- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

Seplat Energy Plc's (LON:SEPL) 25% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Seplat Energy Plc (LON:SEPL) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 27%.

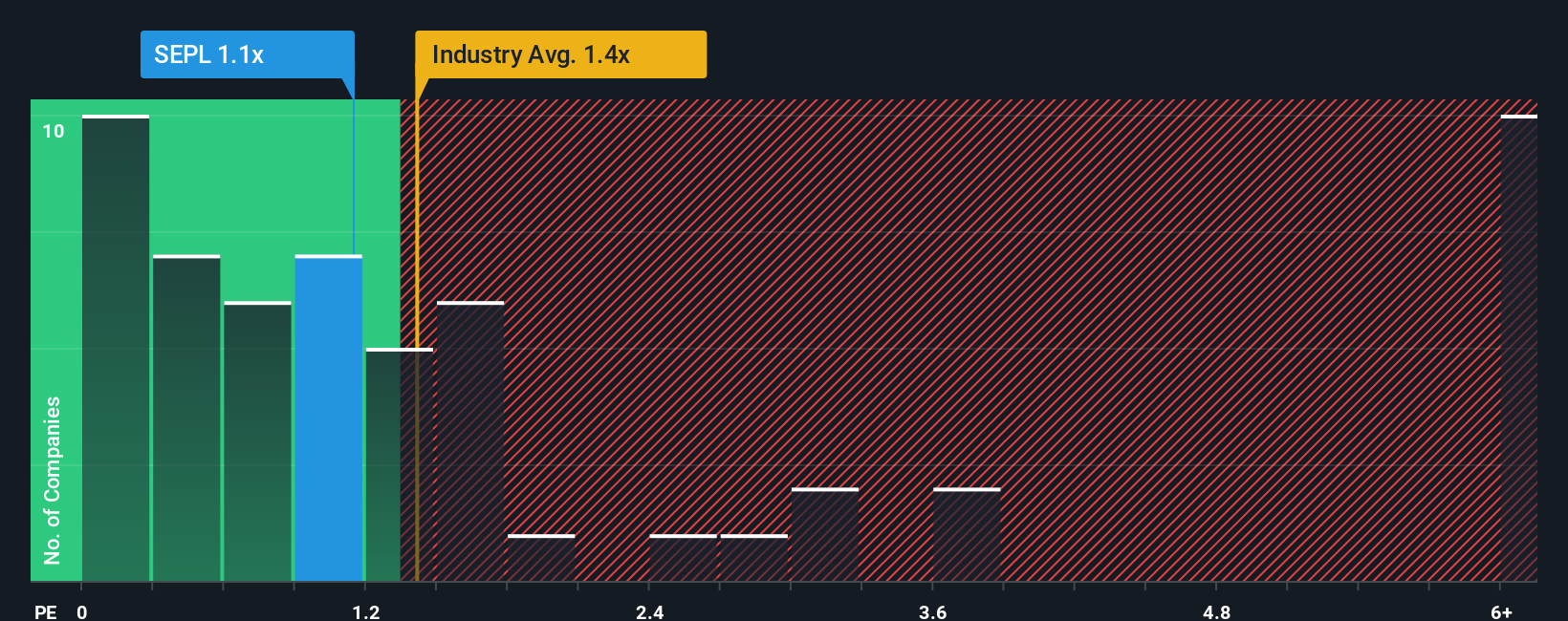

In spite of the firm bounce in price, it's still not a stretch to say that Seplat Energy's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Oil and Gas industry in the United Kingdom, where the median P/S ratio is around 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Seplat Energy

What Does Seplat Energy's Recent Performance Look Like?

Recent times have been pleasing for Seplat Energy as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. Those who are bullish on Seplat Energy will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Seplat Energy's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Seplat Energy's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 92%. The strong recent performance means it was also able to grow revenue by 112% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company are not good at all, suggesting revenue should decline by 46% over the next year. Meanwhile, the broader industry is forecast to moderate by 1.6%, which indicates the company should perform poorly indeed.

With this information, it's perhaps strange that Seplat Energy is trading at a fairly similar P/S in comparison. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Seplat Energy's P/S?

Seplat Energy's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seplat Energy currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. A positive change is needed in order to justify the current price-to-sales ratio.

You need to take note of risks, for example - Seplat Energy has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SEPL

Seplat Energy

An independent energy company, engages in the oil and gas exploration and production, and gas processing activities in Nigeria, Bahamas, Italy, Switzerland, England, and Singapore.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives