- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

Undiscovered Gems in the United Kingdom for March 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with the ripple effects of weak trade data from China, investor sentiment remains cautious amid global economic uncertainties. In this environment, identifying promising small-cap stocks that can navigate these challenges becomes crucial, as they often possess unique growth potential and resilience in fluctuating markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.93% | -8.41% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| AltynGold | 77.07% | 28.64% | 38.10% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

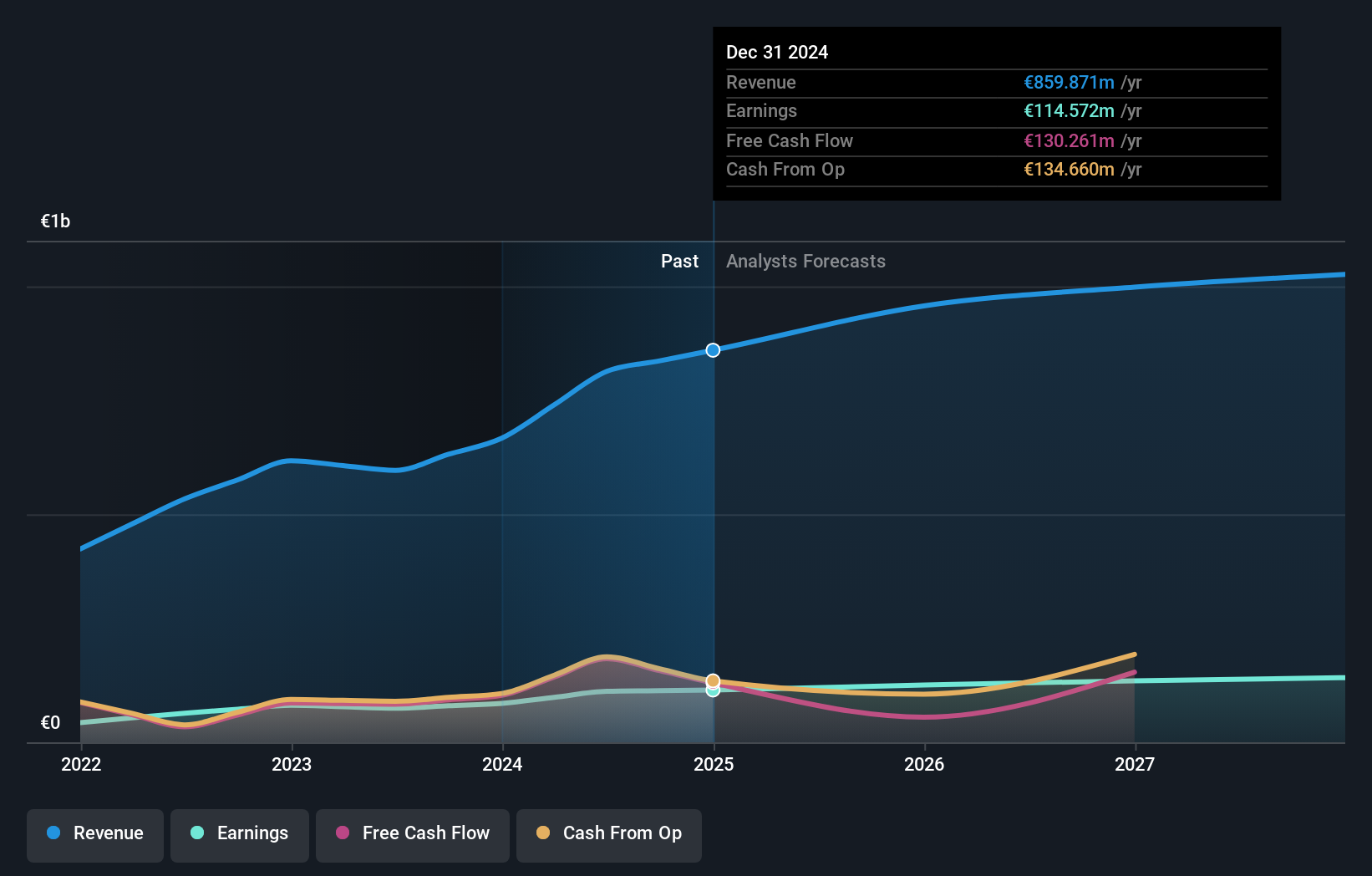

Overview: Cairn Homes plc is a holding company that operates as a home and community builder in Ireland, with a market capitalization of £1.10 billion.

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €813.40 million. The company's financial performance can be analyzed through its revenue streams and cost structures, with a focus on understanding the dynamics that influence its profitability.

Cairn Homes, a nimble player in the UK market, has shown impressive earnings growth of 49.5% over the past year, outpacing the Consumer Durables industry. The company is trading at 12.7% below its estimated fair value and boasts high-quality earnings with a satisfactory net debt to equity ratio of 20.7%. Its interest payments are well covered by EBIT at 9.5 times coverage, indicating robust financial health. Recently, Cairn completed a share buyback program worth €44.92 million for 22,574,301 shares or 3.51%, signaling confidence in its valuation and future prospects.

- Click to explore a detailed breakdown of our findings in Cairn Homes' health report.

Examine Cairn Homes' past performance report to understand how it has performed in the past.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market capitalization of £1.12 billion.

Operations: Seplat Energy generates revenue primarily from oil and gas, with oil contributing $846.68 million and gas $119.56 million.

Seplat Energy, a notable player in the energy sector, has shown impressive earnings growth of 199.5% over the past year, outpacing the broader oil and gas industry significantly. The company's debt to equity ratio increased from 20.2% to 40.3% over five years but remains manageable with a net debt to equity ratio at a satisfactory 15.5%. Seplat's interest payments are well covered by EBIT at 6.7 times coverage, indicating solid financial health. With positive free cash flow and trading slightly below its estimated fair value, Seplat is positioned for continued growth with forecasted earnings expansion of 18.5% annually.

- Click here and access our complete health analysis report to understand the dynamics of Seplat Energy.

Evaluate Seplat Energy's historical performance by accessing our past performance report.

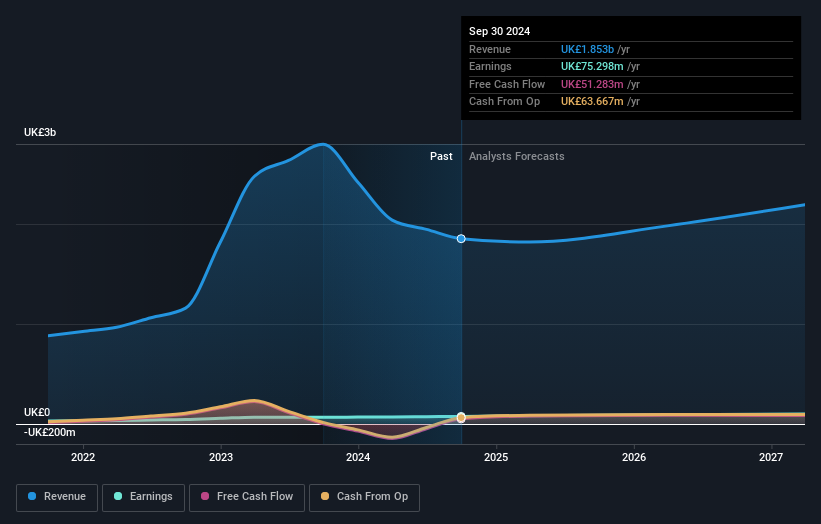

Telecom Plus (LSE:TEP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Telecom Plus Plc provides utility services in the United Kingdom and has a market capitalization of approximately £1.34 billion.

Operations: Telecom Plus generates revenue primarily from its non-regulated utility segment, amounting to £1.85 billion.

Telecom Plus, a compact player in the UK market, showcases strong financial health with earnings growth of 11.2% over the past year. This outpaces the Integrated Utilities industry’s 8.4% growth rate, indicating robust performance. With a net debt to equity ratio at 48.7%, it leans on the higher side but remains manageable given its high-quality earnings and well-covered interest payments (12.1x EBIT coverage). Trading at 26.8% below estimated fair value suggests potential upside for investors seeking undervalued opportunities within this sector, while forecasted annual earnings growth of nearly 12% adds a promising outlook for future expansion.

- Navigate through the intricacies of Telecom Plus with our comprehensive health report here.

Explore historical data to track Telecom Plus' performance over time in our Past section.

Taking Advantage

- Gain an insight into the universe of 64 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SEPL

Seplat Energy

Engages in the oil and gas exploration and production, and gas processing activities in Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives