- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRN

Undiscovered Gems in the UK with Strong Fundamentals for October 2024

Reviewed by Simply Wall St

As the United Kingdom's market grapples with global economic challenges, highlighted by the FTSE 100's recent downturn due to weak trade data from China, investors are increasingly focused on identifying opportunities that can withstand such volatility. In this environment, stocks with strong fundamentals and resilience to external pressures stand out as potential gems, offering a compelling case for consideration amidst broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration and development of mineral properties, with a market capitalization of £291.47 million.

Operations: Griffin Mining generates revenue primarily from the Caijiaying Zinc Gold Mine, amounting to $162.25 million. The company's financial performance is characterized by its gross profit margin trends, which provide insights into its operational efficiency and cost management strategies.

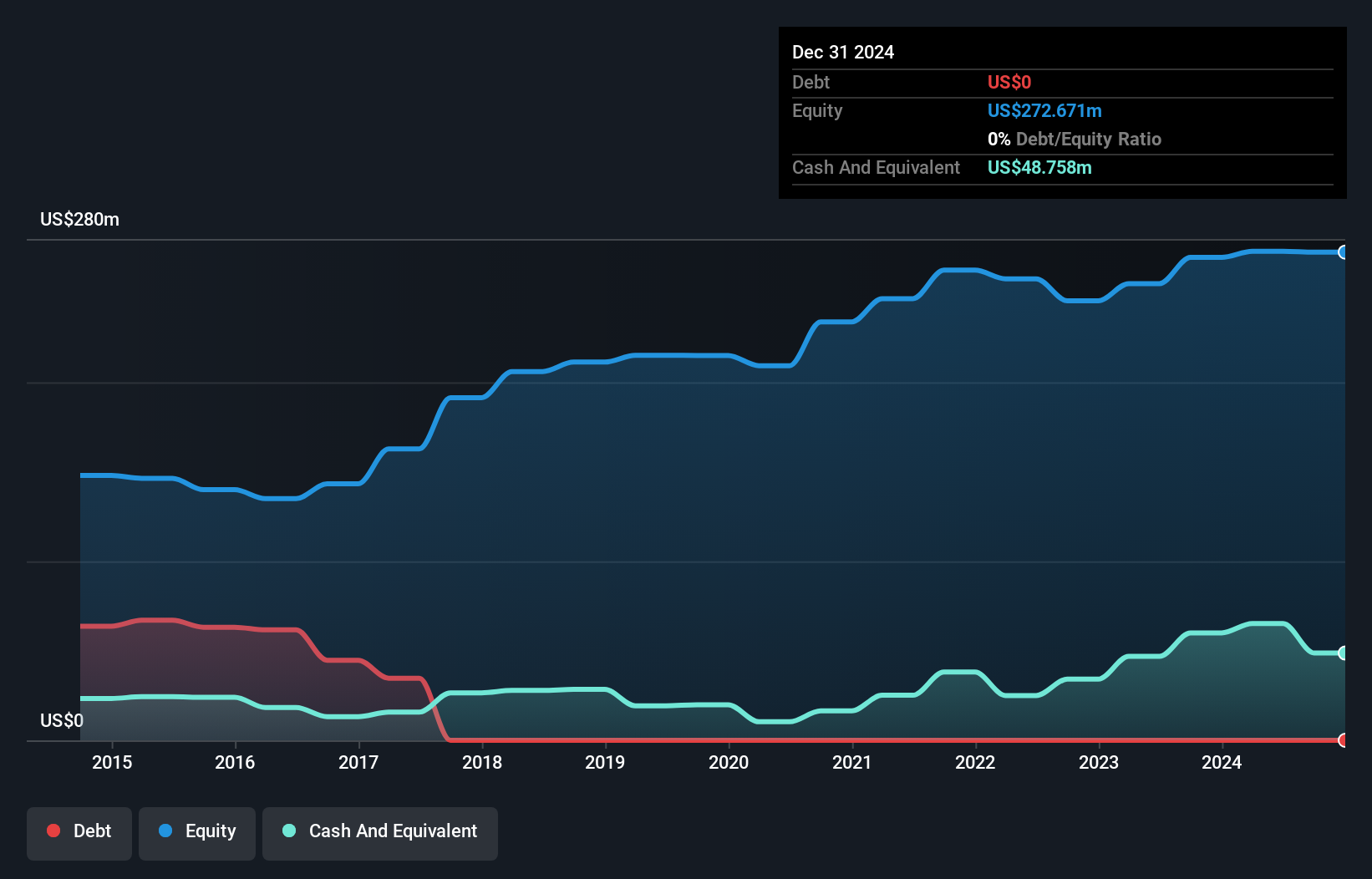

Griffin Mining, a small mining company, has shown impressive growth with earnings surging 116.5% over the past year, outpacing the Metals and Mining industry's 13%. The firm reported half-year sales of US$85.75 million, up from US$69.52 million last year, with net income doubling to US$11.3 million. Notably debt-free for five years and trading at 64.2% below its estimated fair value, Griffin's high-quality earnings reflect robust operational performance and potential undervaluation in the market.

- Dive into the specifics of Griffin Mining here with our thorough health report.

Evaluate Griffin Mining's historical performance by accessing our past performance report.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that functions as a home and community builder in Ireland, with a market capitalization of £1.03 billion.

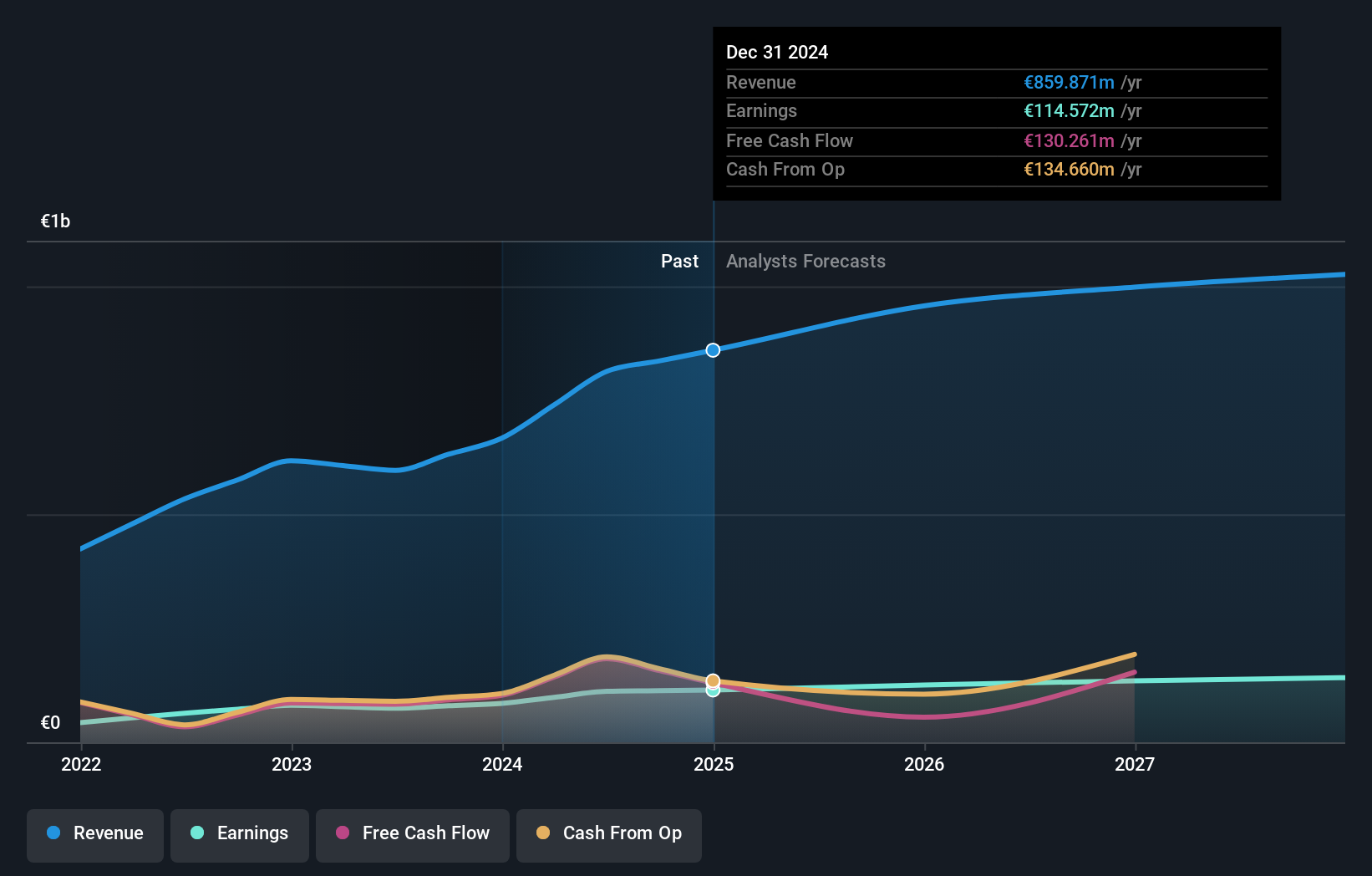

Operations: Cairn Homes generates revenue primarily from its building and property development segment, amounting to €813.40 million.

Cairn Homes, a notable player in the UK market, showcases significant growth with earnings up 49.5% last year, outpacing its industry. The company's price-to-earnings ratio of 11.1x is attractive compared to the broader UK market's 16.6x. A satisfactory net debt to equity ratio of 20.7% highlights prudent financial management, while interest payments are well covered by EBIT at a robust 9.5 times coverage, ensuring financial stability and operational efficiency moving forward.

- Navigate through the intricacies of Cairn Homes with our comprehensive health report here.

Gain insights into Cairn Homes' historical performance by reviewing our past performance report.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market capitalization of £1.22 billion.

Operations: Seplat Energy generates revenue primarily from oil and gas, with oil contributing $815.03 million and gas $120.87 million.

Seplat Energy, a notable player in the oil and gas sector, has shown impressive earnings growth of 207.6% over the past year, outpacing industry averages. Despite a rise in its debt to equity ratio from 20.6% to 41.5% over five years, the company maintains satisfactory net debt levels at 20.6%. Recent results reveal sales of US$241 million for Q2 2024 with net income reaching US$40 million compared to a loss last year, highlighting robust performance amid steady production guidance between 44,000-52,000 boepd.

- Click to explore a detailed breakdown of our findings in Seplat Energy's health report.

Assess Seplat Energy's past performance with our detailed historical performance reports.

Key Takeaways

- Click through to start exploring the rest of the 77 UK Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRN

Cairn Homes

A holding company, operates as a home and community builder in Ireland.

Solid track record with excellent balance sheet.