- United Kingdom

- /

- Healthtech

- /

- AIM:INS

Here's Why We Think Instem (LON:INS) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Instem (LON:INS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Instem with the means to add long-term value to shareholders.

Check out our latest analysis for Instem

Instem's Improving Profits

Instem has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Instem's EPS shot up from UK£0.089 to UK£0.15; a result that's bound to keep shareholders happy. That's a fantastic gain of 63%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Instem shareholders can take confidence from the fact that EBIT margins are up from 7.4% to 10%, and revenue is growing. Both of which are great metrics to check off for potential growth.

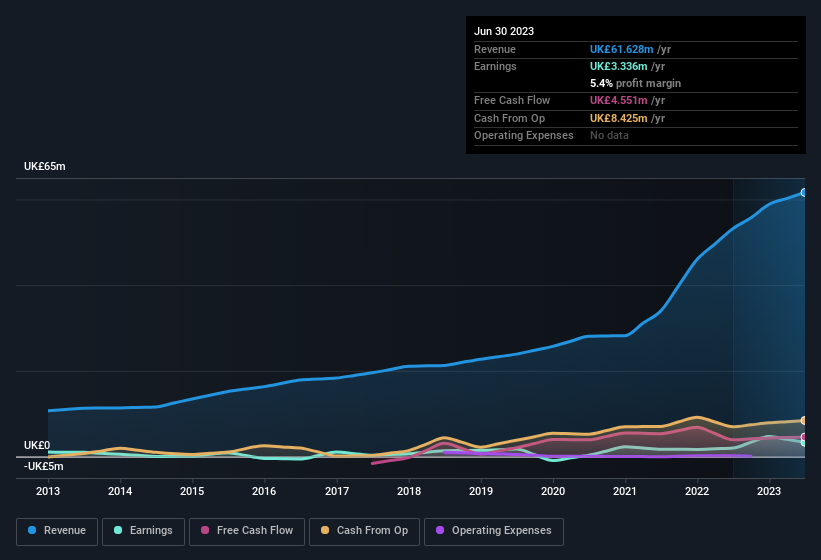

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Instem's future EPS 100% free.

Are Instem Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Instem insiders have a significant amount of capital invested in the stock. As a matter of fact, their holding is valued at UK£27m. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 16% of the shares on issue for the business, an appreciable amount considering the market cap.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Instem, with market caps between UK£82m and UK£330m, is around UK£638k.

The CEO of Instem only received UK£300k in total compensation for the year ending December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Instem Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Instem's strong EPS growth. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. Everyone has their own preferences when it comes to investing but it definitely makes Instem look rather interesting indeed. However, before you get too excited we've discovered 2 warning signs for Instem (1 is significant!) that you should be aware of.

Although Instem certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:INS

Instem

Instem plc, together with its subsidiaries, provides information technology solutions and services to the life sciences healthcare market worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives