- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

Shell (LSE:SHEL): Is There Value After This Month’s Gradual Share Price Dip?

Reviewed by Kshitija Bhandaru

Shell (LSE:SHEL) shares have edged slightly lower over the past week, continuing a gradual retreat that investors have seen unfold this month. Despite the dip, Shell’s broader performance over the past year remains solid. This has prompted some investors to reassess their positions.

See our latest analysis for Shell.

Shell’s share price has softened a bit this month after a strong rally earlier in the year, but investors who held on are still ahead. The total shareholder return over the past 12 months sits at 8.6%, and the five-year total return is a robust 227%. While momentum has cooled in the short term, the longer-term picture shows Shell has rewarded patient shareholders and continues to be a heavyweight in its sector.

If you’re curious to see what else is capturing attention beyond oil and gas, this could be the right moment to discover fast growing stocks with high insider ownership

With Shell’s price now off its highs and forecasts pointing to continued growth, the key question is whether the current dip offers a genuine value opportunity, or if all that future momentum is already reflected in the price.

Most Popular Narrative: 12% Undervalued

Shell’s current price of £26.71 sits well below the narrative’s fair value estimate of £30.50. This difference highlights the potential upside being projected for Shell, driven by confident growth and margin assumptions. Let’s take a look at what’s fueling this valuation.

Shell's significant and growing investment in LNG, highlighted by the start-up and ramp-up of LNG Canada and new projects in Egypt and Trinidad & Tobago, positions the company to benefit from steadily rising global energy demand and LNG's role as a transition fuel. This is likely to drive long-term top-line revenue growth and support future earnings as Shell's LNG portfolio expands and gains more trading flexibility in key markets.

Want to uncover the hidden math pushing Shell’s fair value higher? It all comes down to bold projections for revenue, future earnings, and thinner share count. Unlock the secrets and see which forward-looking numbers this valuation rests on. Could these be the levers for the next leg up?

Result: Fair Value of £30.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged weak margins in Shell’s Chemicals business or setbacks in its transition to renewables could present challenges for the current upbeat forecasts.

Find out about the key risks to this Shell narrative.

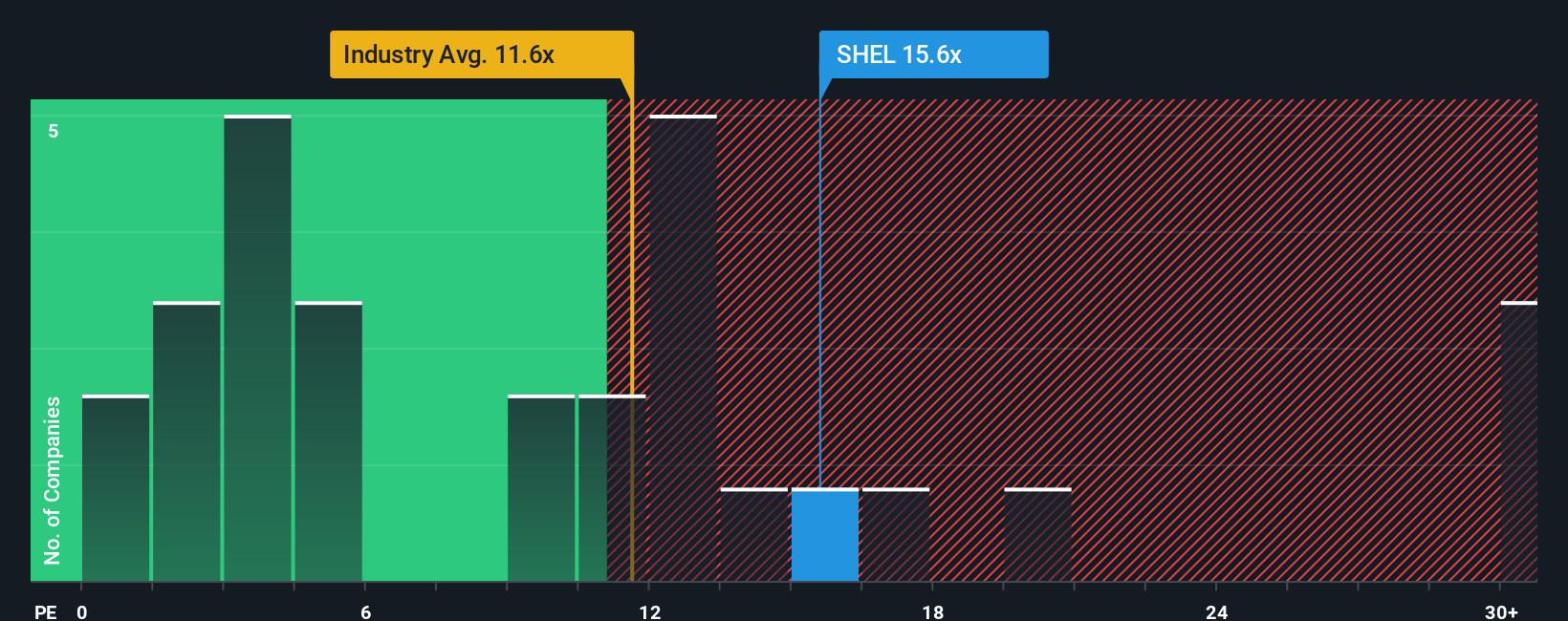

Another View: Price-to-Earnings Versus Industry and Fair Ratio

Taking a different angle, Shell’s current price-to-earnings ratio stands at 15.3x. That is a bit higher than both the peer average (15x) and the UK Oil and Gas industry (13.2x). However, compared with our calculated fair ratio of 21.4x, Shell appears reasonably valued, if not outright cheap on this basis. The result may depend on whether the market shifts toward that higher fair ratio, or if current sector headwinds keep Shell’s valuation anchored near peers. Which direction seems likelier to you in today’s climate?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shell Narrative

If you’re inclined to dig deeper or want a hands-on approach, you can analyze the data and build your own perspective in just a few minutes. Do it your way

A great starting point for your Shell research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take your investing to the next level by tapping into unique opportunities that could shape your portfolio for years to come. Don’t wait and potentially miss out while others take action today.

- Target strong income potential with these 19 dividend stocks with yields > 3%, which consistently offer yields above 3%. This can place steady cash flow at the center of your investment plan.

- Uncover the future of healthcare innovations by checking out these 31 healthcare AI stocks, where new AI breakthroughs are transforming patient care and biotech.

- Get ahead of the next digital trend by exploring these 78 cryptocurrency and blockchain stocks, which features stocks powering advancements in blockchain and the evolving world of cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives