Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should LiDCO Group (LON:LID) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for LiDCO Group

How Long Is LiDCO Group's Cash Runway?

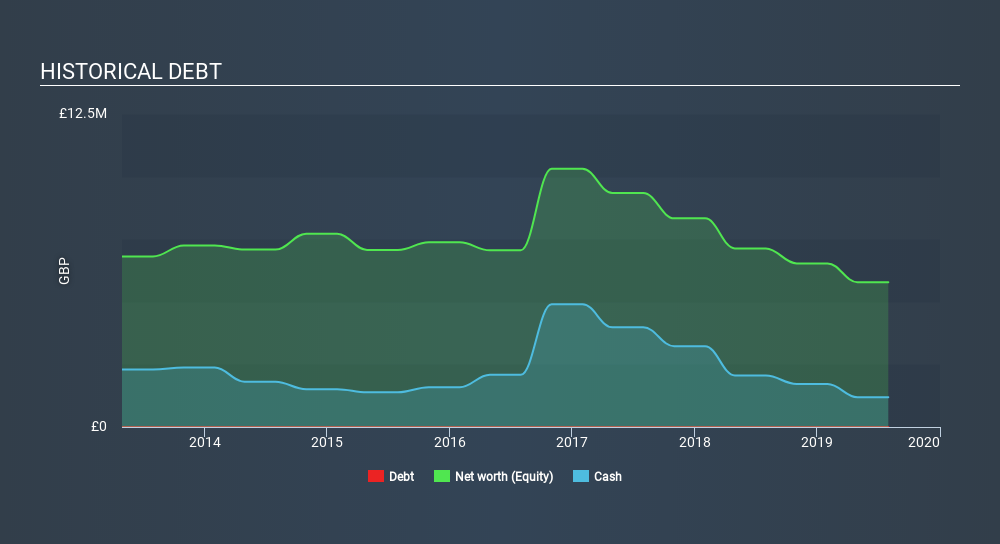

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at July 2019, LiDCO Group had cash of UK£1.2m and no debt. Looking at the last year, the company burnt through UK£750k. Therefore, from July 2019 it had roughly 19 months of cash runway. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. We should note, however, that if we extrapolate recent trends in its cash burn, then its cash runway would get a lot longer. You can see how its cash balance has changed over time in the image below.

How Well Is LiDCO Group Growing?

Happily, LiDCO Group is travelling in the right direction when it comes to its cash burn, which is down 61% over the last year. But it was a bit disconcerting to see operating revenue down 9.7% in that time. On balance, we'd say the company is improving over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For LiDCO Group To Raise More Cash For Growth?

Even though it seems like LiDCO Group is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash to drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

LiDCO Group has a market capitalisation of UK£21m and burnt through UK£750k last year, which is 3.5% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About LiDCO Group's Cash Burn?

Even though its falling revenue makes us a little nervous, we are compelled to mention that we thought LiDCO Group's cash burn relative to its market cap was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 4 warning signs for LiDCO Group that investors should know when investing in the stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)