- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

The five-year shareholder returns and company earnings persist lower as Craneware (LON:CRW) stock falls a further 9.4% in past week

Over the last month the Craneware plc (LON:CRW) has been much stronger than before, rebounding by 32%. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 23% in that time, significantly under-performing the market.

After losing 9.4% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Craneware

SWOT Analysis for Craneware

- Debt is not viewed as a risk.

- Earnings declined over the past year.

- Dividend is low compared to the top 25% of dividend payers in the Healthcare Services market.

- Expensive based on P/E ratio and estimated fair value.

- Annual earnings are forecast to grow faster than the British market.

- Significant insider buying over the past 3 months.

- Dividends are not covered by earnings.

- Revenue is forecast to grow slower than 20% per year.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

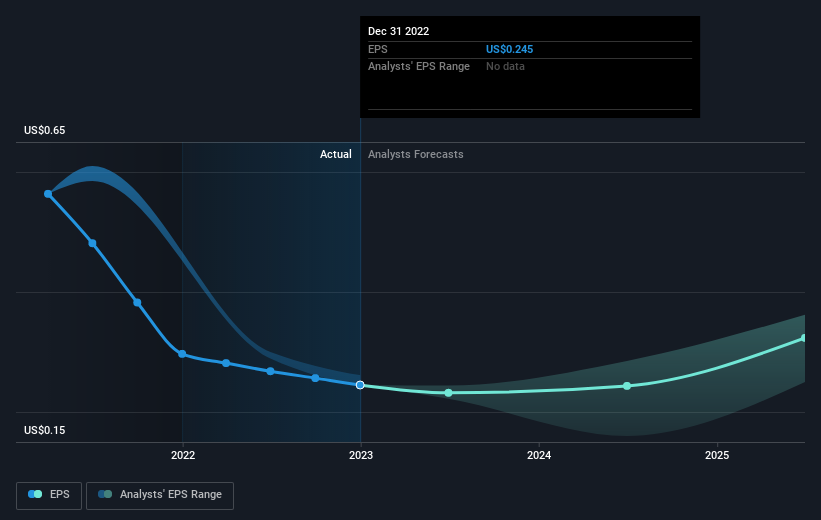

Looking back five years, both Craneware's share price and EPS declined; the latter at a rate of 15% per year. The share price decline of 5% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve. The high P/E ratio of 72.67 suggests that shareholders believe earnings will grow in the years ahead.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Craneware's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Craneware the TSR over the last 5 years was -18%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Craneware shareholders have received a total shareholder return of 9.3% over the last year. And that does include the dividend. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Craneware , and understanding them should be part of your investment process.

Craneware is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives