- United Kingdom

- /

- Beverage

- /

- AIM:FEVR

3 UK Stocks Estimated To Be Trading At Up To 44.5% Below Intrinsic Value

Reviewed by Simply Wall St

The UK market has been experiencing turbulence, with the FTSE 100 closing lower due to weak trade data from China and ongoing global economic concerns. In such uncertain times, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victorian Plumbing Group (AIM:VIC) | £0.992 | £1.87 | 47% |

| GlobalData (AIM:DATA) | £2.105 | £4.10 | 48.7% |

| Topps Tiles (LSE:TPT) | £0.469 | £0.91 | 48.5% |

| Victrex (LSE:VCT) | £9.46 | £17.35 | 45.5% |

| Redcentric (AIM:RCN) | £1.2975 | £2.46 | 47.3% |

| Velocity Composites (AIM:VEL) | £0.43 | £0.83 | 48% |

| Foxtons Group (LSE:FOXT) | £0.63 | £1.20 | 47.7% |

| BATM Advanced Communications (LSE:BVC) | £0.20425 | £0.37 | 45.5% |

| SysGroup (AIM:SYS) | £0.345 | £0.64 | 46.5% |

| Gulf Keystone Petroleum (LSE:GKP) | £1.135 | £2.11 | 46.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Fevertree Drinks (AIM:FEVR)

Overview: Fevertree Drinks PLC, with a market cap of £1.01 billion, develops and sells premium mixer drinks in the United Kingdom, the United States, Europe, and internationally.

Operations: The company generates £364.40 million in revenue from its non-alcoholic beverages segment.

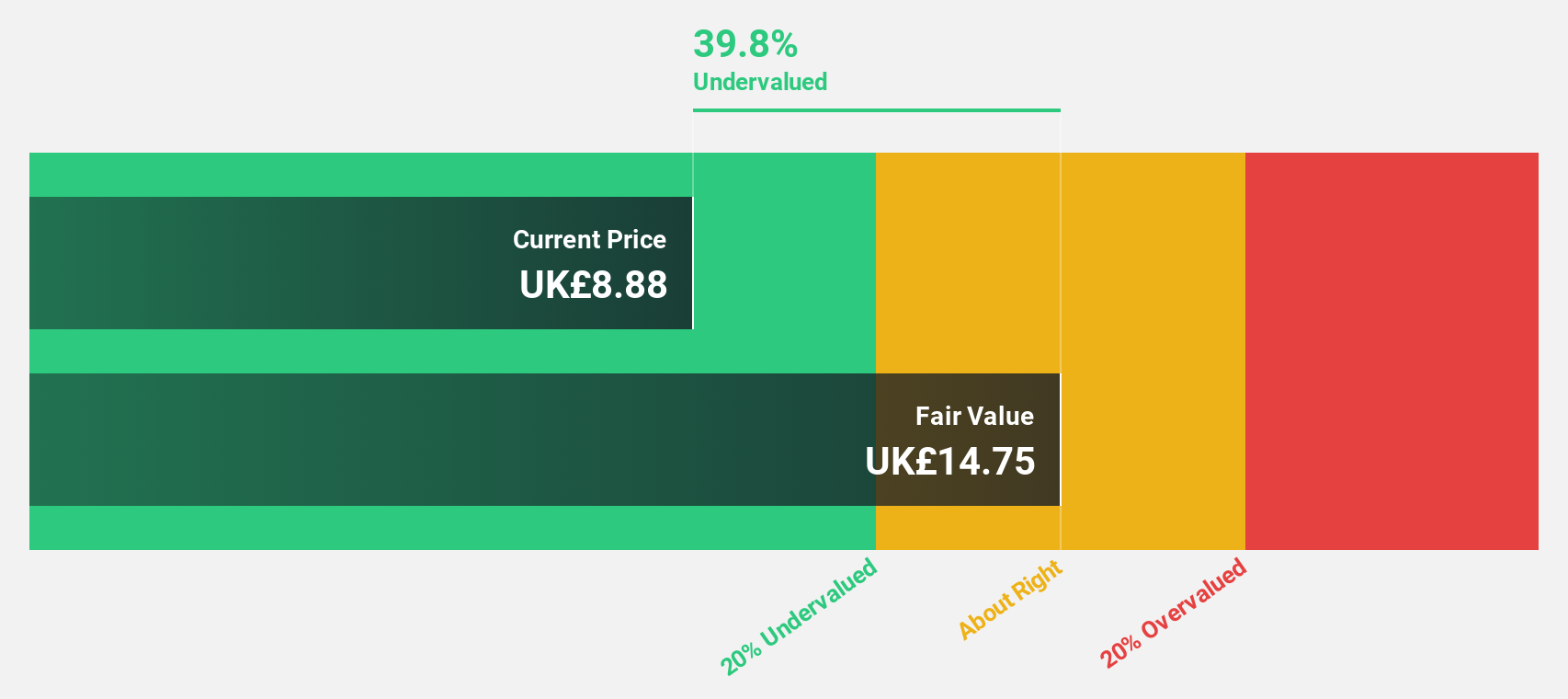

Estimated Discount To Fair Value: 42.4%

Fevertree Drinks is trading at £8.63, significantly below its estimated fair value of £14.97, indicating it may be undervalued based on discounted cash flows. Despite a decline in profit margins from 7.2% to 4.2%, earnings are forecast to grow at 34.3% per year, outpacing the UK market's growth rate of 14.4%. Revenue is also expected to grow faster than the market at 7% per year, making Fevertree a compelling option among undervalued stocks in the UK based on cash flows.

- Upon reviewing our latest growth report, Fevertree Drinks' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Fevertree Drinks with our comprehensive financial health report here.

Genel Energy (LSE:GENL)

Overview: Genel Energy plc, with a market cap of £205.67 million, operates as an independent oil and gas exploration and production company through its subsidiaries.

Operations: Revenue from production amounts to $74.40 million.

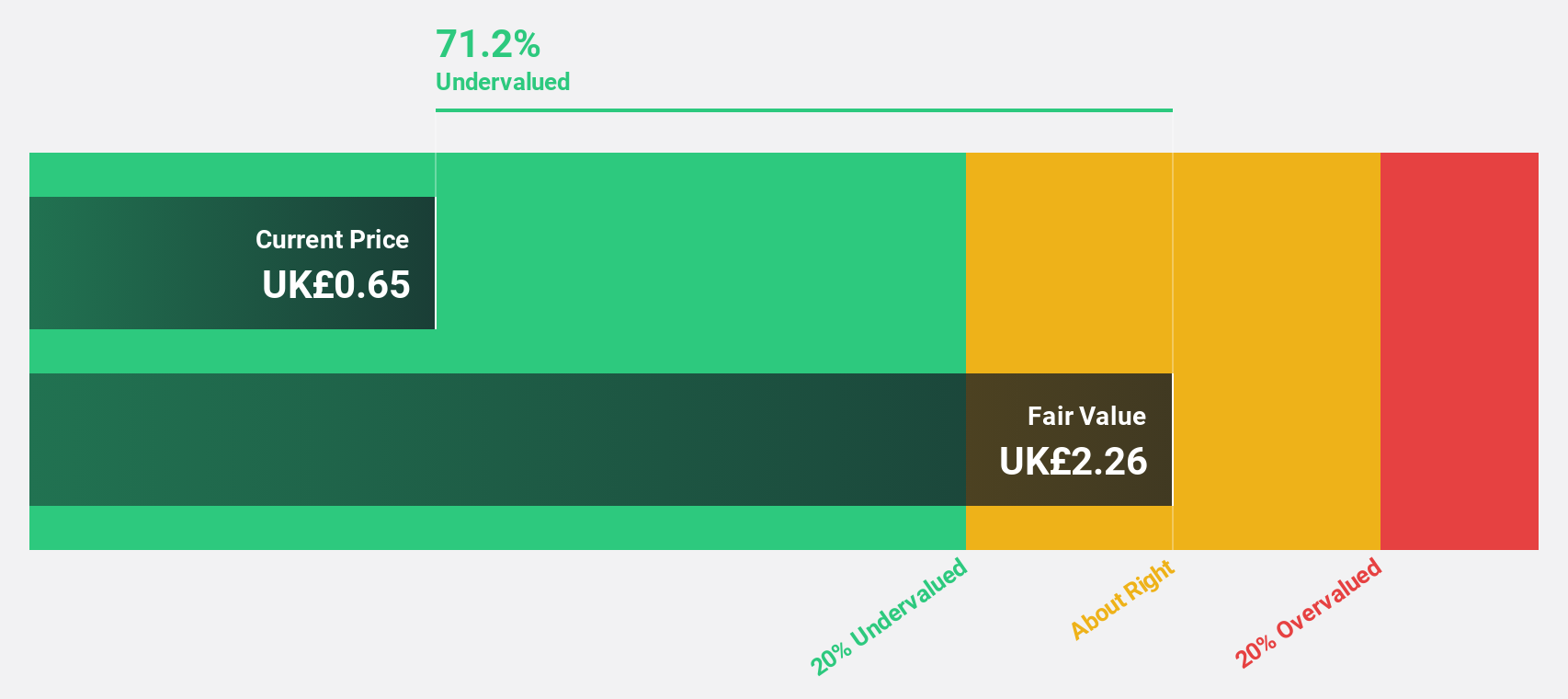

Estimated Discount To Fair Value: 44.5%

Genel Energy is trading at £0.74, significantly below its estimated fair value of £1.34, making it highly undervalued based on discounted cash flows. Despite reporting a net loss of US$21.9 million for H1 2024, the company’s revenue is forecast to grow at 13.4% per year, outpacing the UK market's growth rate of 3.7%. Recent executive changes and strong production results further support its potential for future profitability and robust cash flow generation.

