- United Kingdom

- /

- Food

- /

- LSE:TATE

Tate & Lyle (LSE:TATE) sees earnings growth potential with new Manus alliance and dividend increase

Reviewed by Simply Wall St

Tate & Lyle (LSE:TATE) recently confirmed its unchanged outlook for the fiscal year ending March 2025, anticipating EBITDA growth of 4% to 7% despite a slight dip in constant currency revenue. The company has also increased its interim dividend to 6.4 pence per share, reflecting a commitment to shareholder returns. Key areas covered in the company report include strategic alliances, earnings performance, and future growth prospects amidst ongoing M&A discussions.

Navigate through the intricacies of Tate & Lyle with our comprehensive report here.

Competitive Advantages That Elevate Tate & Lyle

With an earnings forecast of 16.62% per year, Tate & Lyle demonstrates a strong growth trajectory that surpasses the UK market average. The company's financial health is underscored by its cash reserves exceeding total debt, ensuring stability and flexibility in operations. Recent strategic alliances, such as the partnership with Manus to introduce stevia Reb M, highlight its commitment to innovation and market expansion. This collaboration enhances supply chain security and positions the company as a leader in natural sweetener solutions. Furthermore, the interim dividend increase to 6.4 pence per share reflects a commitment to shareholder returns, supported by a solid payout ratio of 49.1%.

Challenges Constraining Tate & Lyle's Potential

Tate & Lyle faces challenges, including a 7.9% earnings decline over the past five years, which contrasts with its positive growth outlook. The company's return on equity stands at 13%, below the industry benchmark, indicating room for improvement in capital efficiency. Additionally, the volatility of dividend payments over the past decade may affect investor confidence. The current Price-To-Earnings Ratio of 18.5x, higher than the industry average, suggests that the market may already price in some of the expected growth, impacting perceived value.

Future Prospects for Tate & Lyle in the Market

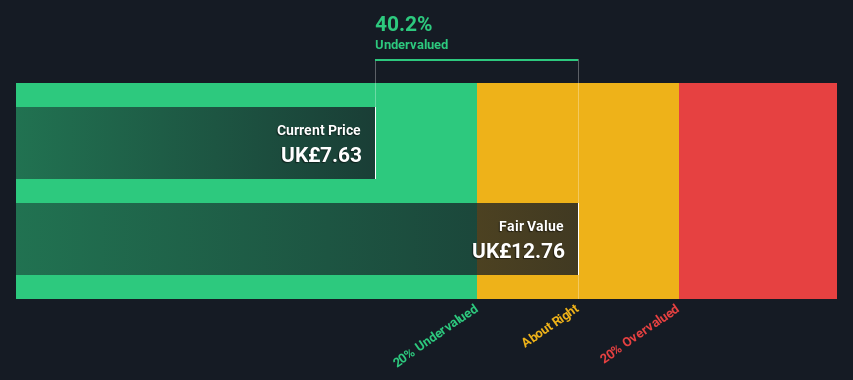

Opportunities abound as the company explores new geographical markets, aiming to tap into emerging demand. The focus on technological investments, particularly in AI and automation, is set to enhance operational efficiency and product development, driving future growth. Trading at £7.68, significantly below its estimated fair value of £12.76, suggests potential for price appreciation, aligning with its strategic goals. The recent earnings call emphasized strong customer relationships, which are pivotal for sustained growth and market presence.

Market Volatility Affecting Tate & Lyle's Position

External factors such as economic headwinds and regulatory challenges pose threats to the company's stability. The management's proactive stance in monitoring economic indicators and navigating complex regulatory environments is crucial for mitigating these risks. Supply chain vulnerabilities remain a concern, yet the strategic partnership with Manus aims to bolster reliability and continuity. The ongoing M&A discussions, including potential takeover bids, add another layer of uncertainty, which could impact market perception and operational focus.

Conclusion

Tate & Lyle's earnings forecast of 16.62% per year, coupled with its solid financial health, positions the company for significant growth, particularly as it expands its market presence through strategic alliances like the one with Manus. However, challenges such as past earnings declines and a return on equity below industry benchmarks suggest areas for improvement, particularly in capital efficiency. Despite these hurdles, the company's focus on technological advancements and new market opportunities, alongside trading at £7.68—well below its estimated fair value of £12.76—indicates potential for price appreciation. This suggests that the market may not fully recognize the company's growth potential, offering a compelling opportunity for investors willing to navigate the associated risks.

Make It Happen

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Tate & Lyle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:TATE

Tate & Lyle

Engages in the provision of ingredients and solutions to the food, beverage, and other industries in North America, Asia, Middle East, Africa, Latin America, and Europe.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives