- United Kingdom

- /

- Machinery

- /

- AIM:JDG

3 UK Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The London markets have recently faced downward pressure, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting ongoing global economic challenges. In such a volatile environment, identifying growth companies with high insider ownership can be particularly advantageous, as this often signals strong confidence in the company's future prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 33.5% |

| Plant Health Care (AIM:PHC) | 34.4% | 121.3% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 27.9% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Velocity Composites (AIM:VEL) | 27.6% | 173.3% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.2% |

| Hochschild Mining (LSE:HOC) | 38.4% | 53.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £835.39 million, develops, licenses, and supports computer software for the healthcare industry in the United States through its subsidiaries.

Operations: The company's revenue segment includes $180.56 million from healthcare software.

Insider Ownership: 17%

Earnings Growth Forecast: 29.4% p.a.

Craneware, a UK-based healthcare software company, shows promising growth potential with forecasted annual earnings growth of 29.4%, significantly outpacing the UK market average. The recent collaboration with Microsoft Azure aims to enhance its Trisus Platform's capabilities and market reach, leveraging advanced AI and data analytics. Despite modest revenue growth projections at 6.7% annually, the company's strong insider ownership aligns management interests with shareholder value creation.

- Dive into the specifics of Craneware here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Craneware's current price could be inflated.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments and has a market cap of £670.77 million.

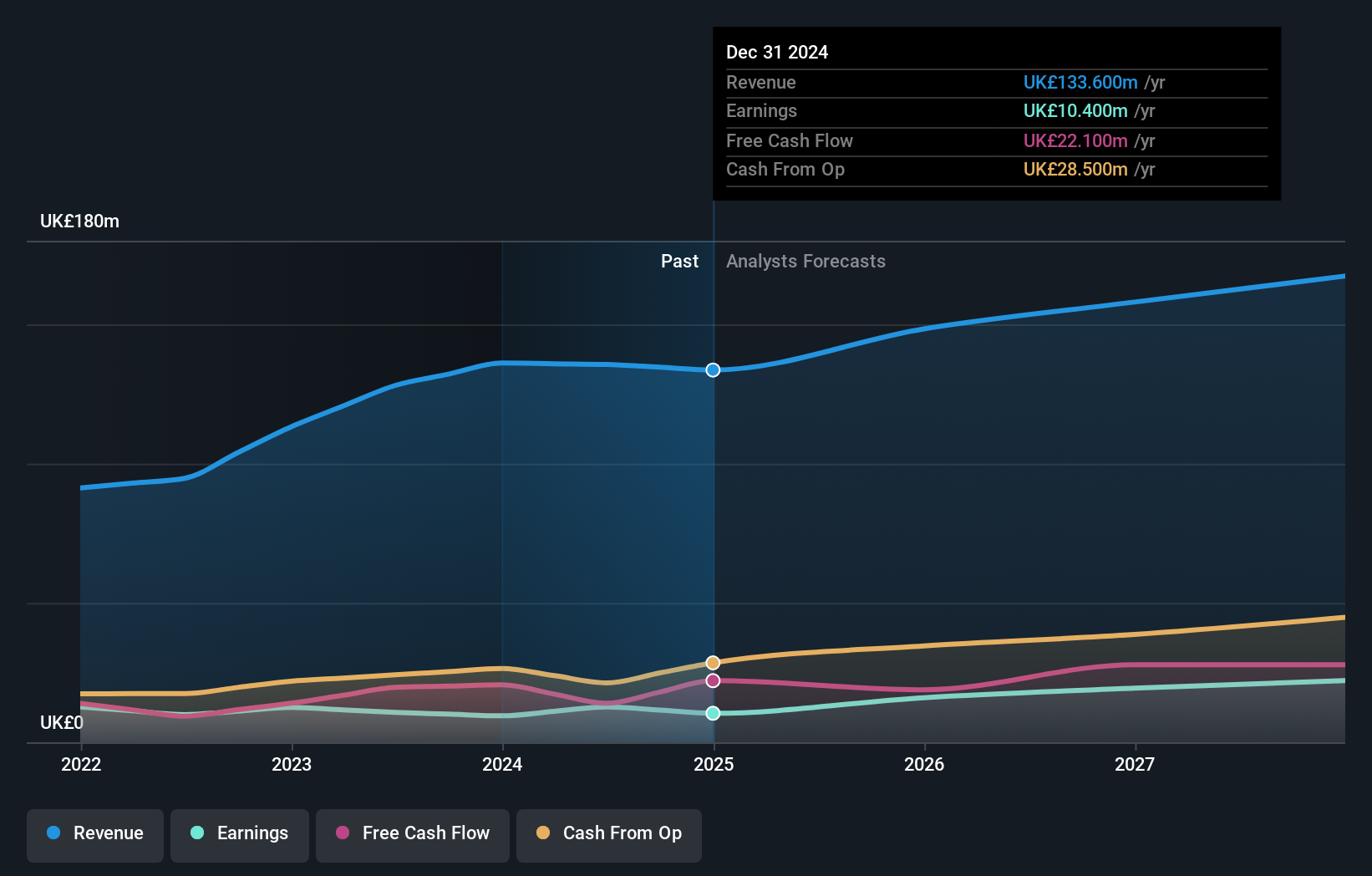

Operations: Judges Scientific plc generates revenue from two main segments: Vacuum (£63.60 million) and Materials Sciences (£72.50 million).

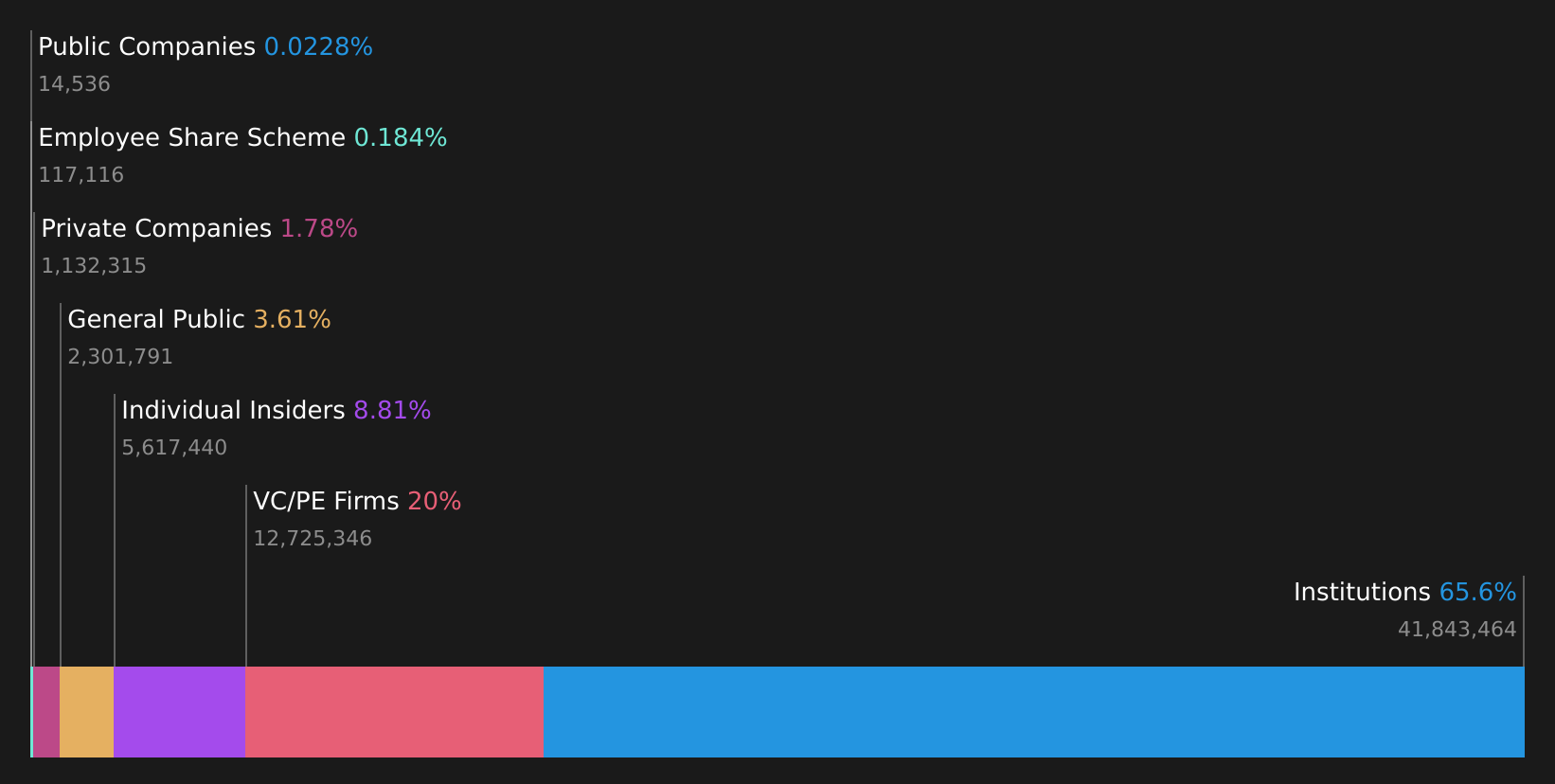

Insider Ownership: 11.9%

Earnings Growth Forecast: 26.2% p.a.

Judges Scientific, a UK-based scientific instrument manufacturer, exhibits strong growth potential with forecasted annual earnings growth of 26.2%, surpassing the UK market average. Despite recent insider selling and a highly volatile share price, the company maintains substantial insider ownership. Recent bylaw changes and dividend increases reflect strategic adjustments and shareholder value focus. Although profit margins have declined from 11% to 7%, revenue is expected to grow faster than the overall market at 4.1% annually.

- Take a closer look at Judges Scientific's potential here in our earnings growth report.

- The analysis detailed in our Judges Scientific valuation report hints at an inflated share price compared to its estimated value.

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC manages and leases residential real estate properties in the United Kingdom with a market cap of £288.58 million.

Operations: The company generates revenue through two main segments: Financial Services (£1.50 million) and Property Franchising (£25.78 million).

Insider Ownership: 13.5%

Earnings Growth Forecast: 36.7% p.a.

Property Franchise Group, a UK-based property services company, demonstrates strong growth potential with forecasted annual revenue growth of 44.7% and earnings growth of 36.7%, both significantly outpacing the market. Despite trading at 60.3% below its estimated fair value and having a history of profit growth (20.6% per year over the past five years), shareholders have faced substantial dilution recently. The upcoming retirement of CFO David Raggett may introduce transitional challenges but allows ample time for succession planning.

- Click here to discover the nuances of Property Franchise Group with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Property Franchise Group's share price might be too optimistic.

Key Takeaways

- Reveal the 66 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JDG

Judges Scientific

Designs, manufactures, and sells scientific instruments.

High growth potential with proven track record and pays a dividend.