- United Kingdom

- /

- Oil and Gas

- /

- LSE:PHAR

Anpario And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK stock market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting ongoing challenges in global economic recovery. Amid these broader market fluctuations, investors often seek opportunities that offer both potential growth and affordability. Penny stocks, while sometimes seen as a relic of past market eras, continue to attract attention for their unique blend of value and growth potential when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.935 | £391.36M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.11 | £470.86M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.47 | £315.6M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.38M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Anpario (AIM:ANP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anpario plc, with a market cap of £79.73 million, produces and distributes natural feed additives focused on animal health, hygiene, and nutrition through its subsidiaries.

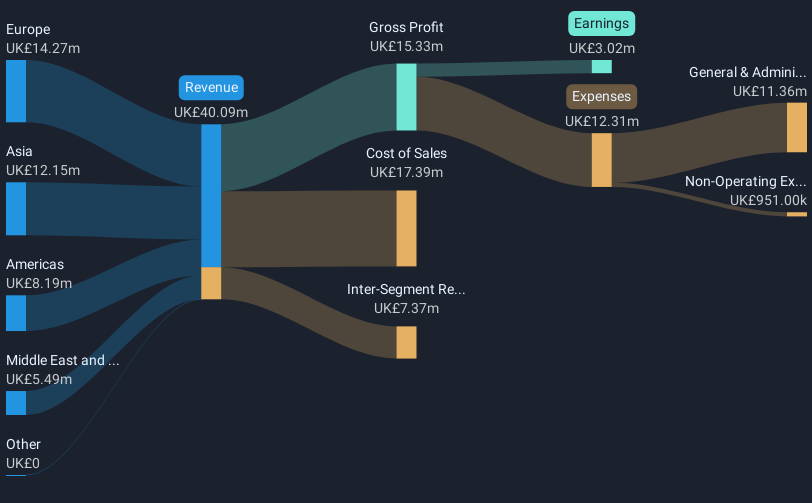

Operations: Anpario's revenue segment includes Vitamins & Nutrition Products, generating £32.72 million.

Market Cap: £79.73M

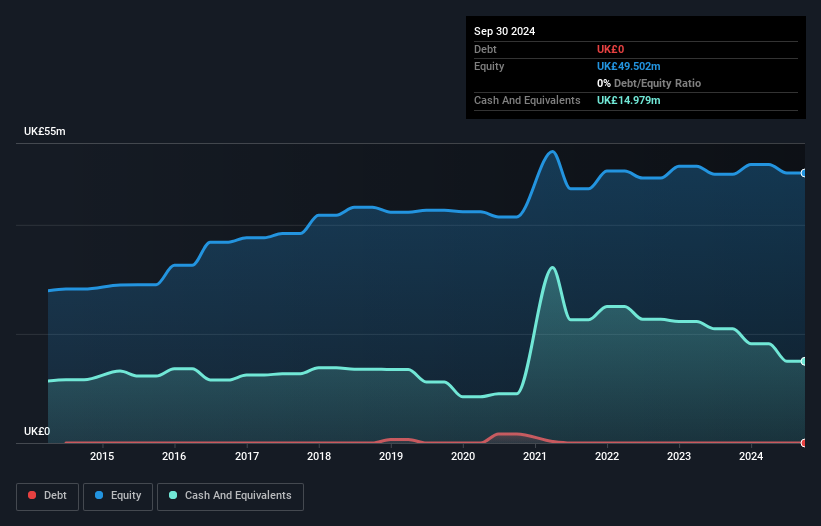

Anpario plc, with a market cap of £79.73 million, demonstrates financial stability by being debt-free for the past five years and maintaining higher net profit margins this year at 9.2% compared to last year's 7.6%. The company's short-term assets of £26.1M comfortably cover both its short-term and long-term liabilities, indicating robust liquidity management. Despite a seasoned management team averaging 10.5 years in tenure, Anpario has seen a decline in earnings over the past five years by 7.4% annually but shows promise with forecasted revenue growth of 17.25% per year amidst an unstable dividend history and low return on equity at 8.5%.

- Click here to discover the nuances of Anpario with our detailed analytical financial health report.

- Understand Anpario's earnings outlook by examining our growth report.

CML Microsystems (AIM:CML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CML Microsystems plc, with a market cap of £46.24 million, designs, manufactures, and markets semiconductor products for the communications industries across the United Kingdom, the Americas, Far East, and internationally.

Operations: The company's revenue is primarily derived from its Semiconductor Components for The Communications Industry segment, which generated £24.85 million.

Market Cap: £46.24M

CML Microsystems plc, with a market cap of £46.24 million, is financially stable, being debt-free and having short-term assets (£26.5M) that exceed both its short-term (£7.0M) and long-term liabilities (£11.5M). The company recently initiated a share buyback program authorized to repurchase up to 14.65% of its issued share capital, indicating confidence in its valuation despite declining net profit margins from 20.8% to 5.2%. While CML reported increased sales for the half year ending September 2024 at £12.53 million, earnings growth has been negative over the past year amidst stable weekly volatility (6%).

- Jump into the full analysis health report here for a deeper understanding of CML Microsystems.

- Gain insights into CML Microsystems' historical outcomes by reviewing our past performance report.

