- United Kingdom

- /

- Personal Products

- /

- AIM:BAR

UK Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index faltering due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, investors often look to penny stocks for their unique potential. Although the term 'penny stocks' might seem outdated, these smaller or newer companies can still offer significant opportunities when they are backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £808.27M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.92 | £148.21M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.25 | £81.05M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £40.03M | ★★★★★★ |

| Union Jack Oil (AIM:UJO) | £0.1075 | £11.72M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.646 | £2.07B | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.44 | £184.02M | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ADVFN (AIM:AFN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ADVFN Plc, along with its subsidiaries, develops and provides financial information and research services online in the UK and internationally, with a market cap of £6.02 million.

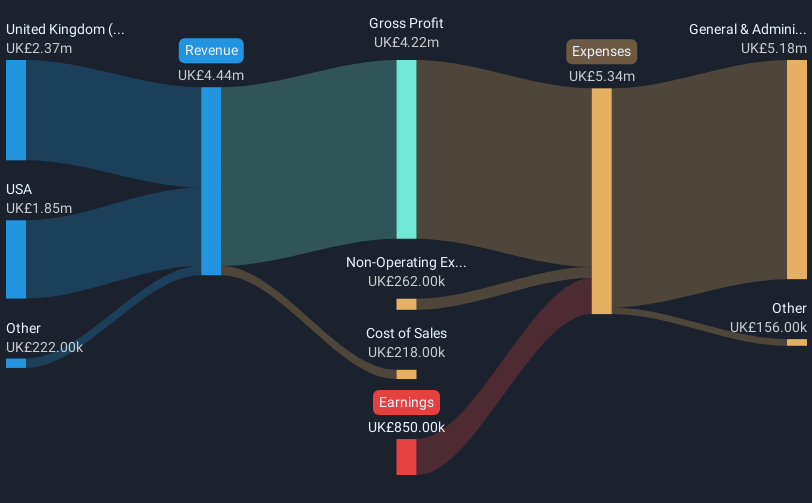

Operations: The company generates revenue of £4.44 million from offering financial information services.

Market Cap: £6.02M

ADVFN Plc, with a market cap of £6.02 million, reported revenue of £4.44 million for the year ending June 2024, but remains unprofitable with a net loss of £0.918 million. Despite high share price volatility and negative return on equity at -23.1%, the company maintains sufficient cash runway for over a year and covers both short-term liabilities (£1.4M) and long-term liabilities (£9K) with its short-term assets (£4.7M). Recent changes include the resignation of non-executive director Anthony Wollenberg in January 2025, highlighting ongoing shifts within its relatively inexperienced board structure (average tenure 2.8 years).

- Click here to discover the nuances of ADVFN with our detailed analytical financial health report.

- Gain insights into ADVFN's historical outcomes by reviewing our past performance report.

Anpario (AIM:ANP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anpario plc, with a market cap of £84.35 million, produces and distributes natural feed additives for animal health, hygiene, and nutrition through its subsidiaries.

Operations: The company's revenue is primarily generated from its Vitamins & Nutrition Products segment, which accounts for £32.72 million.

Market Cap: £84.35M

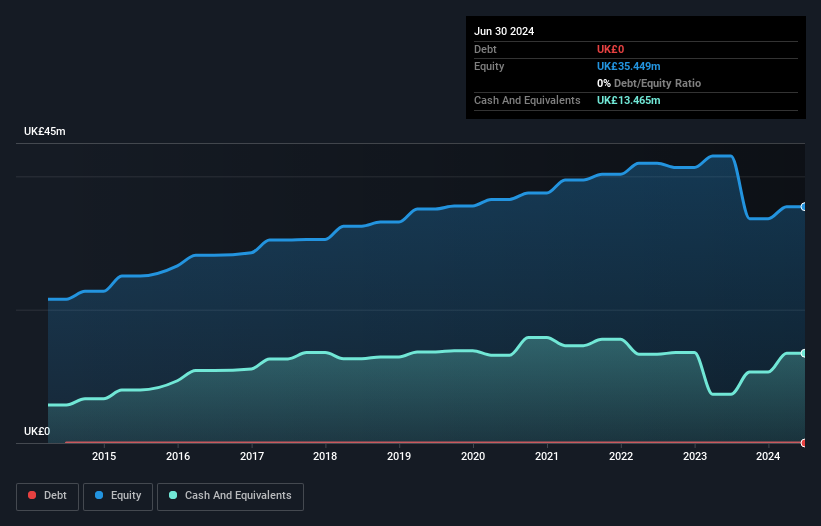

Anpario plc, with a market cap of £84.35 million, has demonstrated stable financial health by remaining debt-free for the past five years and maintaining an experienced management team with an average tenure of 10.6 years. The company's revenue, primarily from its Vitamins & Nutrition Products segment (£32.72 million), is forecasted to grow at 15.21% annually, though past earnings have declined by 7.4% per year over five years despite recent growth of 25.3%. Anpario's short-term assets (£26.1M) comfortably cover both short-term (£4.3M) and long-term liabilities (£2.1M), although it faces challenges with a low return on equity (8.5%).

- Take a closer look at Anpario's potential here in our financial health report.

- Examine Anpario's earnings growth report to understand how analysts expect it to perform.

Brand Architekts Group (AIM:BAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brand Architekts Group plc operates in the beauty sector across the United Kingdom, other European Union countries, and internationally, with a market cap of £13.16 million.

Operations: The company's revenue is derived from Innovaderma Brands, contributing £3.16 million, and Brand Architekt Brands, which accounts for £13.87 million.

Market Cap: £13.16M

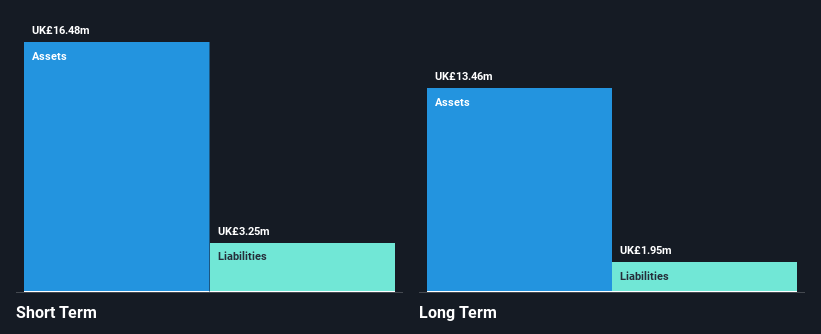

Brand Architekts Group plc, with a market cap of £13.16 million, operates in the beauty sector and is currently unprofitable with a negative return on equity of -5.62%. Despite its financial challenges, the company maintains a strong liquidity position as short-term assets (£16.5M) exceed both short-term (£3.3M) and long-term liabilities (£2.0M). The company is debt-free and has sufficient cash runway for over three years if free cash flow continues to grow at historical rates. Recent developments include an acquisition agreement by Warpaint London PLC valued at £13.4 million, expected to complete by February 2025.

- Jump into the full analysis health report here for a deeper understanding of Brand Architekts Group.

- Assess Brand Architekts Group's previous results with our detailed historical performance reports.

Summing It All Up

- Investigate our full lineup of 444 UK Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brand Architekts Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BAR

Brand Architekts Group

Operates in the beauty sector in the United Kingdom, other European Union countries, and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives