- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

A Sliding Share Price Has Us Looking At Seplat Petroleum Development Company Plc's (LON:SEPL) P/E Ratio

Unfortunately for some shareholders, the Seplat Petroleum Development (LON:SEPL) share price has dived 61% in the last thirty days. Given the 68% drop over the last year, some shareholders might be worried that they have become bagholders. For those wondering, a bagholder is someone who keeps holding a losing stock indefinitely, without taking the time to consider its prospects carefully, going forward.

All else being equal, a share price drop should make a stock more attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So, on certain occasions, long term focussed investors try to take advantage of pessimistic expectations to buy shares at a better price. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

See our latest analysis for Seplat Petroleum Development

Does Seplat Petroleum Development Have A Relatively High Or Low P/E For Its Industry?

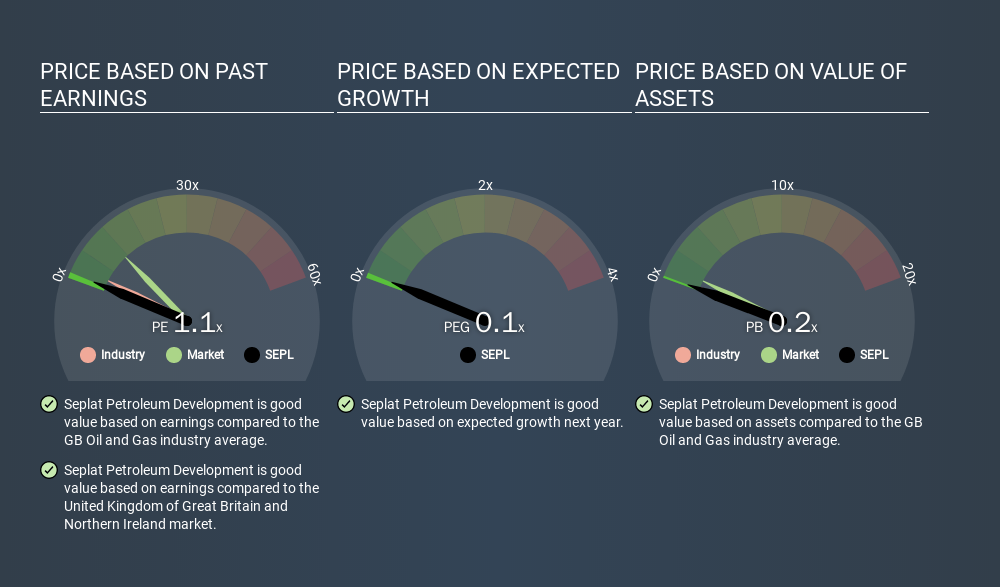

Seplat Petroleum Development's P/E of 1.15 indicates relatively low sentiment towards the stock. The image below shows that Seplat Petroleum Development has a lower P/E than the average (3.1) P/E for companies in the oil and gas industry.

Seplat Petroleum Development's P/E tells us that market participants think it will not fare as well as its peers in the same industry. Since the market seems unimpressed with Seplat Petroleum Development, it's quite possible it could surprise on the upside. You should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. That means even if the current P/E is high, it will reduce over time if the share price stays flat. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Seplat Petroleum Development saw earnings per share decrease by 35% last year. And over the longer term (5 years) earnings per share have decreased 11% annually. This could justify a pessimistic P/E.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Seplat Petroleum Development's Balance Sheet

With net cash of US$98m, Seplat Petroleum Development has a very strong balance sheet, which may be important for its business. Having said that, at 36% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Bottom Line On Seplat Petroleum Development's P/E Ratio

Seplat Petroleum Development's P/E is 1.1 which is below average (11.2) in the GB market. The recent drop in earnings per share would make investors cautious, the relatively strong balance sheet will allow the company time to invest in growth. If it achieves that, then there's real potential that the low P/E could eventually indicate undervaluation. Given Seplat Petroleum Development's P/E ratio has declined from 2.9 to 1.1 in the last month, we know for sure that the market is more worried about the business today, than it was back then. For those who prefer invest in growth, this stock apparently offers limited promise, but the deep value investors may find the pessimism around this stock enticing.

Investors have an opportunity when market expectations about a stock are wrong. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

But note: Seplat Petroleum Development may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:SEPL

Seplat Energy

An independent energy company, engages in the oil and gas exploration and production, and gas processing activities in Nigeria, Bahamas, Italy, Switzerland, England, and Singapore.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)