Pharos Energy (LSE:PHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pharos Energy plc is an independent energy company focused on the exploration, development, and production of oil and gas properties in Vietnam, Egypt, and China with a market cap of £100.50 million.

Operations: The company's revenue is derived from its operations in Egypt, generating $19.6 million, and Southeast Asia, contributing $127.4 million.

Market Cap: £100.5M

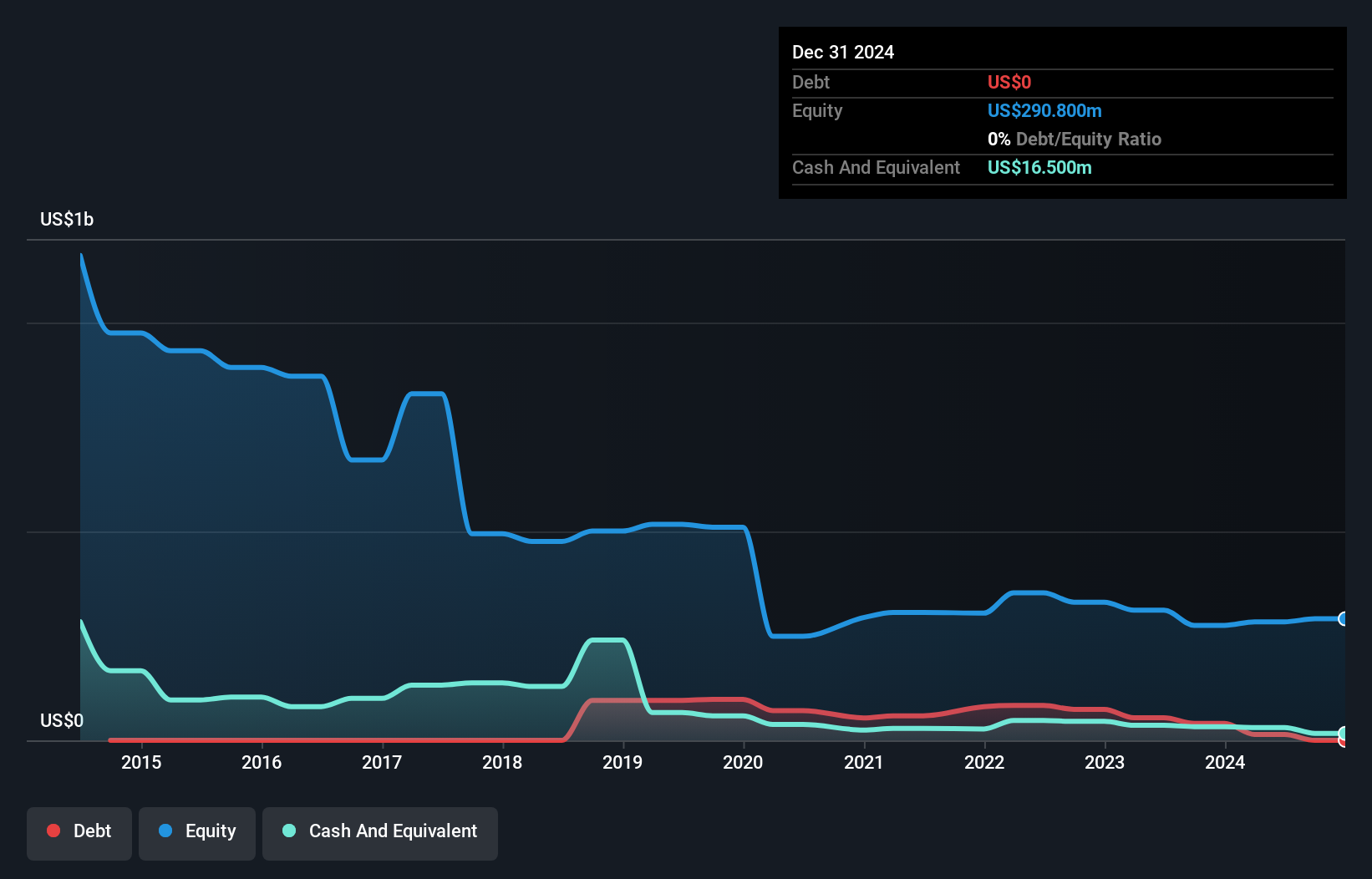

Pharos Energy plc, with a market cap of £100.50 million, focuses on oil and gas exploration in Vietnam, Egypt, and China. The company recently secured five-year licence extensions for its Vietnamese assets, potentially boosting their net present value significantly. Despite being unprofitable currently, Pharos has reduced losses by 27.2% annually over five years and holds sufficient cash to cover operations for more than three years without dilution to shareholders. While trading below estimated fair value and experiencing high share price volatility recently, the company benefits from stable short-term asset coverage over liabilities but faces challenges with long-term liabilities surpassing short-term assets.

- Navigate through the intricacies of Pharos Energy with our comprehensive balance sheet health report here.

- Explore Pharos Energy's analyst forecasts in our growth report.

Summing It All Up

- Get an in-depth perspective on all 469 UK Penny Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PHAR

Pharos Energy

An independent energy company, engages in the exploration, development, and production of oil and gas properties in Vietnam, Egypt, and China.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives