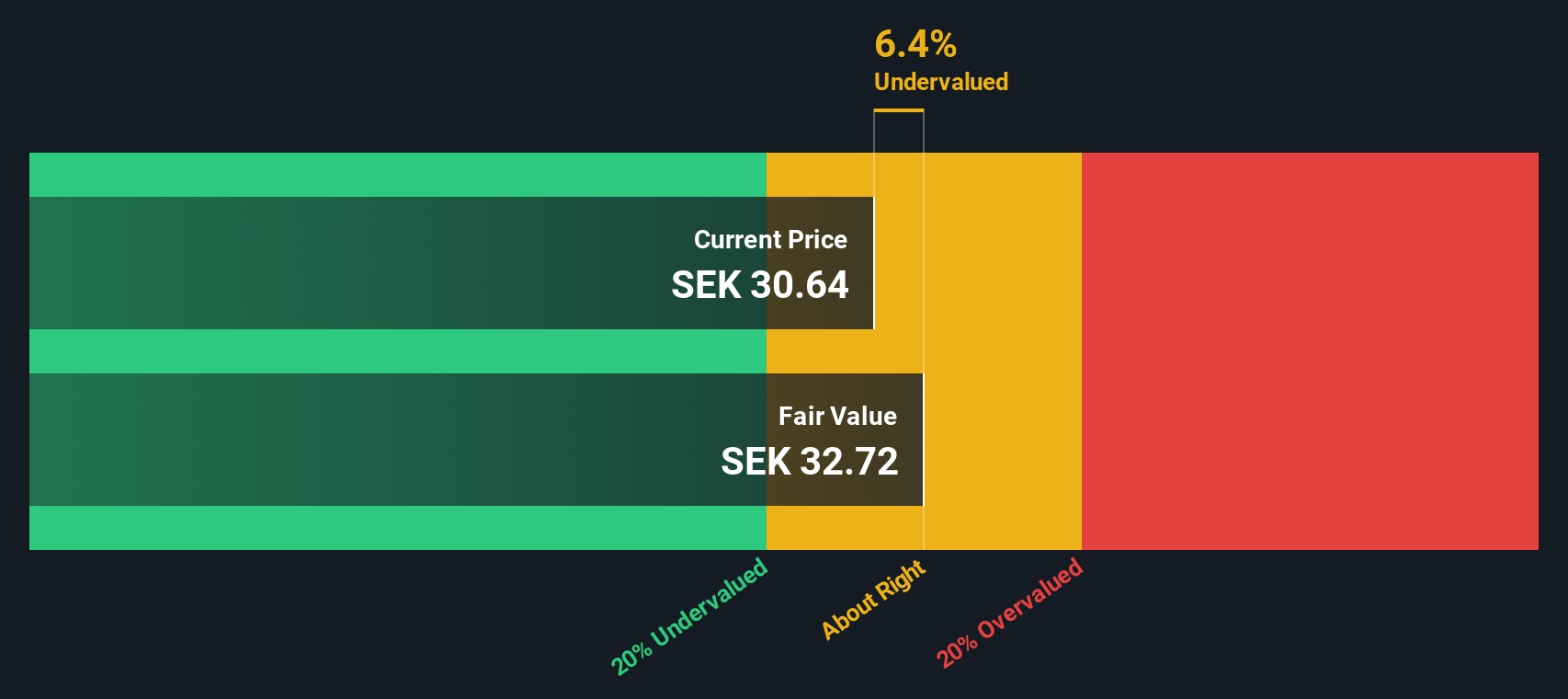

Overview: SSP Group operates in the food and beverage travel sector, primarily at airports and railway stations, with a market cap of approximately £2.14 billion.

Operations: SSP Group's revenue primarily stems from its operations in the food and beverage travel sector, with a notable focus on airports and railway stations. The company's gross profit margin has shown an upward trend, reaching 30.04% as of September 2025. Operating expenses include significant allocations for depreciation and amortization, which reached £407.6 million in the latest period.

PE: -18.3x

SSP Group, a European small-cap company, recently revised its 2026 earnings guidance upwards, indicating potential growth. Despite reporting a net loss of £74.4 million for the year ending September 2025, sales rose to £3.6 billion from £3.4 billion the previous year. The company announced a share buyback program worth up to £100 million to reduce issued capital by October 2026. Insider confidence is evident with recent purchases within the past few months, suggesting optimism about future performance despite current challenges in margin recovery and post-COVID recovery hurdles in UK rail travel.

- Click here to discover the nuances of SSP Group with our detailed analytical valuation report.

Assess SSP Group's past performance with our detailed historical performance reports.

Vimian Group (OM:VIMIAN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vimian Group operates in the animal health sector, focusing on medtech, diagnostics, specialty pharma, and veterinary services with a market capitalization of €1.67 billion.

Operations: Vimian Group generates revenue primarily from Specialty Pharma (€181.60 million) and Medtech (€153.80 million), with additional contributions from Veterinary Services and Diagnostics. The company's gross profit margin has shown variability, reaching 70.01% in Q3 2024 but later adjusting to 68.62% by Q3 2025. Operating expenses, including significant general and administrative costs, impact the overall profitability of the business model.

PE: 46.2x

Vimian Group, a European company in the animal health sector, is gaining attention for its potential growth and strategic ambitions. With earnings forecasted to grow 39% annually, they reported a significant sales increase to €104.3 million in Q3 2025 from €87.6 million the previous year. Despite relying on external borrowing for funding, Vimian's confidence is evident as they pursue acquisitions aggressively to bolster their market position. Recent insider confidence was demonstrated through share purchases earlier this year, signaling belief in future prospects under new CEO Alireza Tajbakhsh's leadership since November 2025.

- Take a closer look at Vimian Group's potential here in our valuation report.

Understand Vimian Group's track record by examining our Past report.

Summing It All Up

- Explore the 73 names from our Undervalued European Small Caps With Insider Buying screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SSPG

SSP Group

Operates food and beverage outlets in North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026