- United Kingdom

- /

- Marine and Shipping

- /

- LSE:ICGC

Discovering Undiscovered Gems in the UK This October 2024

Reviewed by Simply Wall St

In October 2024, the United Kingdom's markets are experiencing fluctuations, with the FTSE 100 and FTSE 250 indices facing downward pressure due to weak trade data from China and broader global economic concerns. Amidst these challenges, discerning investors might find opportunities in lesser-known stocks that demonstrate resilience and potential for growth despite external headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that operates as a home and community builder in Ireland, with a market capitalization of £1.06 billion.

Operations: Cairn Homes generates revenue primarily from its building and property development segment, amounting to €813.40 million.

Cairn Homes, a notable player in the UK market, showcases impressive financial resilience with high-quality earnings and a net debt to equity ratio of 20.7%, deemed satisfactory. The company has outpaced its industry peers with an earnings growth of 49.5% over the past year and maintains a competitive price-to-earnings ratio of 11.3x against the UK market's 16.5x average. Furthermore, Cairn is free cash flow positive and recently completed significant share buybacks totaling €70 million, enhancing shareholder value.

- Unlock comprehensive insights into our analysis of Cairn Homes stock in this health report.

Gain insights into Cairn Homes' historical performance by reviewing our past performance report.

Irish Continental Group (LSE:ICGC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Irish Continental Group plc is a maritime transport company with a market capitalization of £760.13 million.

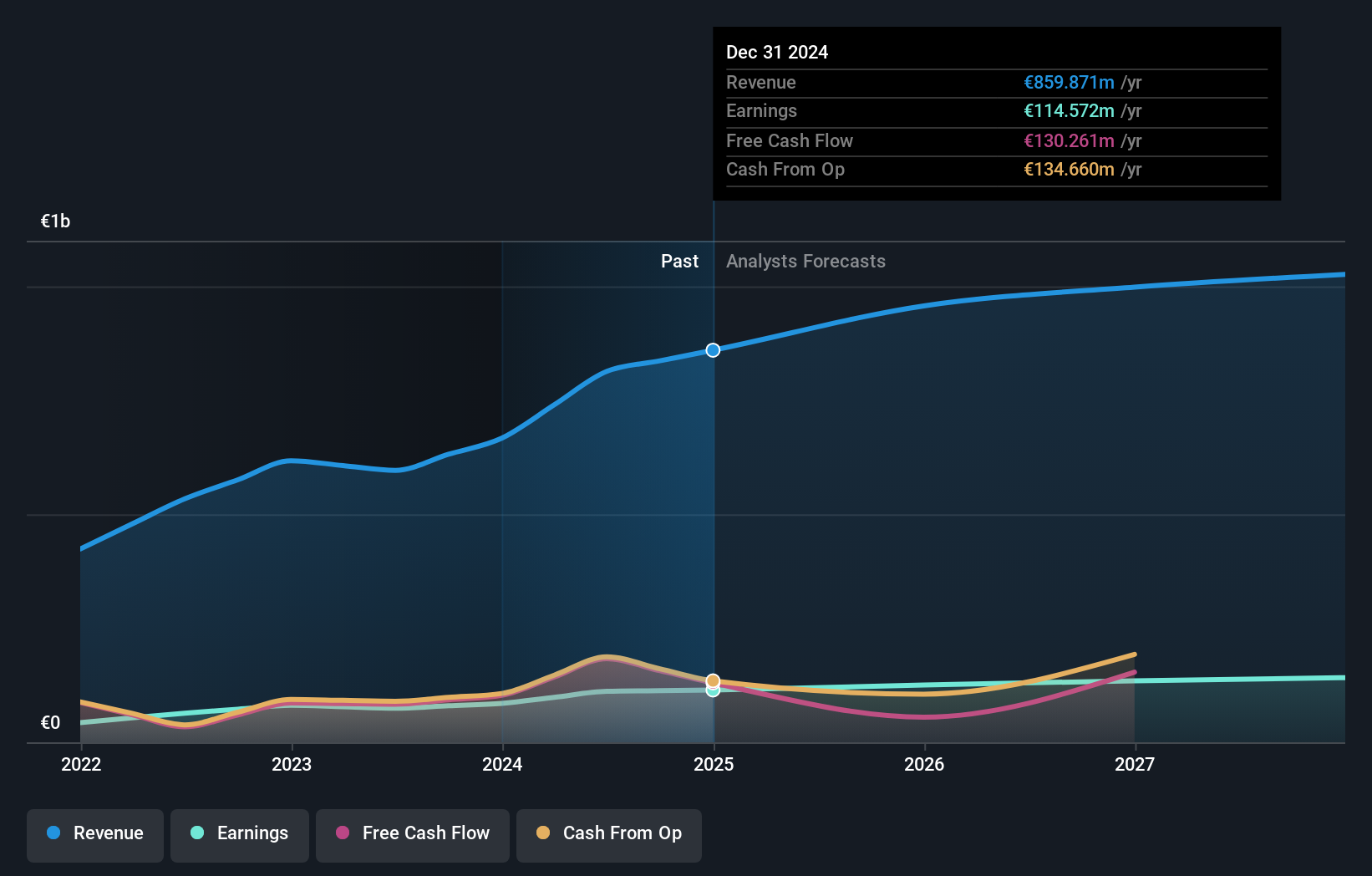

Operations: Irish Continental Group generates revenue primarily from its Ferries segment, contributing €430.10 million, and its Container and Terminal segment, which adds €195.80 million. The company has a market capitalization of £760.13 million.

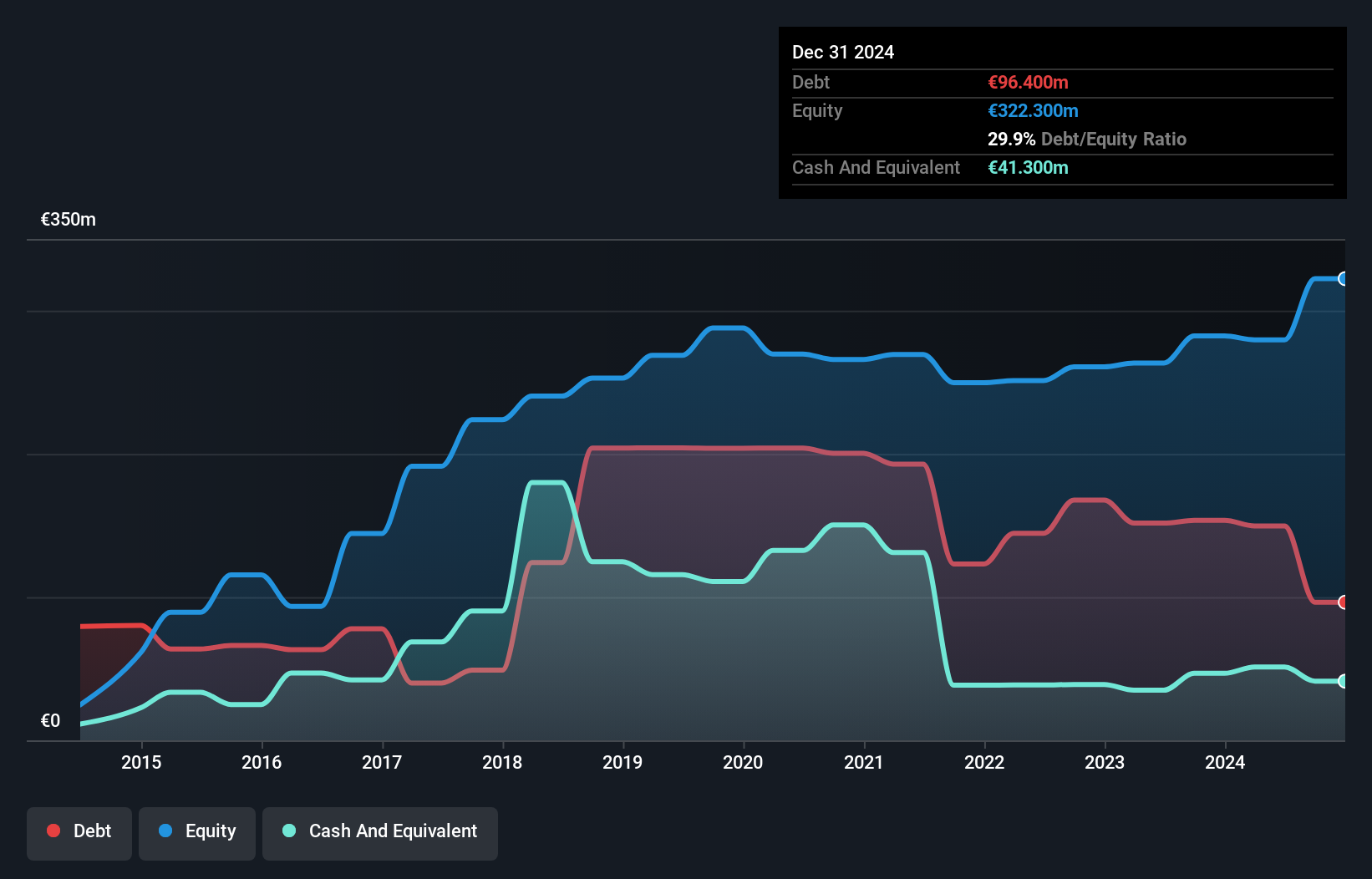

ICG, a notable player in the shipping sector, has shown promising financial health with debt to equity dropping from 76% to 53.5% over five years. The company's interest payments are comfortably covered by EBIT at a ratio of 10x, indicating robust earnings quality. Recent half-year results reveal sales of €285.5 million and net income of €13.7 million, up from the previous year’s figures, alongside an increased interim dividend of €0.0511 per share reflecting steady growth momentum.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.22 billion.

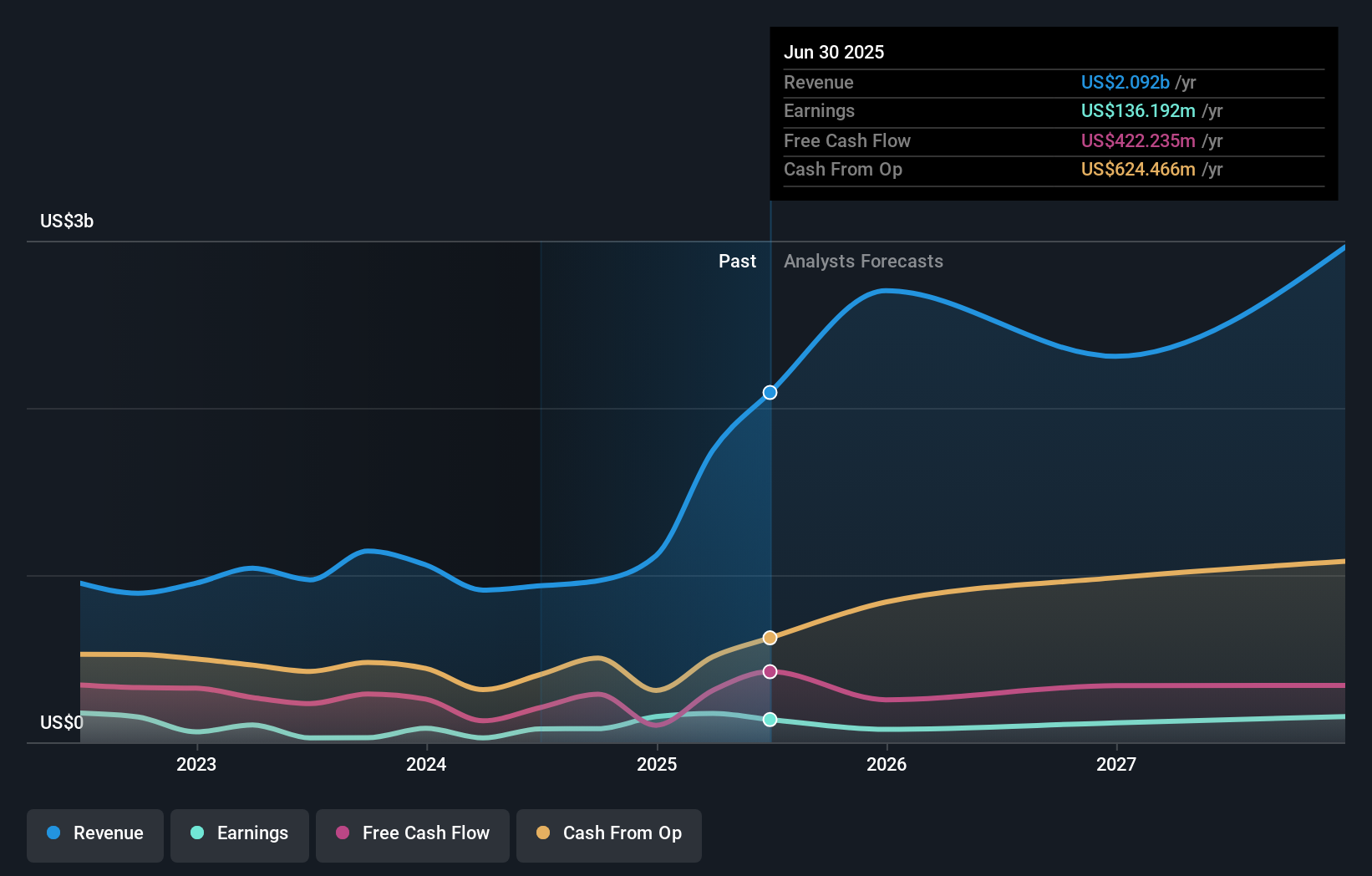

Operations: Seplat Energy generates revenue primarily from oil and gas, with oil contributing $815.03 million and gas $120.87 million.

Seplat Energy, a dynamic player in the energy sector, reported a notable shift from a net loss of US$14.63 million last year to a net income of US$39.72 million this quarter. With earnings soaring by 207.6% over the past year, it outpaced its industry peers significantly. The company's debt to equity ratio rose from 20.6% to 41.5% over five years but remains satisfactory at 20.6%. Despite these challenges, Seplat continues to maintain high-quality earnings and positive free cash flow.

- Click here to discover the nuances of Seplat Energy with our detailed analytical health report.

Gain insights into Seplat Energy's past trends and performance with our Past report.

Where To Now?

- Gain an insight into the universe of 82 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ICGC

Solid track record with adequate balance sheet and pays a dividend.