- United Kingdom

- /

- Entertainment

- /

- AIM:LBG

Spotlight On Intelligent Ultrasound Group And 2 Other UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines following weak trade data from China, highlighting ongoing global economic uncertainties. Despite these broader market pressures, investors often look to penny stocks as potential opportunities for growth due to their lower price points and the possibility of discovering undervalued companies. While the term "penny stock" might seem outdated, these investments can still offer significant upside when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £145.75M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.39 | £64.65M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.165 | £99.53M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.28 | £197.41M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.86 | £383.9M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.45 | $261.6M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.41 | £307.94M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Intelligent Ultrasound Group (AIM:IUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intelligent Ultrasound Group plc develops, markets, and distributes medical training simulators globally, with a market cap of £41.72 million.

Operations: The company generates revenue from two main segments: Simulation (£7.34 million) and Clinical AI (£2.83 million).

Market Cap: £41.72M

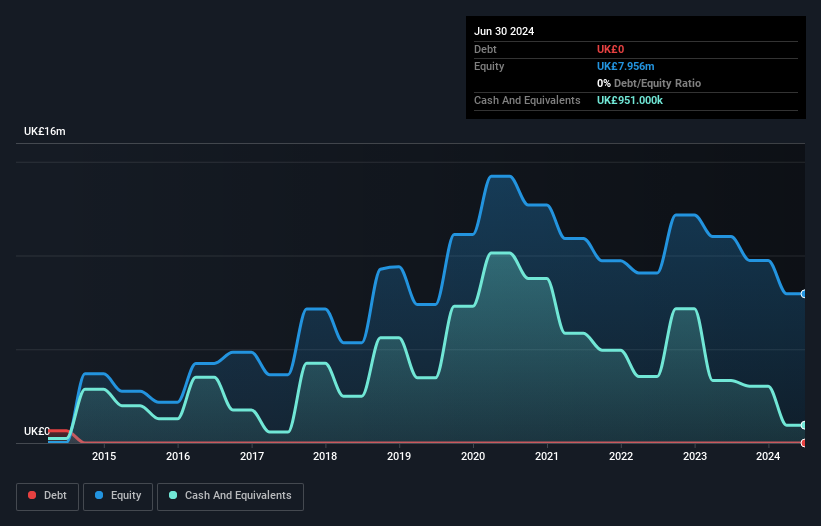

Intelligent Ultrasound Group plc, with a market cap of £41.72 million, operates in the medical training simulator sector and is currently unprofitable but has reduced losses over the past five years. The company is debt-free and maintains a stable financial position with short-term assets exceeding liabilities. However, it faces challenges with less than a year of cash runway if free cash flow grows at historical rates. Recently, Surgical Science Sweden AB agreed to acquire Intelligent Ultrasound for £42.5 million, valuing shares at £0.13 each; this acquisition is expected to complete in early 2025 pending approvals.

- Get an in-depth perspective on Intelligent Ultrasound Group's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Intelligent Ultrasound Group's track record.

LBG Media (AIM:LBG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LBG Media plc is an online media publisher operating in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £278.08 million.

Operations: The company generates revenue of £82.54 million from its online media publishing industry.

Market Cap: £278.08M

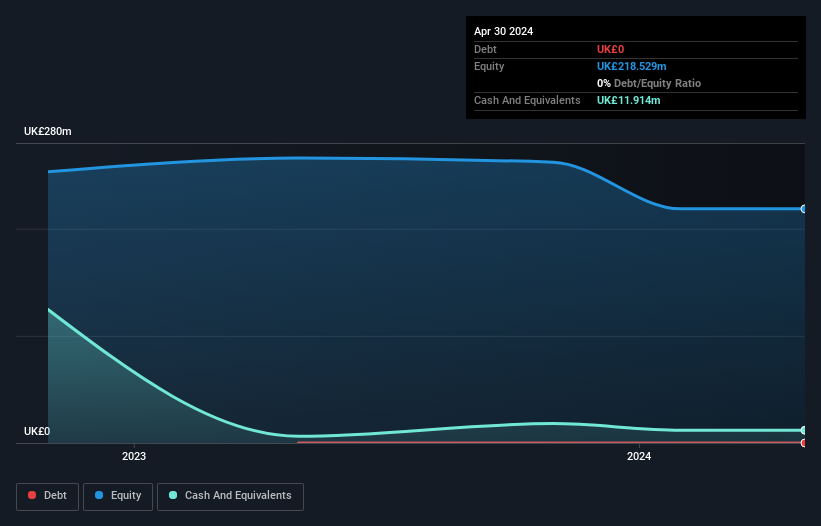

LBG Media plc, with a market cap of £278.08 million, has shown robust financial performance with earnings growing by 33% over the past year, surpassing the entertainment industry’s decline. The company is debt-free and its short-term assets (£54.5M) comfortably cover both short-term (£22.4M) and long-term liabilities (£7.6M). Despite a low Return on Equity at 10.1%, LBG's profit margins have slightly improved to 8.6%. Trading at a discount of 26% below estimated fair value, analysts agree on potential price appreciation by about 20%. However, recent financials were impacted by a significant one-off loss of £3.5 million.

- Unlock comprehensive insights into our analysis of LBG Media stock in this financial health report.

- Gain insights into LBG Media's outlook and expected performance with our report on the company's earnings estimates.

Harmony Energy Income Trust (LSE:HEIT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Harmony Energy Income Trust Plc is an investment company specializing in commercial scale battery energy storage and renewable energy generation projects in the UK, with a market cap of £148.09 million.

Operations: The company operates in the commercial scale battery energy storage and renewable energy generation sectors within the UK.

Market Cap: £148.09M

Harmony Energy Income Trust Plc, with a market cap of £148.09 million, is currently pre-revenue and unprofitable. The company operates without debt, which eliminates concerns over interest payments or debt coverage. Its short-term assets (£14.9M) significantly exceed its short-term liabilities (£449.8K), indicating solid liquidity management despite the lack of revenue generation. The board is considered experienced with an average tenure of 3.2 years, though detailed management experience data is lacking. Recent developments include an asset sale process managed by JLL, attracting non-binding offers from multiple parties, although the outcome remains uncertain as negotiations continue into late 2024.

- Click here and access our complete financial health analysis report to understand the dynamics of Harmony Energy Income Trust.

- Learn about Harmony Energy Income Trust's future growth trajectory here.

Key Takeaways

- Take a closer look at our UK Penny Stocks list of 472 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LBG

LBG Media

Operates an online media publisher the United Kingdom, Ireland, Australia, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.