- United Kingdom

- /

- Beverage

- /

- LSE:DGE

Assessing Diageo’s Value After 9.5% Price Jump and Recent Profit Growth

Reviewed by Simply Wall St

If you are sitting there wondering whether to stick with Diageo stock, trim your position, or maybe even buy into the recent dip, you are definitely not alone. Making the right move in today's market often comes down to understanding what has actually changed, both beneath the surface and in trading activity. Over the past month, Diageo shares are up nearly 9.5% after a period of underperformance that saw the stock lose around 16.9% year to date. Longer-term returns show a mixed picture as well, ranging from a rough patch over the last three years to more muted five-year results.

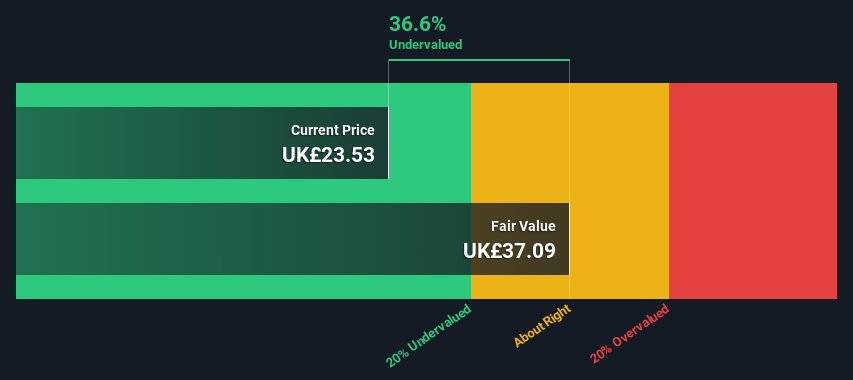

Some of this volatility can be traced back to recent market turbulence in consumer goods and changing sentiment around global demand, with investors sometimes pivoting quickly between defensive and risk-seeking plays as the economic outlook shifts. Diageo’s latest annual numbers showed revenue up modestly and net income jumping more than 12%. This suggests the business still has some levers to pull. In addition, the current share price remains at a roughly 10% discount to analyst targets, and an almost 19.3% discount to certain intrinsic valuation models.

Looking at the bigger picture, Diageo earns a valuation score of 3 out of 6 on the most popular undervaluation checks. This means it ranks well in half the areas analysts examine for hidden value, while showing room to improve elsewhere. Now, let’s break down which valuation methods matter most when evaluating Diageo, before exploring a more effective way to consider whether the stock is truly a bargain right now.

Diageo delivered -12.6% returns over the last year. See how this stacks up to the rest of the Beverage industry.Approach 1: Diageo Cash Flows

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s money. This calculation helps investors see beyond short-term noise and focus on what the business could actually be worth in the future.

Currently, Diageo generates Free Cash Flow of approximately $2.79 billion, a solid base that analysts expect to keep growing. According to forecasts, Free Cash Flow could reach about $4.00 billion by 2035, with steady increases each year reflecting both analyst consensus and expected operational improvements.

Based on these projections, the DCF model estimates Diageo’s intrinsic value at £26.21 per share. At current trading levels, the stock shows a 19.3% undervaluation compared to this fair value estimate. This suggests that, on pure cash flow grounds, Diageo is priced attractively relative to long-term expectations according to this widely followed method.

