- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

3 Undiscovered Gems in the United Kingdom for Savvy Investors

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, yet it is up 9.8% over the past year with earnings projected to grow by 14% annually in the coming years. In this environment, identifying stocks that combine strong fundamentals with potential for growth can be key to capitalizing on these positive trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across the United Kingdom, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £756.47 million.

Operations: James Halstead generates revenue primarily through the manufacture and distribution of flooring products, amounting to £274.88 million.

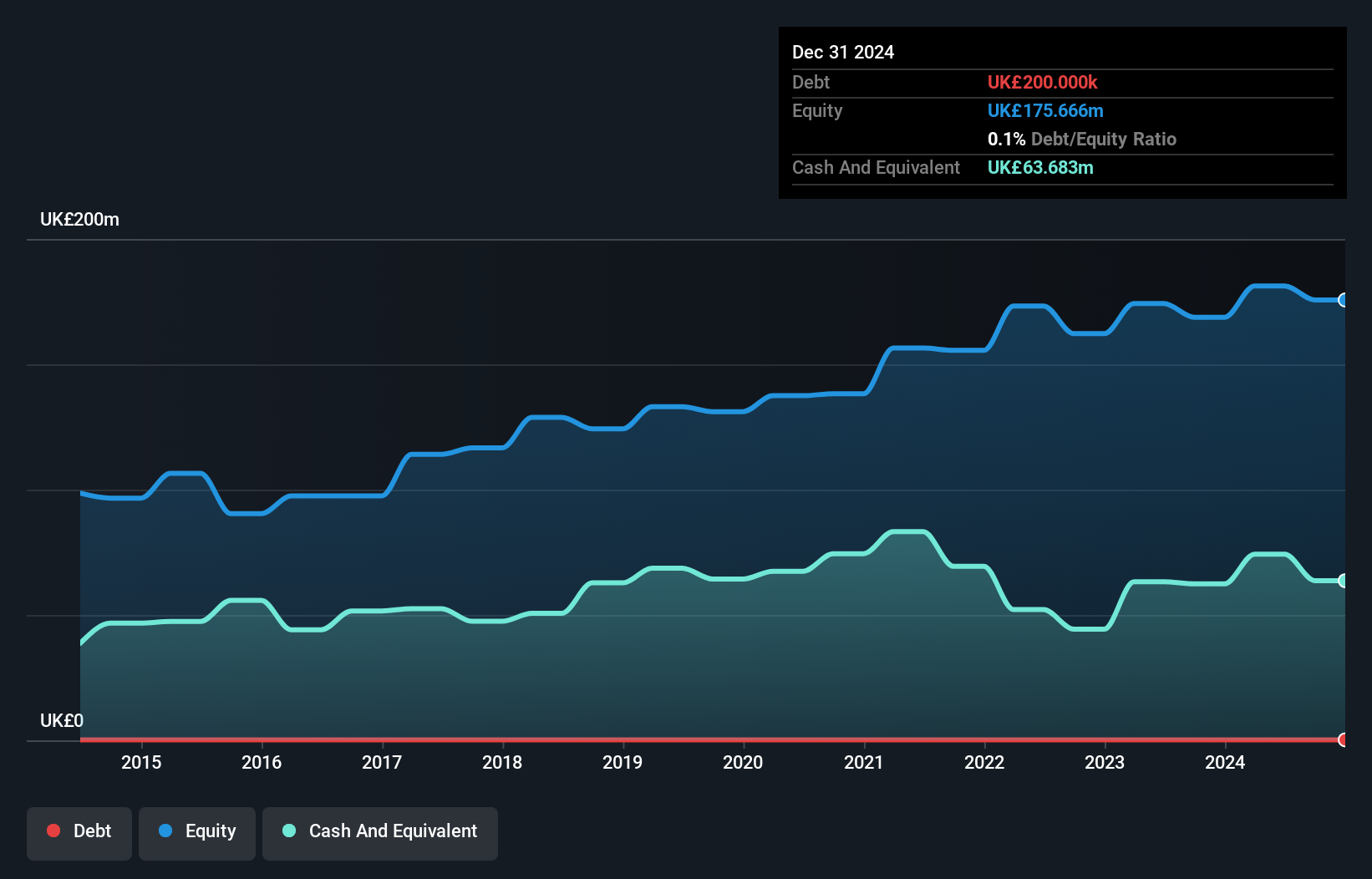

James Halstead, a company with high-quality earnings and a debt-to-equity ratio reduced from 0.2 to 0.1 over five years, reported sales of £274.88 million for the year ending June 2024, down from £303.56 million the previous year. Despite negative earnings growth of -2.1% against the industry average of 4.4%, it remains profitable with free cash flow reaching £49.54 million in March 2024 and is trading at 6.2% below estimated fair value, suggesting potential undervaluation opportunities for investors seeking stable dividend growth as evidenced by its record dividend proposal this year.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector with a market capitalization of £1.27 billion.

Operations: Yellow Cake generates revenue primarily from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

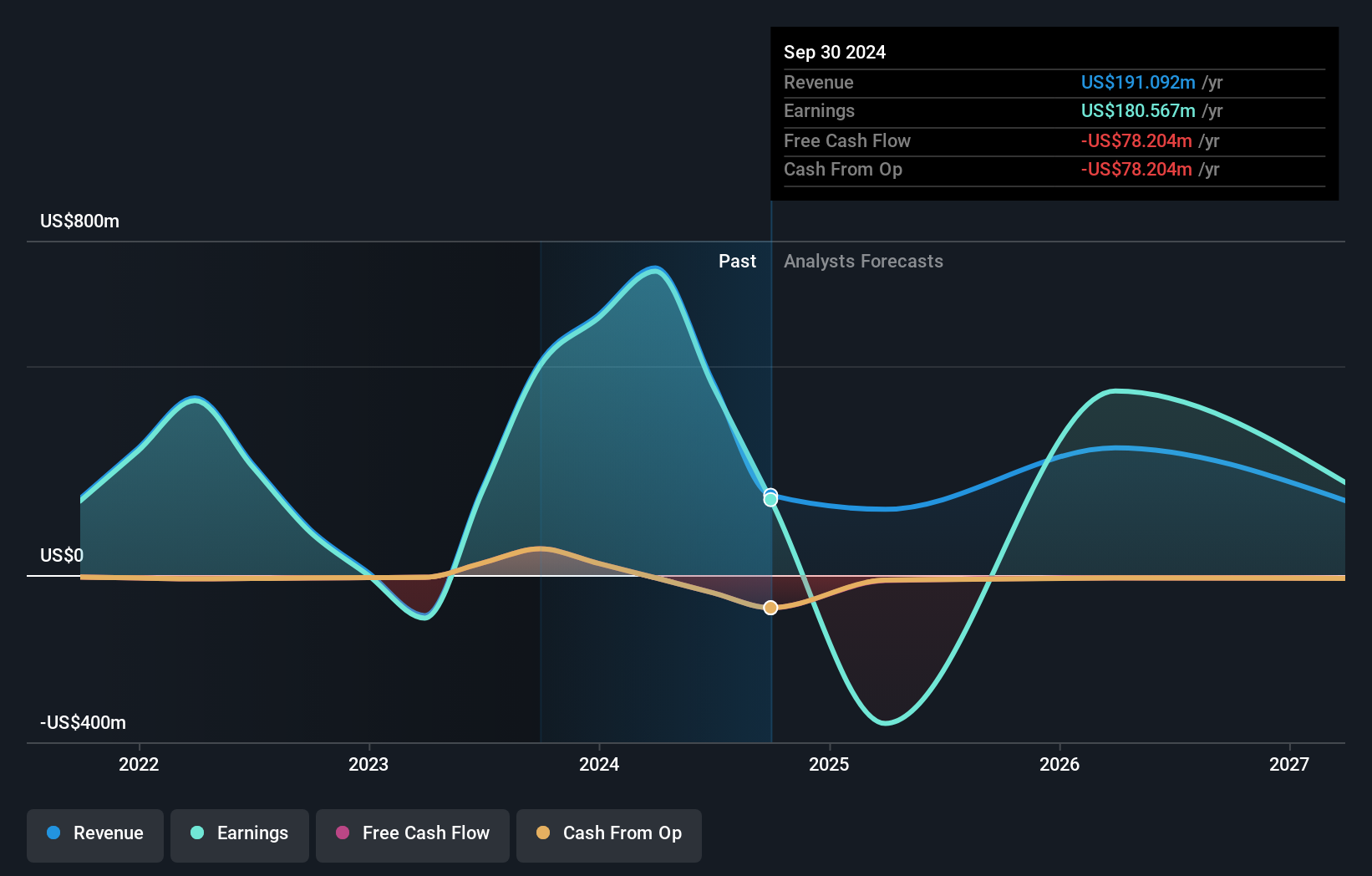

Yellow Cake, a niche player in the uranium market, has shown remarkable financial turnaround with revenue reaching US$735 million from a previous negative of US$96.9 million. Net income also saw an impressive shift to US$727 million from a net loss of US$102.94 million, highlighting its profitability this year. Despite being debt-free for five years and trading at a favorable price-to-earnings ratio of 2.3x compared to the UK market's 16.6x, earnings are forecasted to decline by an average of 78% annually over the next three years, presenting both opportunities and challenges for investors seeking value in this sector.

- Unlock comprehensive insights into our analysis of Yellow Cake stock in this health report.

Evaluate Yellow Cake's historical performance by accessing our past performance report.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market capitalization of £1.21 billion.

Operations: Seplat Energy generates revenue primarily from oil and gas, with oil contributing $815.03 million and gas $120.87 million.

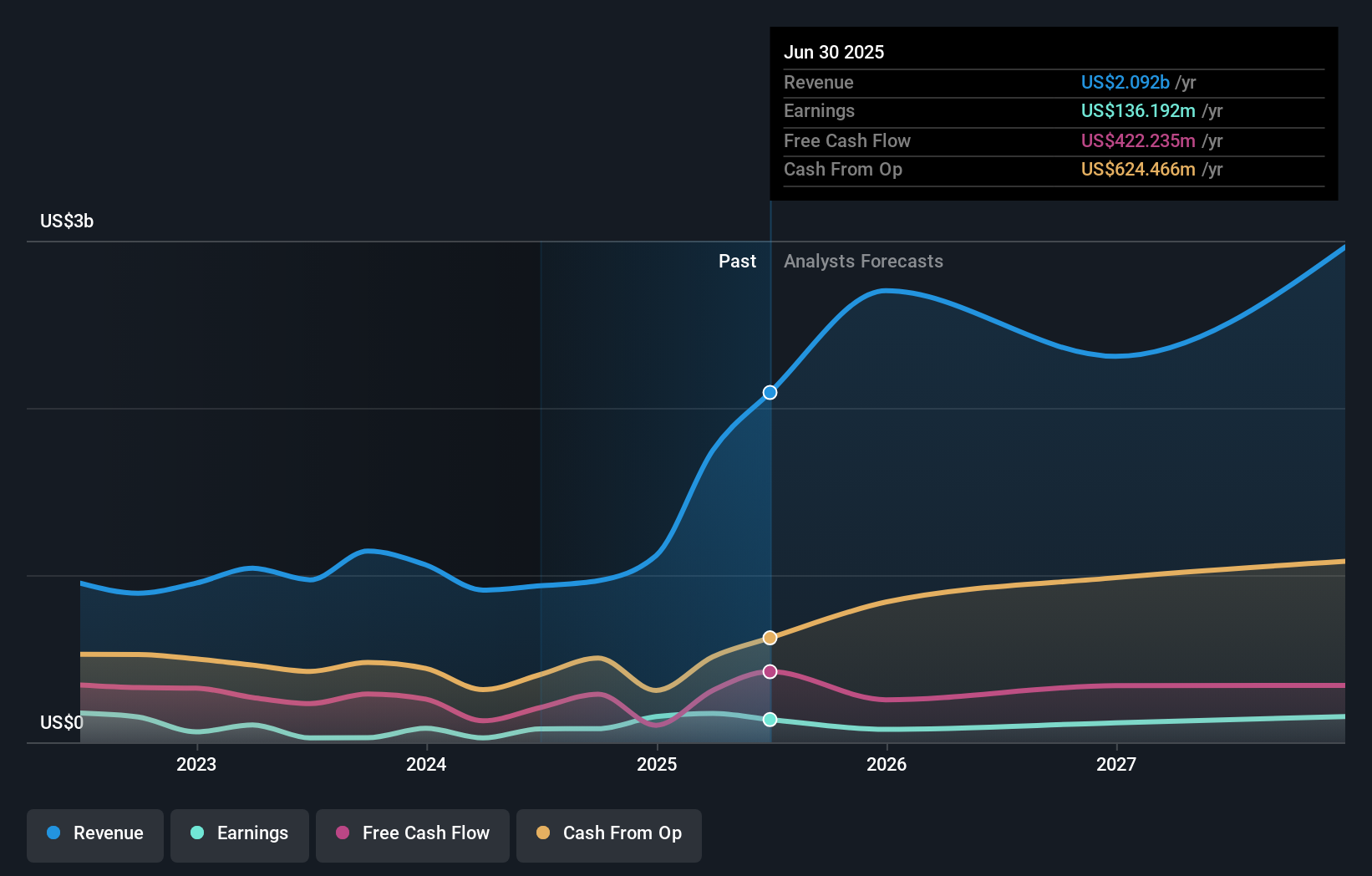

Seplat Energy, a nimble player in the oil and gas sector, has shown remarkable earnings growth of 208% over the past year, outpacing industry trends. The company's net debt to equity ratio sits at a satisfactory 20.6%, although it has risen to 41.5% over five years. With high-quality earnings and positive free cash flow, Seplat's interest payments are well-covered by EBIT at 5.8 times, reflecting robust financial health despite production averaging slightly lower at 48,407 boepd compared to last year’s figures.

- Click here to discover the nuances of Seplat Energy with our detailed analytical health report.

Gain insights into Seplat Energy's historical performance by reviewing our past performance report.

Make It Happen

- Click this link to deep-dive into the 80 companies within our UK Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Seplat Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SEPL

Seplat Energy

An independent energy company, engages in the oil and gas exploration and production, and gas processing activities in Nigeria, Bahamas, Italy, Switzerland, England, and Singapore.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives