- United Kingdom

- /

- Healthcare Services

- /

- AIM:CVSG

3 UK Stocks That May Be Trading Below Their Intrinsic Value By At Least 20.8%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, influenced by weak trade data from China and declining commodity prices, which have impacted several key sectors. In this environment of uncertainty, identifying stocks that may be trading below their intrinsic value presents an opportunity for investors to potentially capitalize on mispriced assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Savills (LSE:SVS) | £9.45 | £16.63 | 43.2% |

| Gooch & Housego (AIM:GHH) | £3.71 | £7.12 | 47.9% |

| Aptitude Software Group (LSE:APTD) | £2.83 | £5.15 | 45% |

| NIOX Group (AIM:NIOX) | £0.616 | £1.10 | 43.8% |

| On the Beach Group (LSE:OTB) | £2.635 | £4.78 | 44.9% |

| Trainline (LSE:TRN) | £2.866 | £5.18 | 44.7% |

| ECO Animal Health Group (AIM:EAH) | £0.72 | £1.28 | 43.6% |

| Kromek Group (AIM:KMK) | £0.051 | £0.10 | 49.6% |

| Ibstock (LSE:IBST) | £1.774 | £3.24 | 45.3% |

| CVS Group (AIM:CVSG) | £10.34 | £18.55 | 44.3% |

Let's dive into some prime choices out of the screener.

CVS Group (AIM:CVSG)

Overview: CVS Group plc operates in the veterinary, pet crematoria, online pharmacy, and retail sectors, with a market cap of £741.79 million.

Operations: The company generates revenue from several segments, including Veterinary Practices (£600.50 million), Online Retail Business (£48.50 million), Laboratories (£30.90 million), and Crematoria (£12.20 million).

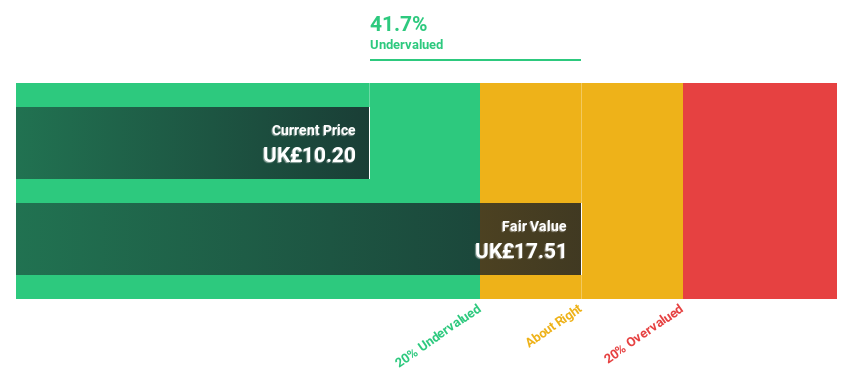

Estimated Discount To Fair Value: 44.3%

CVS Group is trading at £10.34, significantly below its estimated fair value of £18.55, suggesting undervaluation based on discounted cash flow analysis. While earnings are forecast to grow at 21.24% annually, outpacing the UK market's growth rate, revenue growth is slower at 5.4%. Recent financials show a decline in net income and profit margins compared to last year, with interest payments not well covered by earnings, indicating some financial challenges despite expected profit growth.

- Our growth report here indicates CVS Group may be poised for an improving outlook.

- Navigate through the intricacies of CVS Group with our comprehensive financial health report here.

Genus (LSE:GNS)

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of approximately £1.05 billion.

Operations: The company's revenue is primarily derived from its Genus ABS segment, which includes operations in Asia and generates £311.10 million, and the Genus PIC segment, also including Asian operations, contributing £358 million.

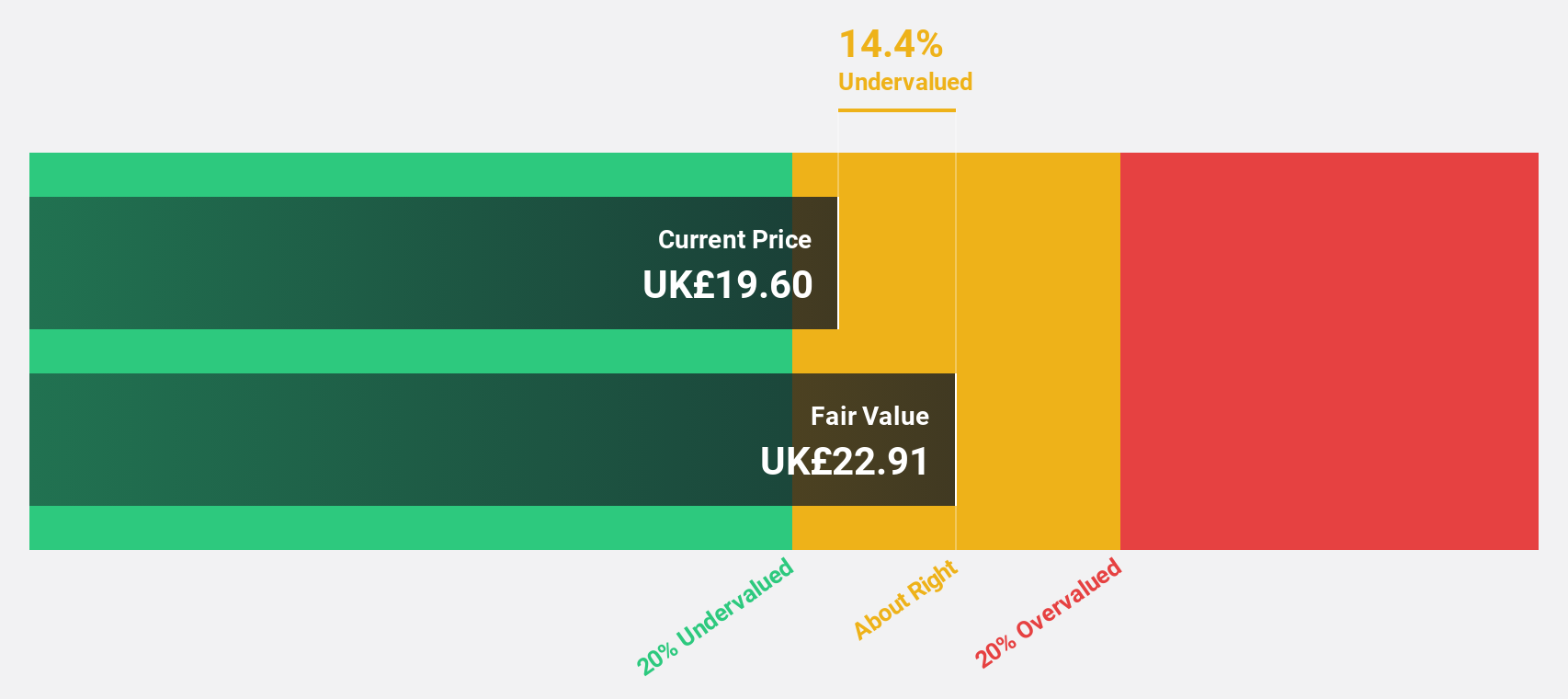

Estimated Discount To Fair Value: 20.8%

Genus is trading at £16.04, over 20% below its estimated fair value of £20.25, highlighting potential undervaluation based on discounted cash flow analysis. Despite recent earnings showing a drop in net income to £1.5 million from £10.3 million last year, Genus's earnings are forecast to grow significantly at 46.67% annually over the next three years, with revenue growth slightly above the UK market average, suggesting robust future cash flow improvements amidst executive transitions.

- Insights from our recent growth report point to a promising forecast for Genus' business outlook.

- Click here to discover the nuances of Genus with our detailed financial health report.

W.A.G payment solutions (LSE:WPS)

Overview: W.A.G payment solutions plc operates an integrated payments and mobility platform targeting the commercial road transportation industry in Europe, with a market cap of £412.66 million.

Operations: The company's revenue is primarily derived from its Payment Solutions segment, accounting for €2.11 billion, with additional income from Mobility Solutions totaling €125.57 million.

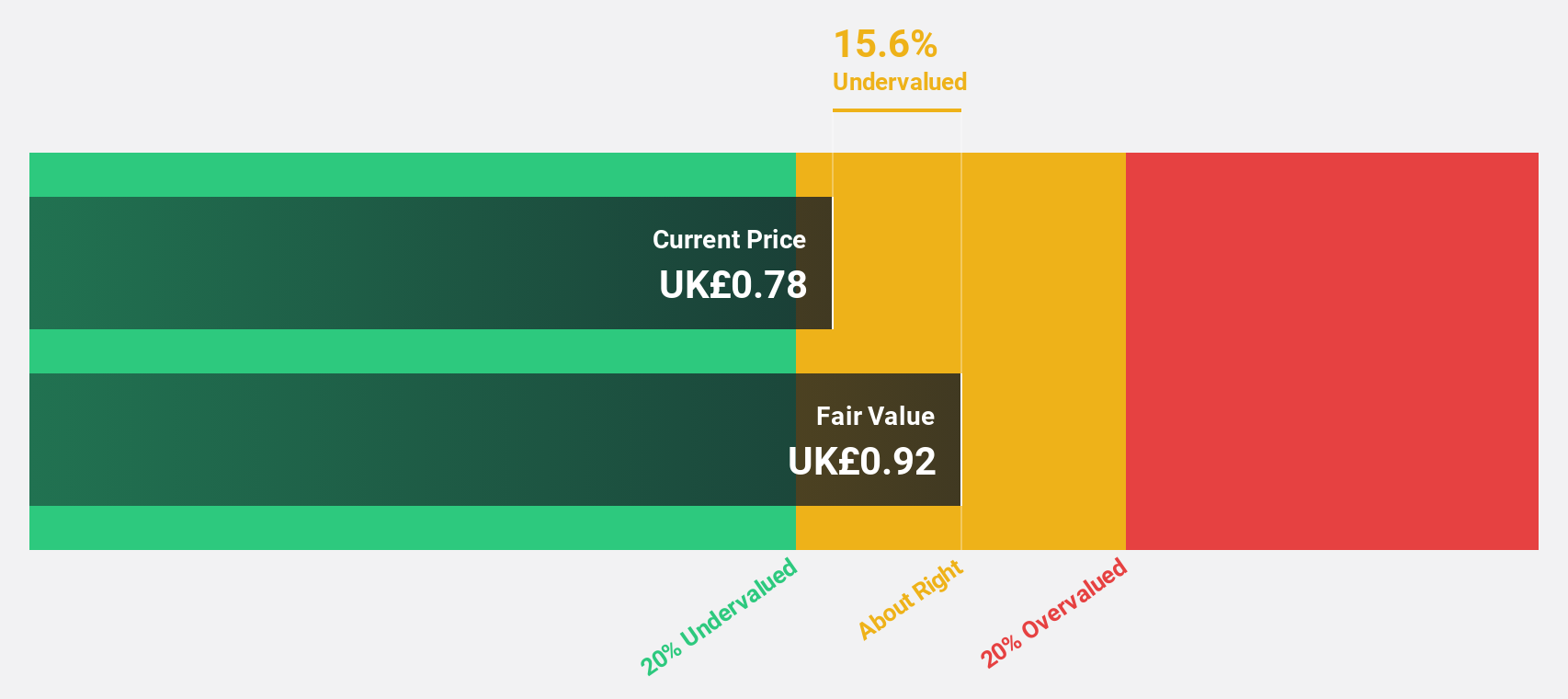

Estimated Discount To Fair Value: 36%

W.A.G payment solutions is trading at £0.6, significantly below its estimated fair value of £0.93, indicating undervaluation based on discounted cash flow analysis. Despite a forecasted 65.4% annual decline in revenue over the next three years, earnings are expected to grow substantially at 35.37% annually, outpacing the UK market's average growth rate of 13.7%. Recent guidance anticipates low-teen net revenue growth for 2025 alongside a proposed special dividend of 3 pence per share.

- In light of our recent growth report, it seems possible that W.A.G payment solutions' financial performance will exceed current levels.

- Dive into the specifics of W.A.G payment solutions here with our thorough financial health report.

Taking Advantage

- Investigate our full lineup of 52 Undervalued UK Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CVSG

CVS Group

Engages in veterinary, online pharmacy, and retail businesses in the United Kingdom and Australia.

Fair value with moderate growth potential.

Market Insights

Community Narratives