Result: UNDERVALUED

Approach 2: Diageo Price vs Earnings

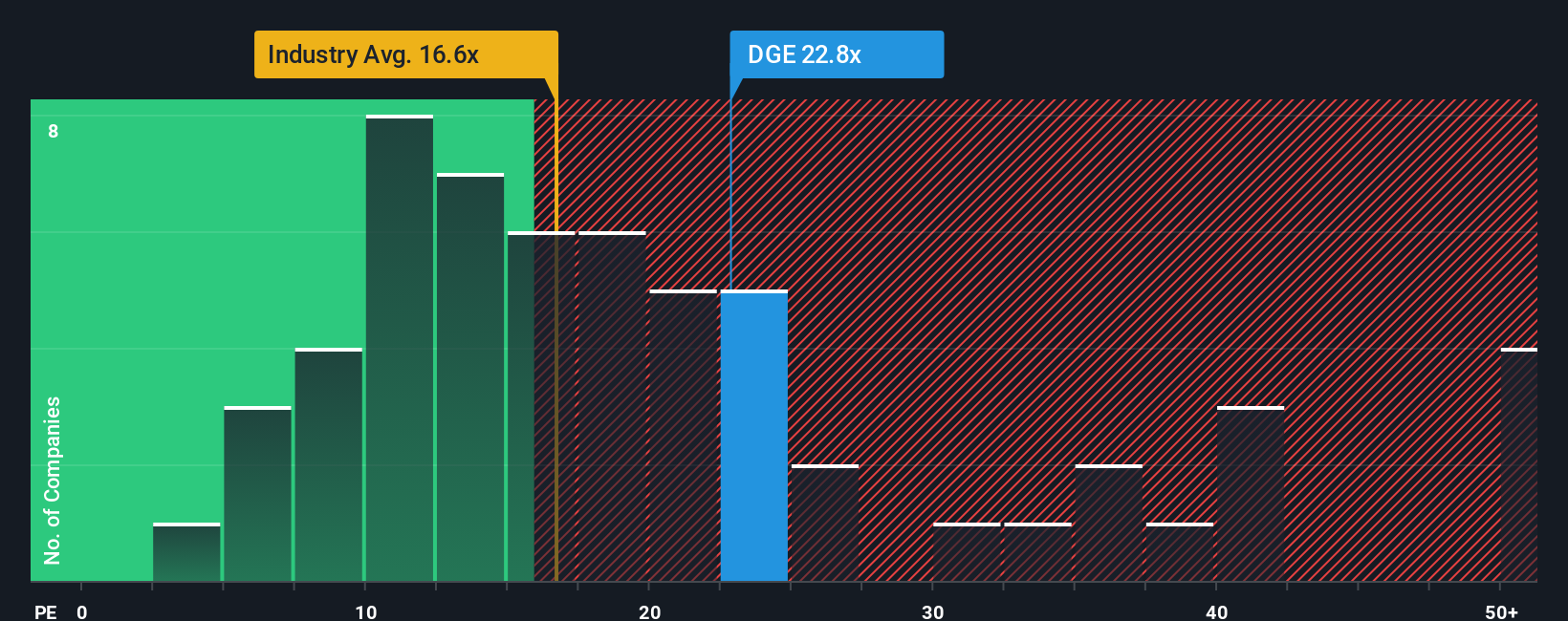

The Price-to-Earnings (PE) ratio is one of the most popular ways to value profitable companies like Diageo. It helps investors quickly gauge how much the market is willing to pay today for a pound of the company’s current earnings. For established industry leaders with a track record of stable profit growth, PE can be a practical starting point for making "apples-to-apples" comparisons against industry peers and the market overall.

Higher growth expectations generally justify higher PE ratios. Companies facing more risks or slower growth tend to trade at lower multiples. For Diageo, the current PE ratio sits at 26.8x, which is slightly lower than the peer group’s average of 28.5x, but well above the industry average of 18.2x. This suggests the market is willing to pay a premium for Diageo’s brand strength and stability compared to most competitors.

Simply Wall St’s proprietary Fair Ratio for Diageo is calculated at 31.3x. This figure takes into account a variety of company-specific factors including projected earnings growth, profitability, and sector trends, giving a nuanced picture of what a "justified" PE might look like in today’s market.

Because the Fair Ratio is meaningfully higher than Diageo’s current PE, this suggests that the stock is undervalued according to this metric, offering room for the multiple to expand if fundamentals remain strong.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Diageo Narrative

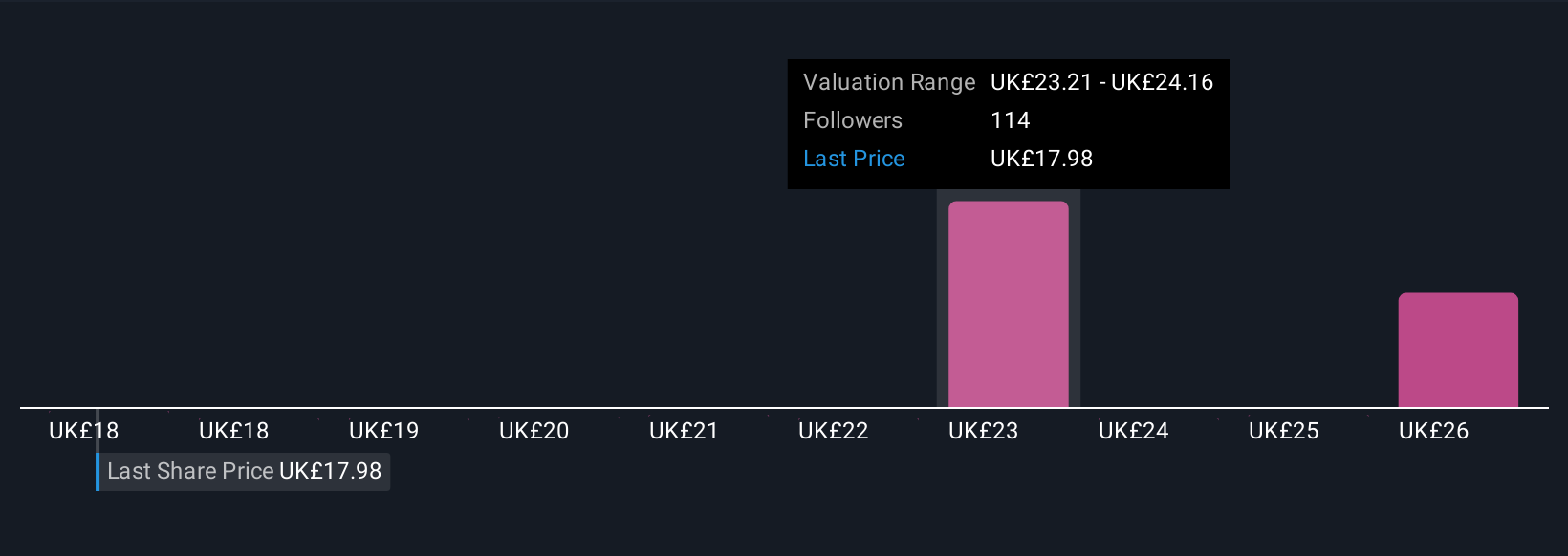

Beyond the numbers, a Narrative represents your unique perspective on a company’s future by connecting its story to your assumptions about revenue, earnings, and margins, tying it all together into an estimated fair value.

Simply put, Narratives allow you to ask, "What do I believe about Diageo’s next chapter, and how does that shape what I think the stock is worth?" On the Simply Wall St platform, you can easily create these Narratives and compare yours with millions of other investors. This makes it a practical and accessible tool for both new and experienced users.

Narratives help guide decision making: you see the Fair Value that your story produces, then compare it to the current Price to decide if it’s time to buy, sell, or wait. Narratives are refreshed whenever the company reports earnings or news breaks, so your view stays up-to-date automatically.

For example, when it comes to Diageo, some investors might use aggressive growth and margin forecasts and arrive at a fair value over £27.08 per share, while others take a more cautious stance and calculate just £17.04. This shows how powerful and personal Narratives can be for shaping your own investment view.

Do you think there's more to the story for Diageo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DGE

Diageo

Engages in the production, marketing, and distribution of alcoholic beverages in North America, Europe, the Asia Pacific, Latin America and Caribbean, and Africa.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives