- United Kingdom

- /

- Food

- /

- LSE:ABF

Investors Aren't Entirely Convinced By Associated British Foods plc's (LON:ABF) Earnings

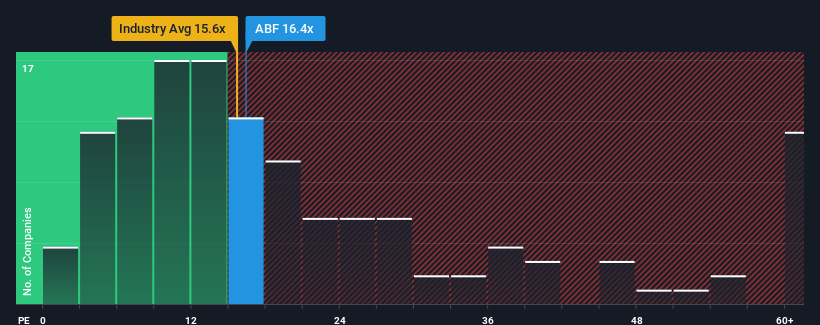

There wouldn't be many who think Associated British Foods plc's (LON:ABF) price-to-earnings (or "P/E") ratio of 16.4x is worth a mention when the median P/E in the United Kingdom is similar at about 15x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for Associated British Foods as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Associated British Foods

Is There Some Growth For Associated British Foods?

The only time you'd be comfortable seeing a P/E like Associated British Foods' is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 51%. Pleasingly, EPS has also lifted 141% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 16% per year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 12% per year growth forecast for the broader market.

With this information, we find it interesting that Associated British Foods is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Associated British Foods' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Associated British Foods with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Associated British Foods, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ABF

Associated British Foods

Operates as a diversified food, ingredients, and retail company worldwide.

Flawless balance sheet, undervalued and pays a dividend.