- The analysis detailed in our Genel Energy growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Genel Energy.

Sage Group (LSE:SGE)

Overview: The Sage Group plc, with a market cap of £9.95 billion, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally.

Operations: Sage Group's revenue segments include £595 million from Europe, £1.01 billion from North America, and £488 million from the United Kingdom & Ireland.

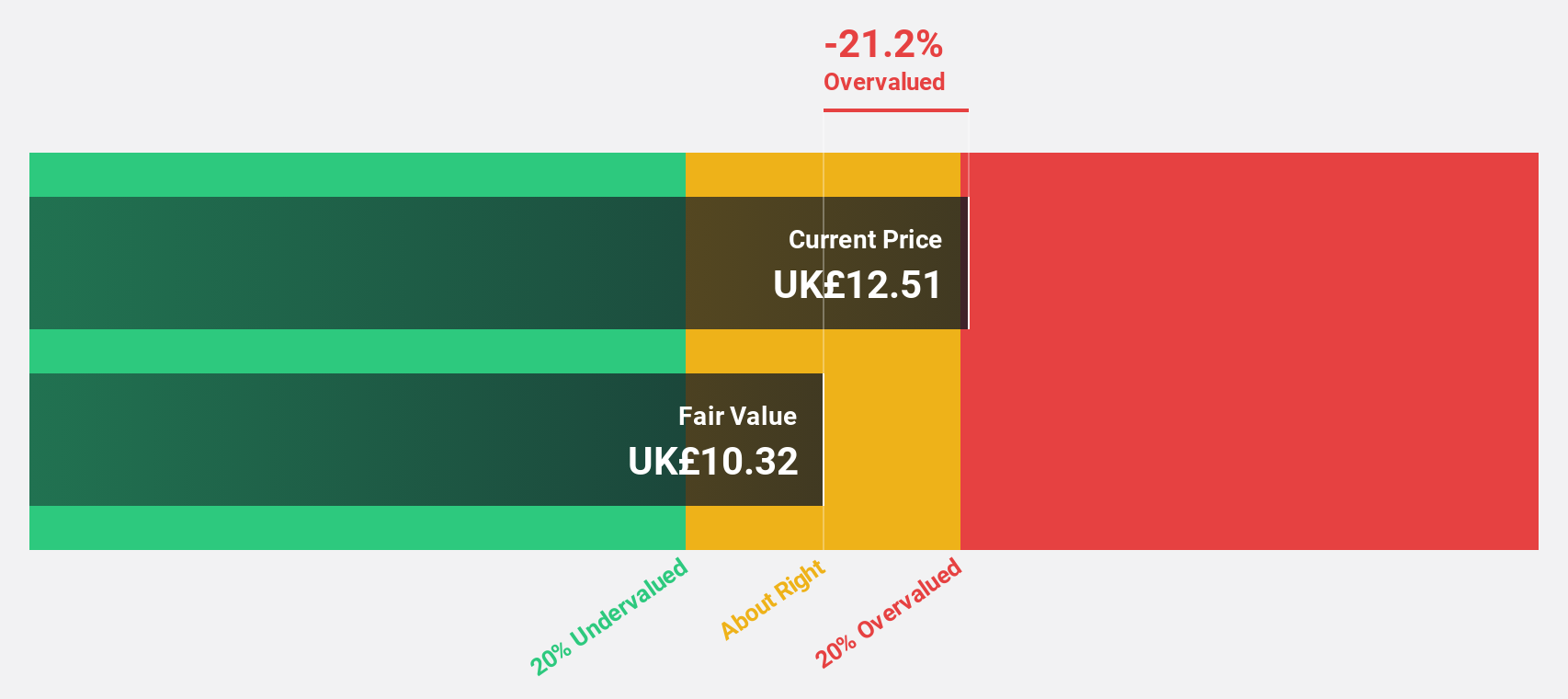

Estimated Discount To Fair Value: 24.4%

Sage Group, trading at £9.97, is significantly undervalued relative to its estimated fair value of £13.19 based on discounted cash flows. The company’s earnings grew by 28.4% over the past year and are forecast to grow at 15.1% annually, outpacing the UK market's growth rate of 14.4%. Despite a high level of debt and recent insider selling, Sage's robust revenue growth and strategic partnerships like VoPay enhance its financial position and operational efficiency.

- Insights from our recent growth report point to a promising forecast for Sage Group's business outlook.

- Unlock comprehensive insights into our analysis of Sage Group stock in this financial health report.

Next Steps

- Delve into our full catalog of 50 Undervalued UK Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FEVR

Fevertree Drinks

Engages in the development and sale of mixer drinks in the United Kingdom, the United States, Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives